- Netherlands

- /

- Machinery

- /

- ENXTAM:EBUS

Ebusco Holding N.V.'s (AMS:EBUS) P/S Still Appears To Be Reasonable

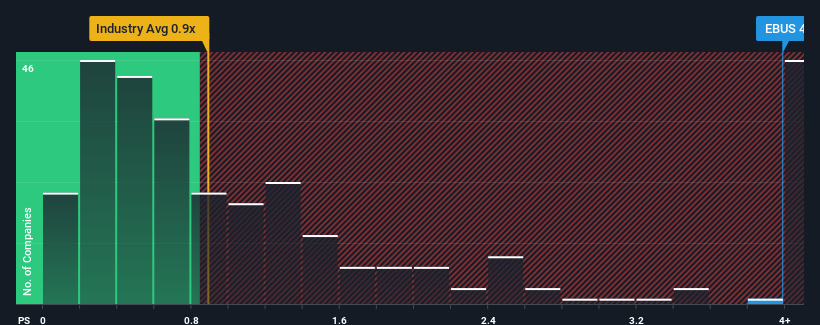

When you see that almost half of the companies in the Machinery industry in the Netherlands have price-to-sales ratios (or "P/S") below 0.9x, Ebusco Holding N.V. (AMS:EBUS) looks to be giving off strong sell signals with its 4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Ebusco Holding

How Ebusco Holding Has Been Performing

Recent times have been advantageous for Ebusco Holding as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ebusco Holding.Is There Enough Revenue Growth Forecasted For Ebusco Holding?

Ebusco Holding's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Pleasingly, revenue has also lifted 128% in aggregate from three years ago, thanks to the last 12 months of explosive growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 79% each year as estimated by the four analysts watching the company. With the industry only predicted to deliver 6.0% per year, the company is positioned for a stronger revenue result.

With this information, we can see why Ebusco Holding is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Ebusco Holding maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Machinery industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 2 warning signs for Ebusco Holding that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Ebusco Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:EBUS

Ebusco Holding

Engages in the development, manufacture, and distribution of zero emission buses and charging systems.

High growth potential slight.

Similar Companies

Market Insights

Community Narratives