November 2024's Leading Growth Stocks With Strong Insider Confidence

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration, investors are closely watching policy shifts that could impact sectors like financials and energy, while others such as healthcare and electric vehicles face potential challenges. In this environment of fluctuating sentiment and economic indicators, growth companies with high insider ownership often signal strong internal confidence, making them compelling to consider for those seeking resilient investment opportunities in today's market landscape.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 52.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's take a closer look at a couple of our picks from the screened companies.

Envipco Holding (ENXTAM:ENVI)

Simply Wall St Growth Rating: ★★★★★★

Overview: Envipco Holding N.V. is a company that specializes in the design, development, manufacturing, assembly, marketing, sales, leasing, and servicing of reverse vending machines for collecting and processing used beverage containers across the Netherlands, North America, and Europe with a market cap of €281.53 million.

Operations: Envipco Holding N.V. generates revenue through the design, development, production, marketing, leasing, and servicing of reverse vending machines used for collecting and processing beverage containers in regions including the Netherlands, North America, and Europe.

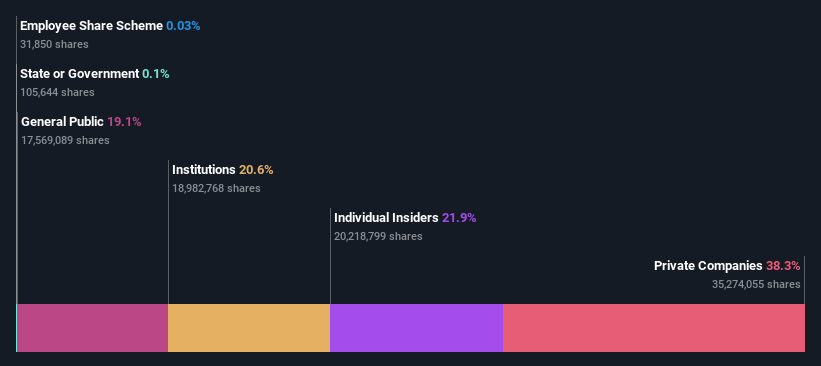

Insider Ownership: 36.7%

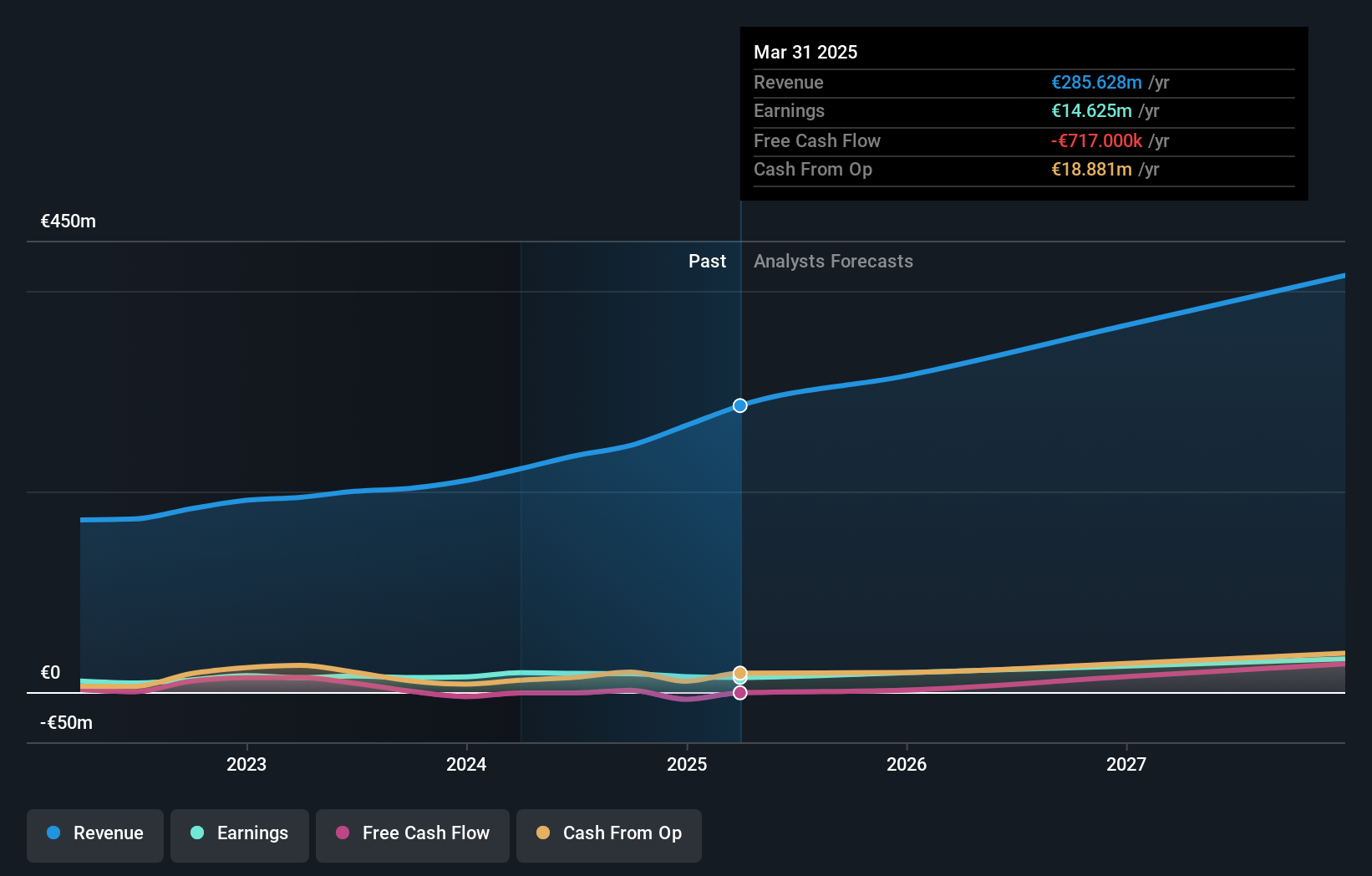

Revenue Growth Forecast: 33.1% p.a.

Envipco Holding demonstrates strong growth potential with earnings forecasted to grow significantly at 84.63% annually, outpacing the Dutch market. Revenue is also expected to rise by 33.1% per year, surpassing market averages. The company recently appointed Patrick Gierman as CFO, bringing extensive financial expertise from prominent firms like GE and PwC. Despite past shareholder dilution, Envipco trades well below its estimated fair value and has secured substantial orders in Romania, indicating robust demand for its products.

- Navigate through the intricacies of Envipco Holding with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Envipco Holding's share price might be too optimistic.

Indoco Remedies (NSEI:INDOCO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Indoco Remedies Limited is engaged in the manufacturing, marketing, and sale of formulations and active pharmaceutical ingredients both in India and internationally, with a market cap of ₹28.05 billion.

Operations: The company generates revenue of ₹17.73 billion from its Pharmaceuticals segment.

Insider Ownership: 22%

Revenue Growth Forecast: 11.7% p.a.

Indoco Remedies faces challenges with declining profit margins and recent losses, yet it shows potential for growth as earnings are expected to rise significantly at 72.2% annually, outpacing the Indian market. Despite trading well below its estimated fair value and not having substantial insider buying recently, Indoco has received USFDA approvals for generic drugs like Varenicline and Cetirizine, which could bolster future revenue streams in competitive markets.

- Delve into the full analysis future growth report here for a deeper understanding of Indoco Remedies.

- Insights from our recent valuation report point to the potential overvaluation of Indoco Remedies shares in the market.

init innovation in traffic systems (XTRA:IXX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Init innovation in traffic systems SE, along with its subsidiaries, provides intelligent transportation systems solutions for public transportation globally and has a market cap of €362.45 million.

Operations: The company generates revenue from its Wireless Communications Equipment segment, amounting to €245.89 million.

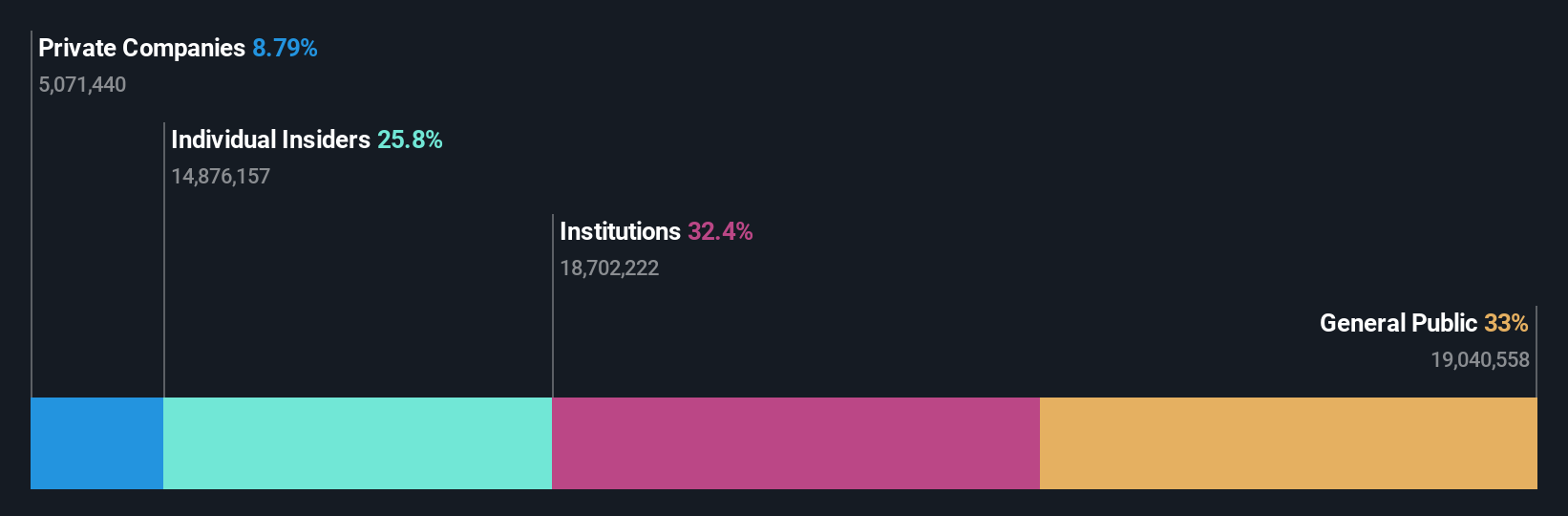

Insider Ownership: 39.6%

Revenue Growth Forecast: 13.2% p.a.

init innovation in traffic systems is trading at 25% below its estimated fair value, with earnings growth forecasted at 27.78% annually, outpacing the German market. Revenue is expected to grow by 13.2% per year, higher than the market average but below 20%. Recent earnings show increased sales of €178.12 million for nine months ending September 2024, though net income slightly declined in Q3 compared to last year.

- Take a closer look at init innovation in traffic systems' potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that init innovation in traffic systems is priced lower than what may be justified by its financials.

Make It Happen

- Click this link to deep-dive into the 1540 companies within our Fast Growing Companies With High Insider Ownership screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if init innovation in traffic systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:IXX

init innovation in traffic systems

Engages in the provision of intelligent transportation systems solutions for public transportation worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives