- Netherlands

- /

- Machinery

- /

- ENXTAM:ENVI

Undiscovered Gems with Promising Potential for January 2025

Reviewed by Simply Wall St

As global markets wrap up the year with mixed signals, including a dip in U.S. consumer confidence and fluctuating indices, investors are closely watching for opportunities amid the economic uncertainties. In this environment, identifying stocks that exhibit strong fundamentals and resilience against market volatility can be crucial for uncovering potential growth stories in the small-cap sector.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Boursa Kuwait Securities Company K.P.S.C | NA | 14.28% | 2.26% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Al-Enma'a Real Estate Company K.S.C.P | 16.44% | -13.00% | 21.11% | ★★★★★☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Envipco Holding (ENXTAM:ENVI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Envipco Holding N.V. specializes in the design, development, manufacturing, assembly, marketing, sales, leasing, and servicing of reverse vending machines for collecting and processing used beverage containers across the Netherlands, North America, and Europe with a market cap of €314.41 million.

Operations: Envipco Holding generates revenue primarily from the sale and leasing of reverse vending machines across various regions, including the Netherlands, North America, and Europe. The company's financial performance includes a market capitalization of €314.41 million.

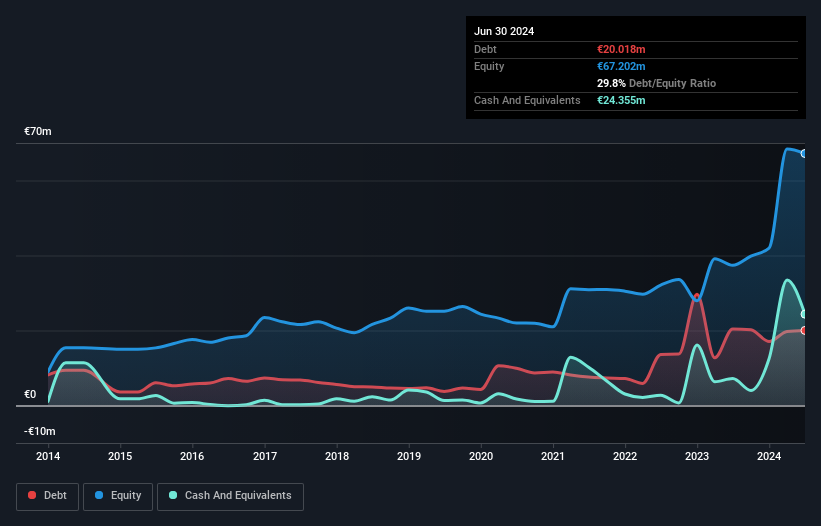

Envipco has seen its debt to equity ratio rise from 17.6% to 39.8% over five years, indicating increased leverage, while interest coverage remains tight at 2.8x EBIT. Despite this, the company is trading at a significant discount of 84.3% below estimated fair value and boasts high-quality earnings with positive free cash flow recently reported at €1.94 million for Q3 2024. Earnings are forecasted to grow by an impressive 105% annually, though recent results show a net loss of €0.53 million for the quarter despite sales growth to €27.45 million from €25.27 million year-on-year.

- Take a closer look at Envipco Holding's potential here in our health report.

Understand Envipco Holding's track record by examining our Past report.

ITAB Shop Concept (OM:ITAB)

Simply Wall St Value Rating: ★★★★★★

Overview: ITAB Shop Concept AB (publ) specializes in solution design, customized shop fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for physical stores with a market cap of approximately SEK5.29 billion.

Operations: The company generates revenue primarily from its Furniture & Fixtures segment, amounting to SEK6.42 billion.

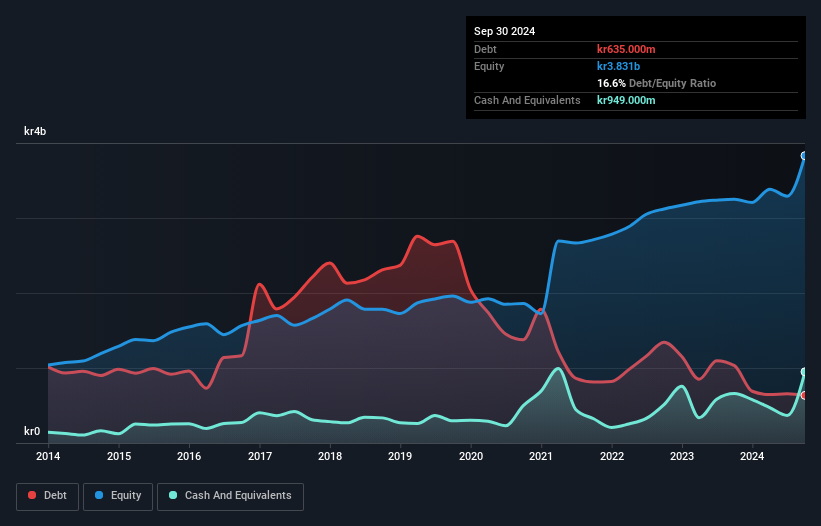

ITAB, a player in the retail solutions sector, has recently shown robust earnings growth of 53.6%, outpacing its industry peers who faced a -5.6% trend. Over the past five years, ITAB's financial prudence is evident as it slashed its debt to equity ratio from 137.3% to a manageable 16.6%. The company trades at about 23.7% below estimated fair value, suggesting potential undervaluation in the market. Despite shareholder dilution last year, ITAB remains profitable with free cash flow positivity and strong EBIT coverage of interest payments by 61 times, indicating solid operational efficiency and financial health moving forward.

- Dive into the specifics of ITAB Shop Concept here with our thorough health report.

Explore historical data to track ITAB Shop Concept's performance over time in our Past section.

Investment AB Öresund (OM:ORES)

Simply Wall St Value Rating: ★★★★★★

Overview: Investment AB Öresund (publ) is an investment company focused on asset management activities in Sweden, with a market capitalization of SEK4.81 billion.

Operations: Öresund generates revenue primarily from unclassified services amounting to SEK920.77 million. The company's market capitalization stands at SEK4.81 billion, reflecting its scale in the investment sector within Sweden.

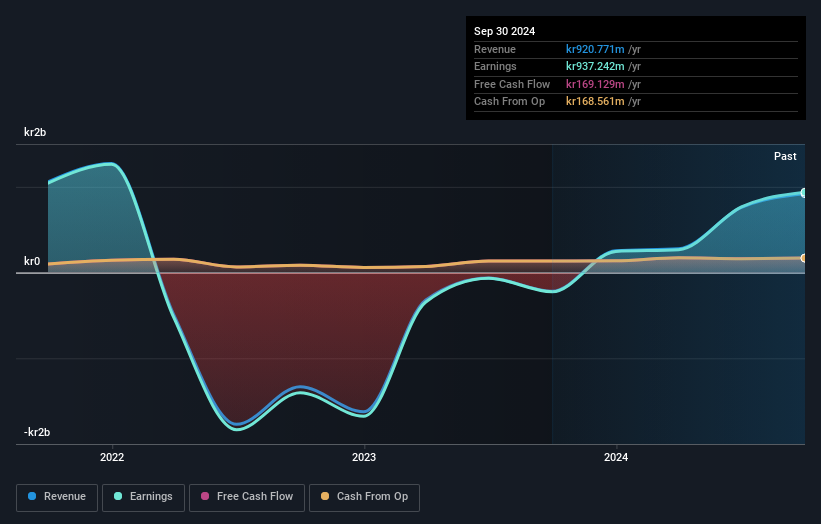

Investment AB Öresund has emerged as a notable player, showcasing a Price-To-Earnings ratio of 5.3x, significantly lower than the Swedish market average of 23.2x. The company reported a net income of SEK 488.4 million for the nine months ending September 2024, compared to a net loss of SEK 202.3 million in the previous year, highlighting its turnaround to profitability this year. With no debt on its books for over five years and positive free cash flow reaching SEK 169.13 million recently, Öresund stands out with high-quality earnings and no concerns about interest coverage or cash runway challenges.

- Delve into the full analysis health report here for a deeper understanding of Investment AB Öresund.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 4644 Undiscovered Gems With Strong Fundamentals now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Envipco Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ENVI

Envipco Holding

Designs, develops, manufactures, assembles, markets, sells, leases, and services reverse vending machines (RVM) to collect and process used beverage containers primarily in the Netherlands, North America, and rest of Europe.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives