Südwestdeutsche Salzwerke And 2 Undiscovered Gems For Savvy Investors

Reviewed by Simply Wall St

In recent weeks, the European market has shown resilience with the pan-European STOXX Europe 600 Index achieving its longest streak of weekly gains since August 2012, buoyed by encouraging company results and gains in defense stocks. Amidst this backdrop of mixed economic signals across major European economies, identifying promising stocks requires a focus on those companies that demonstrate strong fundamentals and potential for growth despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Linc | NA | 19.35% | 23.17% | ★★★★★★ |

| Mirbud | 16.01% | 27.19% | 26.48% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Bahnhof | NA | 8.39% | 14.20% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| ABG Sundal Collier Holding | 0.61% | -1.57% | -8.96% | ★★★★☆☆ |

| Prim | 10.72% | 10.36% | 0.14% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Südwestdeutsche Salzwerke (DB:SSH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Südwestdeutsche Salzwerke AG, along with its subsidiaries, is engaged in the mining, production, and sale of salt across Germany, the European Union, and internationally with a market capitalization of approximately €583.17 million.

Operations: The company generates revenue primarily from its salt segment, which accounted for €283.67 million, and waste management services contributing €62.46 million. The reconciliations segment showed a negative impact of -€17.18 million on the overall revenue figures.

Südwestdeutsche Salzwerke, a small player in the European market, has shown remarkable earnings growth of 4290.9% over the past year, far outpacing its industry peers. The company appears to be trading at a significant discount, about 89.9% below its estimated fair value. Despite this impressive growth and valuation advantage, it’s important to note that their financial reports are more than six months old, which may raise questions about current performance metrics. With high-quality earnings and more cash than total debt, SSH seems well-positioned financially but faces volatility in share price recently.

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Value Rating: ★★★★★★

Overview: Koninklijke Heijmans N.V. operates in property development, construction, and infrastructure sectors both in the Netherlands and internationally, with a market capitalization of approximately €1.08 billion.

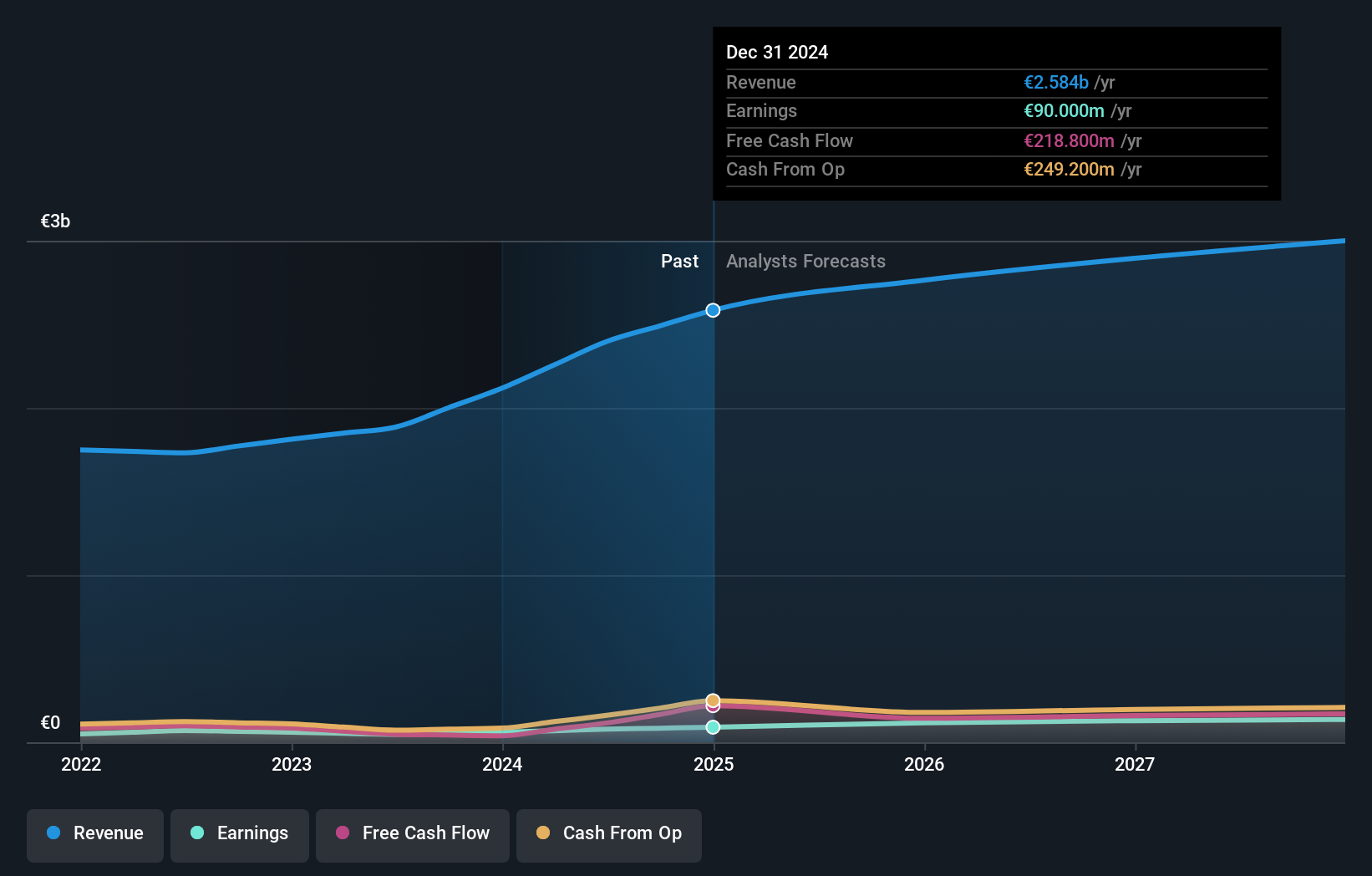

Operations: Heijmans generates revenue from three primary segments: Living (€994 million), Working (€635 million), and Connecting (€997 million).

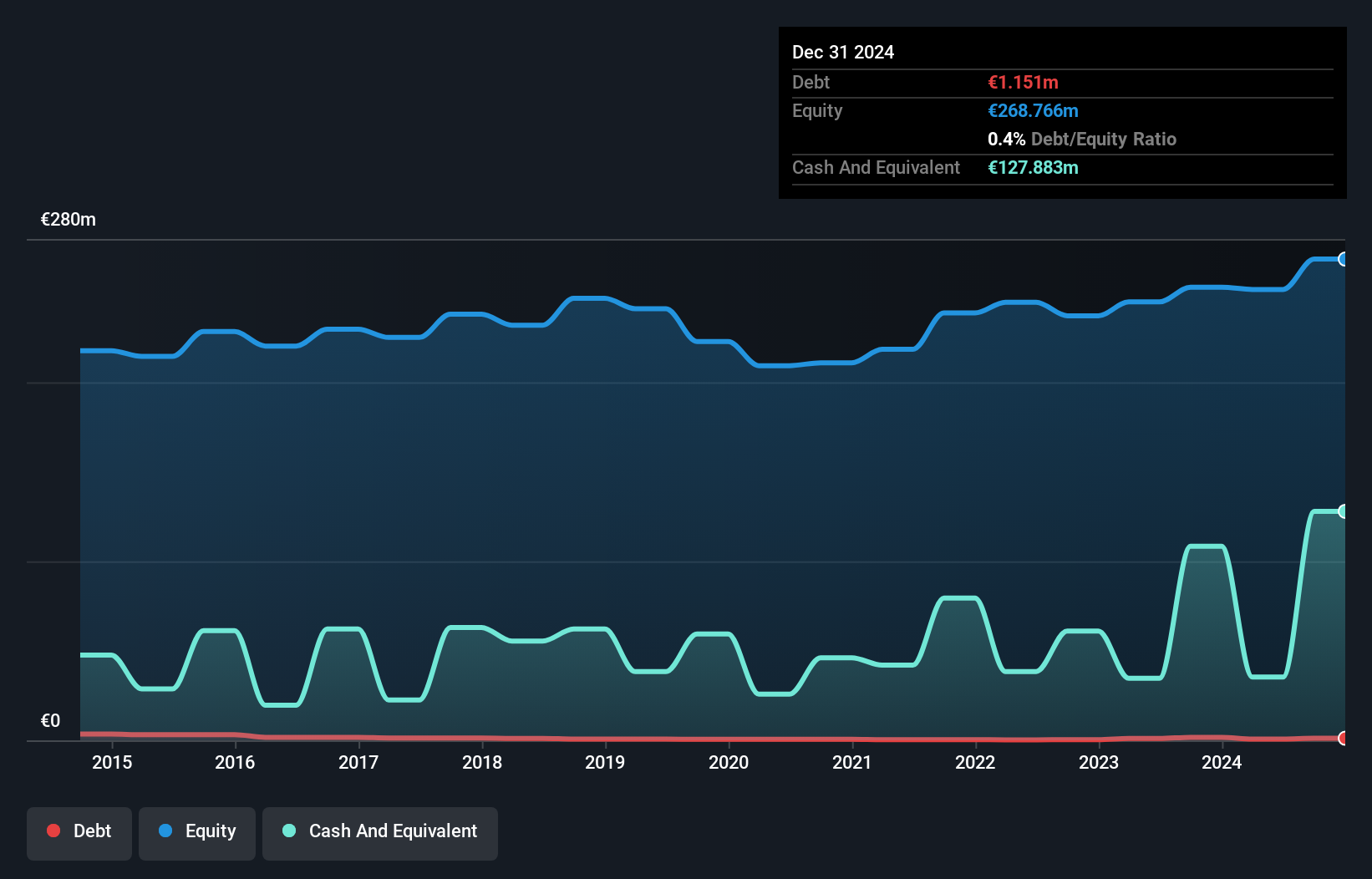

Koninklijke Heijmans, a nimble player in the construction sector, has shown impressive growth with earnings surging by 50.7% over the past year, outpacing the industry average of 11.4%. The company's debt to equity ratio has significantly improved from 29.9% to just 1.7% over five years, indicating robust financial health. Trading at an attractive valuation—72.3% below its estimated fair value—Heijmans also boasts high-quality earnings and positive free cash flow. Recent announcements include a dividend increase to €1.64 per share and net income rising from €60 million to €90 million last year, reinforcing its strong performance trajectory amidst market volatility and regulatory challenges in Europe’s construction landscape.

Idun Industrier (OM:IDUN B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Idun Industrier AB (publ) is an investment holding company that specializes in the manufacture and sale of glass fiber reinforced fat- and oil separators in Sweden, with a market capitalization of approximately SEK3.80 billion.

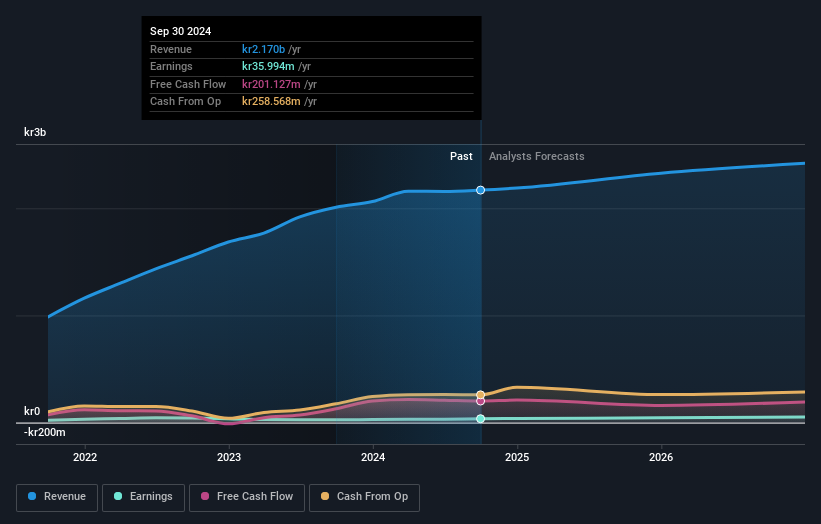

Operations: Idun Industrier generates revenue primarily through its Manufacturing segment, contributing SEK1.34 billion, and its Service & Maintenance segment, which adds SEK834.40 million. The company's gross profit margin stands at 45%.

Idun Industrier, a promising player in the European market, has seen its debt to equity ratio improve significantly from 185.4% to 99.5% over five years. Despite this progress, interest payments remain poorly covered by EBIT at 2.6 times, indicating potential financial strain. However, the company boasts impressive earnings growth of 37.3% over the past year, outpacing industry averages and showcasing robust performance potential. With a high net debt to equity ratio of 56.9%, challenges persist but are offset by positive free cash flow and forecasts suggesting continued earnings growth at an annual rate of 16.72%.

- Unlock comprehensive insights into our analysis of Idun Industrier stock in this health report.

Gain insights into Idun Industrier's past trends and performance with our Past report.

Next Steps

- Unlock our comprehensive list of 360 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:SSH

Südwestdeutsche Salzwerke

Südwestdeutsche Salzwerke AG, together with its subsidiaries, mines, produces, and sells salt in Germany, the European Union, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives