- Netherlands

- /

- Construction

- /

- ENXTAM:HEIJM

Top Dividend Stocks On Euronext Amsterdam For October 2024

Reviewed by Simply Wall St

As European markets experience a modest uptick, with the pan-European STOXX Europe 600 Index rising amid hopes for interest rate cuts and economic stimulus from China, investors are turning their attention to dividend stocks on Euronext Amsterdam. In this environment, a good dividend stock typically offers reliable income through consistent payouts, making it an attractive option for those seeking stability amidst fluctuating market conditions.

Top 5 Dividend Stocks In The Netherlands

| Name | Dividend Yield | Dividend Rating |

| Koninklijke Heijmans (ENXTAM:HEIJM) | 3.27% | ★★★★☆☆ |

| Randstad (ENXTAM:RAND) | 5.14% | ★★★★☆☆ |

| ABN AMRO Bank (ENXTAM:ABN) | 9.72% | ★★★★☆☆ |

| Signify (ENXTAM:LIGHT) | 6.96% | ★★★★☆☆ |

| Aalberts (ENXTAM:AALB) | 3.27% | ★★★★☆☆ |

| ING Groep (ENXTAM:INGA) | 6.91% | ★★★★☆☆ |

| Acomo (ENXTAM:ACOMO) | 6.56% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

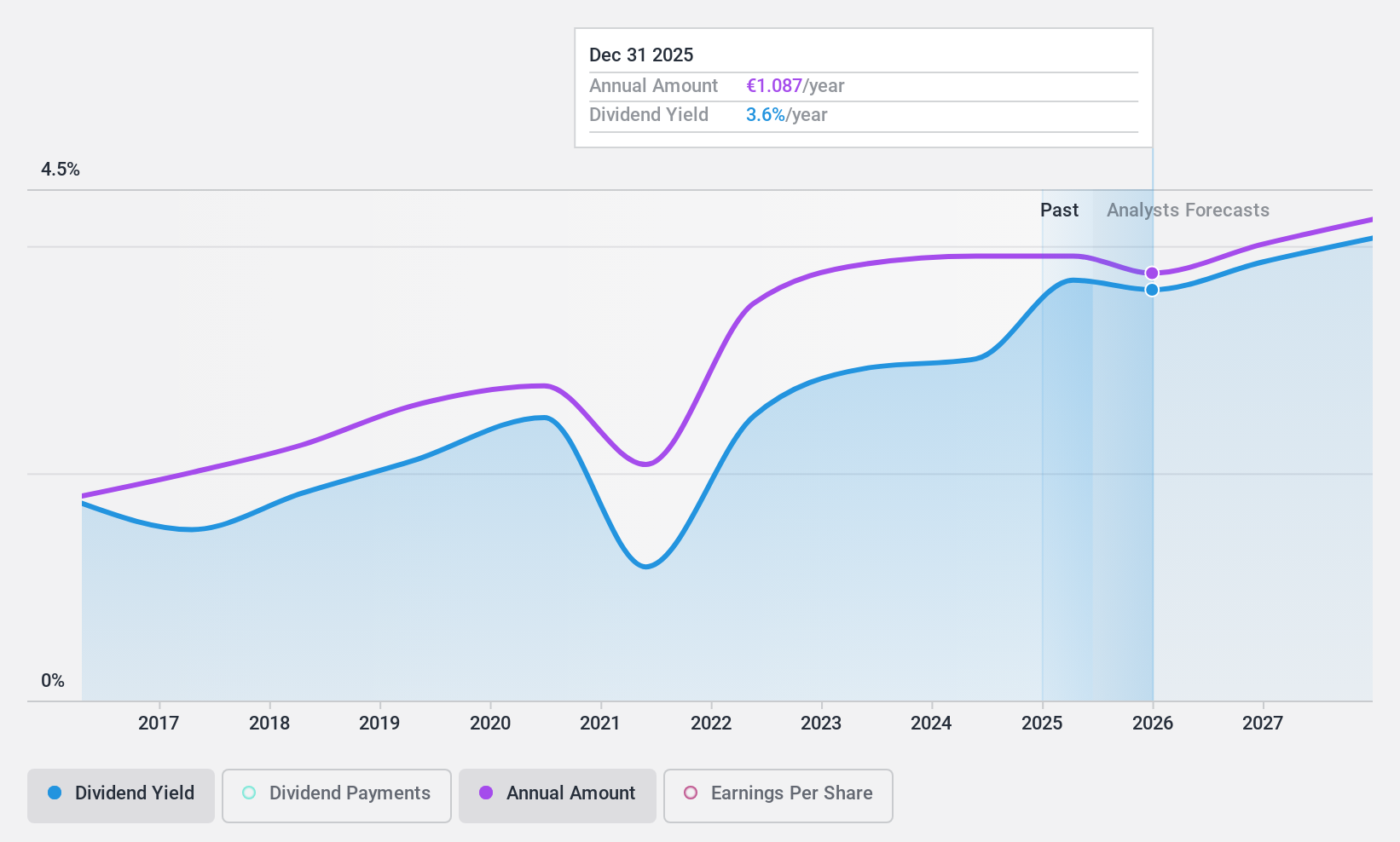

Aalberts (ENXTAM:AALB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aalberts N.V. provides mission-critical technologies for the aerospace, automotive, building, and maritime sectors with a market cap of €3.82 billion.

Operations: Aalberts N.V.'s revenue is primarily derived from its Building Technology segment, which contributes €1.74 billion, and its Industrial Technology segment, which accounts for €1.49 billion.

Dividend Yield: 3.3%

Aalberts N.V. offers a mixed picture for dividend investors. While the company's dividends are well-covered by earnings and cash flows, with a payout ratio of 41% and a cash payout ratio of 60.4%, its dividend yield of 3.27% is below the top quartile in the Dutch market. Although dividends have grown over the past decade, they have been volatile, experiencing significant annual drops exceeding 20%. Recent earnings show slight declines in sales and net income compared to last year.

- Navigate through the intricacies of Aalberts with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Aalberts is priced lower than what may be justified by its financials.

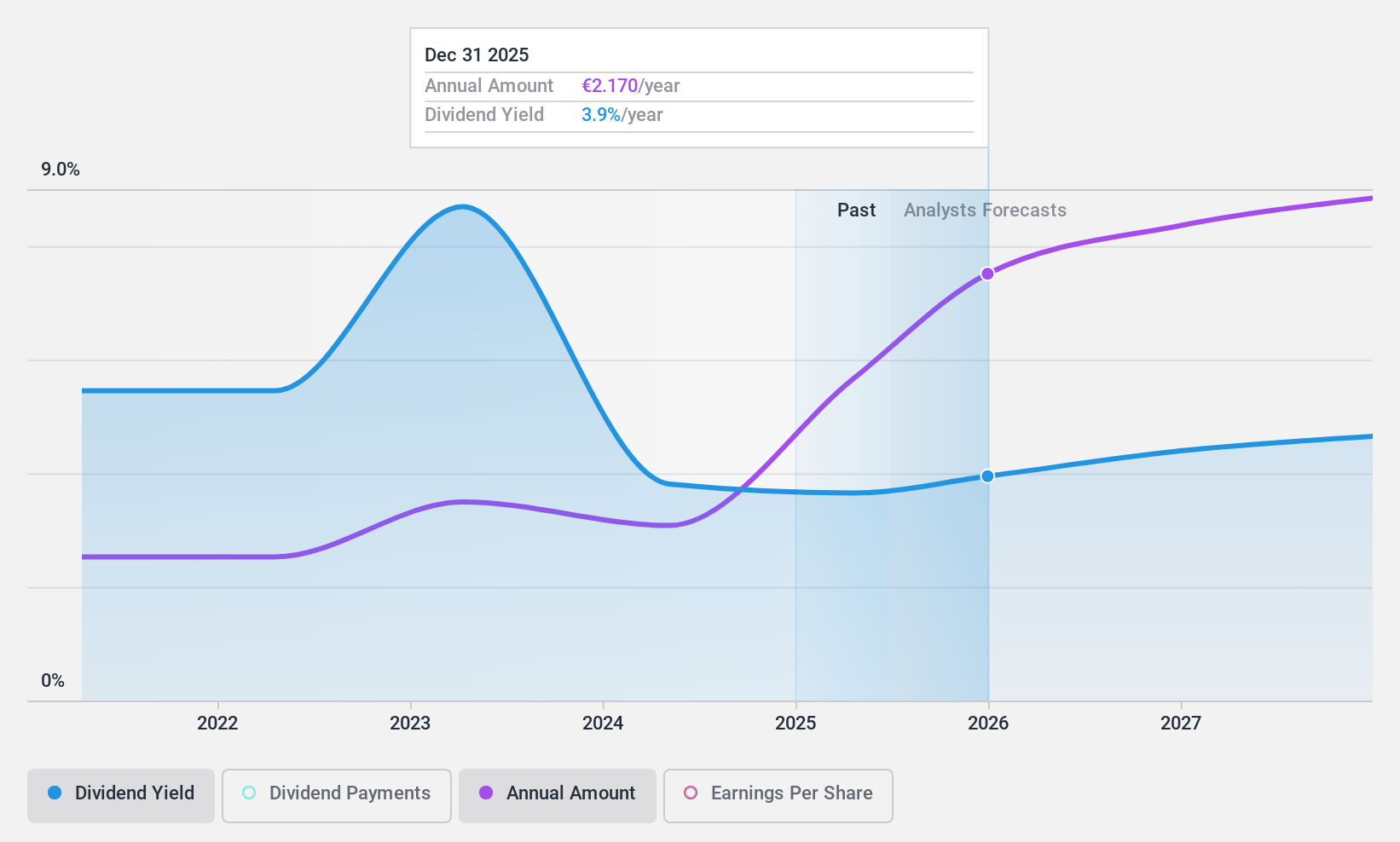

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. operates in property development, construction, and infrastructure sectors in the Netherlands and internationally with a market cap of €729.66 million.

Operations: Koninklijke Heijmans N.V. generates revenue from its Connecting segment, amounting to €871.03 million, with a Segment Adjustment of €1.83 billion.

Dividend Yield: 3.3%

Koninklijke Heijmans presents a complex scenario for dividend investors. Despite a low payout ratio of 30% and cash payout ratio of 20.7%, indicating dividends are well-covered, its dividend yield of 3.27% is below the Dutch market's top tier. The company has shown strong earnings growth, with recent half-year net income doubling to €37 million, yet its dividends have been volatile over the past decade, lacking stability in payments.

- Delve into the full analysis dividend report here for a deeper understanding of Koninklijke Heijmans.

- The analysis detailed in our Koninklijke Heijmans valuation report hints at an deflated share price compared to its estimated value.

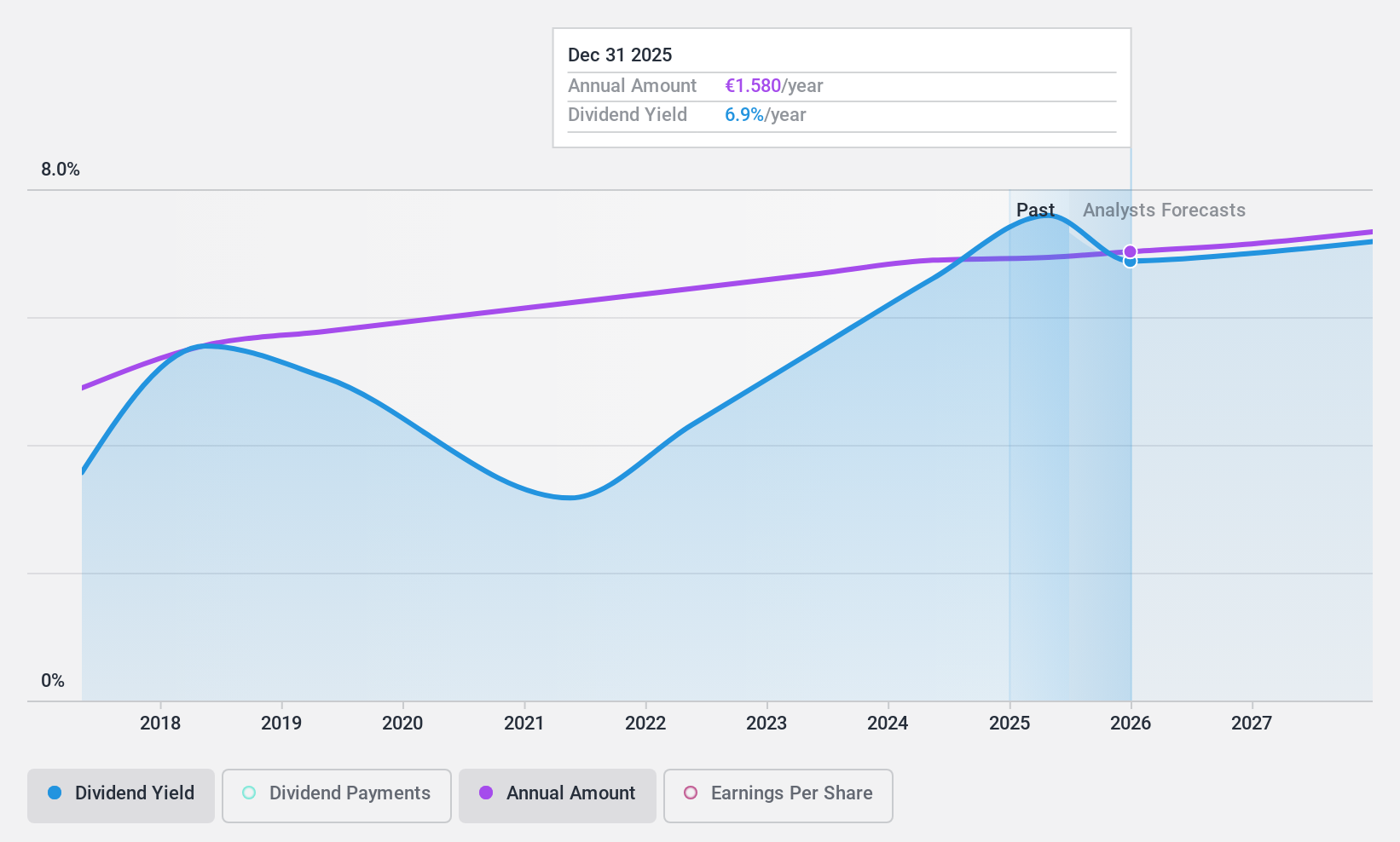

Signify (ENXTAM:LIGHT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Signify N.V. is a global provider of lighting products, systems, and services operating in Europe, the Americas, and other international markets with a market cap of €2.81 billion.

Operations: Signify N.V.'s revenue segments include €519 million from Conventional lighting products.

Dividend Yield: 7.0%

Signify's dividend profile is marked by volatility, with payments over the past eight years being unreliable despite a top-tier yield of 6.96% in the Dutch market. While dividends are covered by earnings and cash flows—payout ratios at 80.4% and 34.2%, respectively—the company's recent removal from the FTSE All-World Index raises concerns about stability. Earnings have improved, with net income rising to €62 million in Q2 2024 from €41 million a year prior, but large one-off items affect financial results reliability.

- Dive into the specifics of Signify here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Signify shares in the market.

Next Steps

- Click here to access our complete index of 7 Top Euronext Amsterdam Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke Heijmans might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:HEIJM

Koninklijke Heijmans

Engages in the property development, construction, and infrastructure businesses in the Netherlands and internationally.

Flawless balance sheet with solid track record and pays a dividend.