- Netherlands

- /

- Machinery

- /

- ENXTAM:ENVI

Envipco Holding N.V. (AMS:ENVI) Looks Just Right With A 33% Price Jump

Envipco Holding N.V. (AMS:ENVI) shareholders would be excited to see that the share price has had a great month, posting a 33% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 7.9% in the last twelve months.

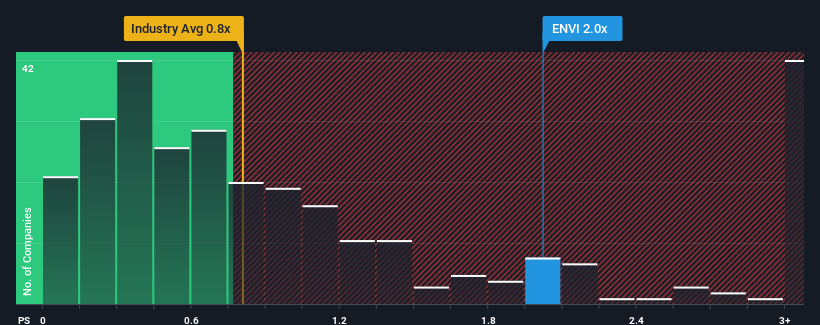

After such a large jump in price, given close to half the companies operating in the Netherlands' Machinery industry have price-to-sales ratios (or "P/S") below 0.8x, you may consider Envipco Holding as a stock to potentially avoid with its 2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Envipco Holding

What Does Envipco Holding's Recent Performance Look Like?

Recent revenue growth for Envipco Holding has been in line with the industry. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Envipco Holding's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Envipco Holding?

In order to justify its P/S ratio, Envipco Holding would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered an exceptional 18% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 108% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 85% over the next year. With the industry only predicted to deliver 2.2%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Envipco Holding's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Envipco Holding's P/S is on the rise since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Envipco Holding shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Envipco Holding (1 shouldn't be ignored!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Envipco Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Envipco Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Envipco Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:ENVI

Envipco Holding

Designs, develops, manufactures, assembles, markets, sells, leases, and services reverse vending machines (RVM) to collect and process used beverage containers primarily in the Netherlands, North America, and rest of Europe.

Exceptional growth potential and good value.

Market Insights

Community Narratives