- Netherlands

- /

- Machinery

- /

- ENXTAM:AALB

European Dividend Stocks To Watch In October 2025

Reviewed by Simply Wall St

As European markets reach record highs, buoyed by technology stocks and expectations of lower U.S. borrowing costs, investors are keenly watching for opportunities in dividend stocks that can provide stability amid fluctuating economic conditions. In such an environment, a good dividend stock is often characterized by its ability to offer consistent payouts and maintain strong fundamentals despite broader market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.34% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.32% | ★★★★★☆ |

| Sulzer (SWX:SUN) | 3.09% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.80% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.76% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.95% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.25% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.67% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.06% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.66% | ★★★★★☆ |

Click here to see the full list of 220 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

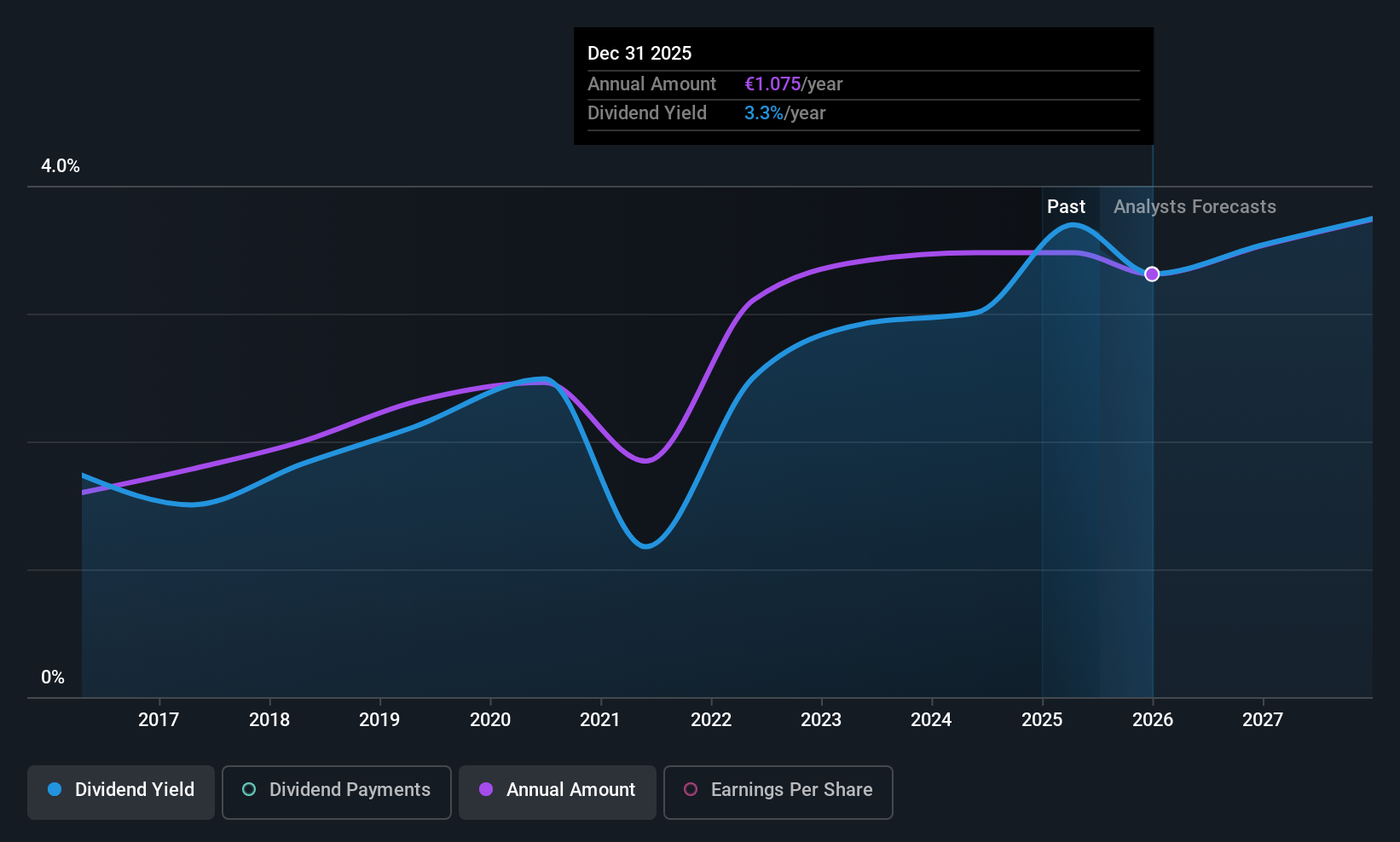

Aalberts (ENXTAM:AALB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aalberts N.V. operates through its subsidiaries to provide mission-critical technologies for the building, industry, and semiconductor markets across Europe, the United States, Asia Pacific, the Middle East, and Africa with a market cap of €3.12 billion.

Operations: Aalberts N.V. generates revenue through its key segments: Building Technology (€1.58 billion), Industrial Technology (€1.06 billion), and Semicon (€467.10 million).

Dividend Yield: 3.9%

Aalberts' recent removal from the FTSE All-World Index and volatile dividend history may concern some investors. Despite a 10-year upward trend in dividends, payments have been inconsistent, with significant annual drops. The company's dividend yield is below the top quartile of Dutch payers. However, dividends are currently covered by earnings and cash flows, suggesting sustainability for now. Recent share buybacks totaling €134.58 million might indicate management's confidence despite declining sales and net income for H1 2025.

- Delve into the full analysis dividend report here for a deeper understanding of Aalberts.

- Our comprehensive valuation report raises the possibility that Aalberts is priced lower than what may be justified by its financials.

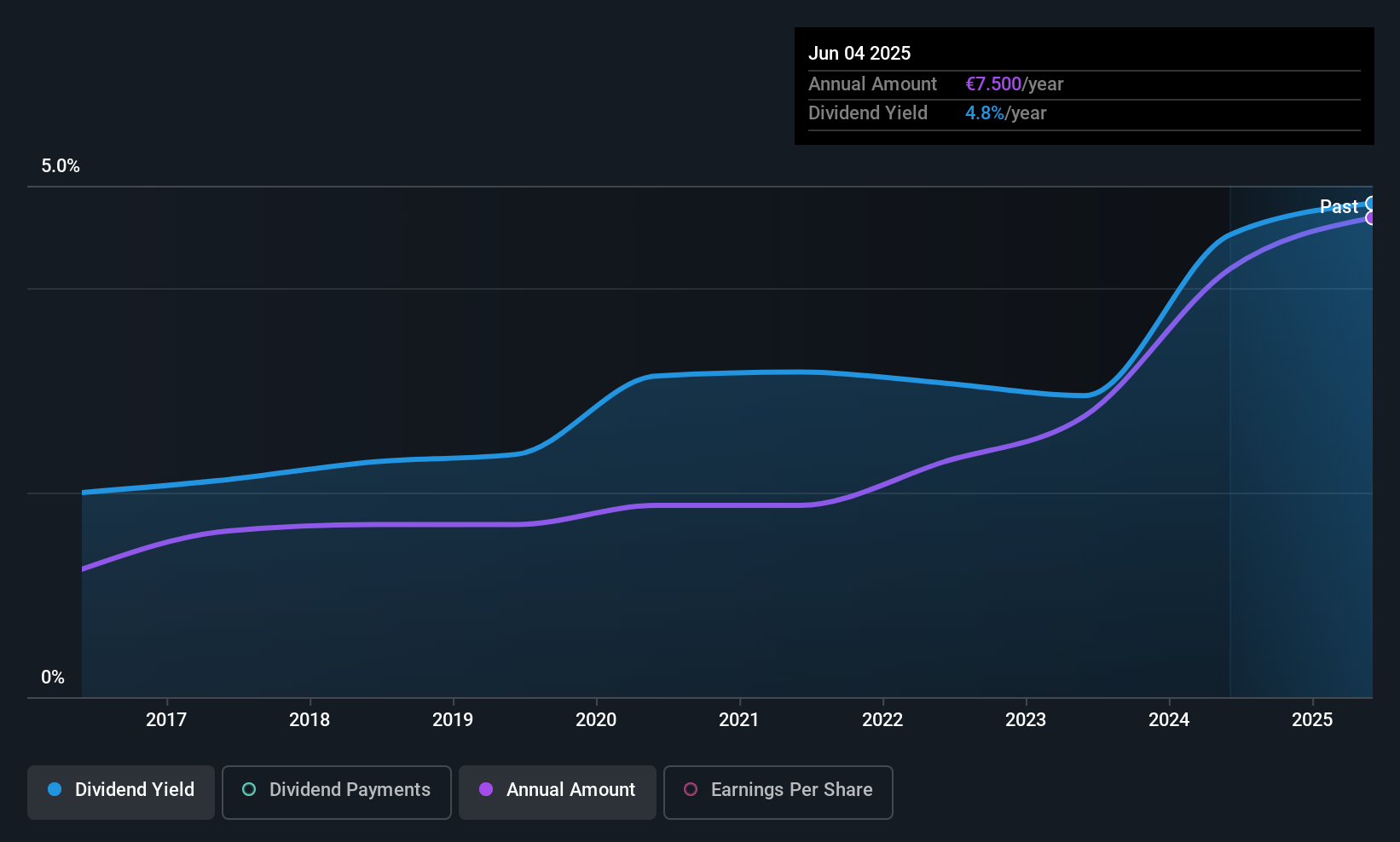

Exacompta Clairefontaine (ENXTPA:ALEXA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Exacompta Clairefontaine S.A. is involved in producing, finishing, and formatting papers in France, Europe, and internationally with a market cap of €181.04 million.

Operations: Exacompta Clairefontaine S.A. generates revenue from its operations in the production, finishing, and formatting of papers across France, Europe, and internationally.

Dividend Yield: 4.7%

Exacompta Clairefontaine's dividend yield of 4.69% is below the top quartile in France but has been stable and growing over the past decade, indicating reliability. The payout ratio of 27% suggests dividends are well covered by earnings, though cash flow coverage data is insufficient. Recent executive changes and a projected decline in operating income may impact future performance. H1 2025 saw decreased sales (€393.7 million) and net income (€6.52 million), potentially affecting dividend sustainability.

- Take a closer look at Exacompta Clairefontaine's potential here in our dividend report.

- Our valuation report here indicates Exacompta Clairefontaine may be undervalued.

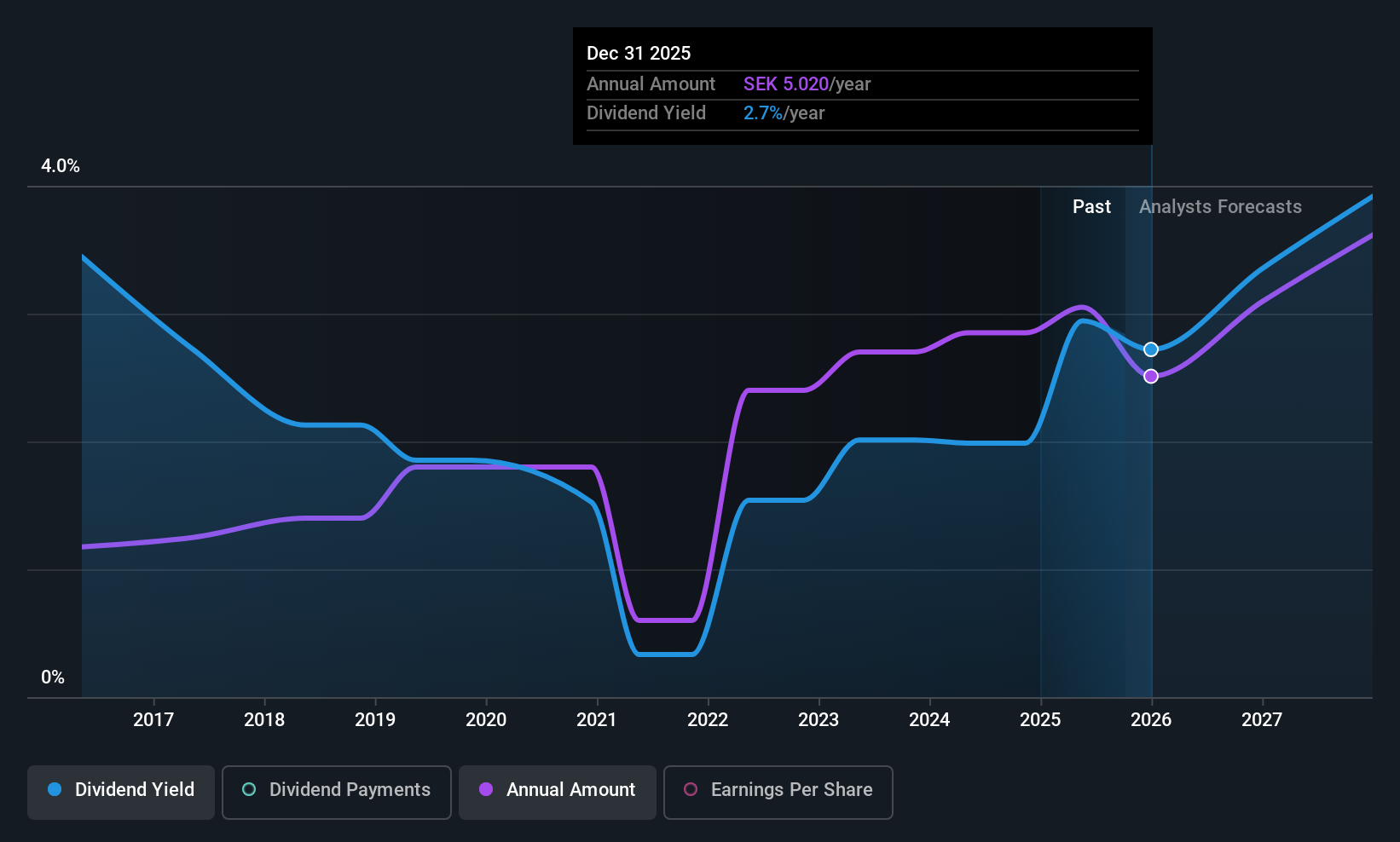

BTS Group (OM:BTS B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BTS Group AB (publ) is a professional services firm with a market cap of approximately SEK3.57 billion.

Operations: BTS Group AB (publ) generates revenue from several segments, including BTS North America with SEK1.52 billion, BTS Other Markets at SEK861.95 million, BTS Europe contributing SEK660.37 million, and Advantage Performance Group (APG) adding SEK131.19 million.

Dividend Yield: 3.3%

BTS Group's dividend payments have increased over the past decade, though they have been volatile and unreliable. The payout ratio of 35% and cash payout ratio of 52.2% indicate dividends are covered by earnings and cash flows. Despite trading at a significant discount to its estimated fair value, BTS's recent earnings decline—SEK 39.31 million in Q2 compared to SEK 60.41 million last year—could challenge dividend sustainability amidst strategic expansions like its new Nairobi office.

- Click here and access our complete dividend analysis report to understand the dynamics of BTS Group.

- Our valuation report unveils the possibility BTS Group's shares may be trading at a discount.

Key Takeaways

- Access the full spectrum of 220 Top European Dividend Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:AALB

Aalberts

Offers mission-critical technologies for building, industry, and semicon markets in Europe, the United States, the Asia Pacific, the Middle East, and Africa.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives