- Netherlands

- /

- Banks

- /

- ENXTAM:INGA

ING (ENXTAM:INGA): Assessing Valuation Following CEO Appointment for Italian Operations

Reviewed by Simply Wall St

ING Groep (ENXTAM:INGA) has caught investors’ attention with its decision to appoint Andrea Diamanti as CEO for its Italian operations, effective January 2026. Diamanti will lead both retail and wholesale banking in the country.

See our latest analysis for ING Groep.

Following the announcement of Andrea Diamanti’s upcoming leadership in Italy, momentum in ING Groep’s shares remains solid. The latest share price sits at €22.39, with a standout year-to-date share price return of 47.4%. Longer-term, the bank has delivered a robust 60.3% total shareholder return over the past twelve months, reflecting both renewed investor confidence and continued earnings growth.

If leadership shakeups have you thinking bigger-picture, now is the perfect time to discover fast growing stocks with high insider ownership.

With robust returns and new leadership on the horizon, investors must now weigh whether ING Groep’s current momentum signals further upside or if the market is already factoring in the bank’s future growth. Could there still be a buying opportunity?

Most Popular Narrative: 19.8% Undervalued

According to the most-followed narrative from PittTheYounger, ING Groep’s fair value is estimated near €27.92, noticeably above the last close of €22.39. This perspective frames the bank as meaningfully priced below what robust financials and sector shifts may warrant. This invites a deeper look at the drivers behind this valuation stance.

First, there is the pan-European drive among governments to invest heavily in public infrastructure that is in urgent need of repairs and refurbishment after decades of neglect. Public investment is one of the key stimulants of economic activity, providing banks with more and better opportunities to lend, while steepening the rate curve at the same time. This, in turn, enhances NII.

Curious about the financial underpinnings behind this narrative? Find out what ambitious targets for long-term profit margins, revenue transitions, and sector dynamics could mean for ING’s valuation and see what makes this scenario stand out from the market’s own projections.

Result: Fair Value of €27.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, global rate cuts and geopolitical tensions could easily disrupt ING’s projected upside. These factors may test both investor optimism and management’s long-term strategy.

Find out about the key risks to this ING Groep narrative.

Another View: Market Multiples Send a Different Signal

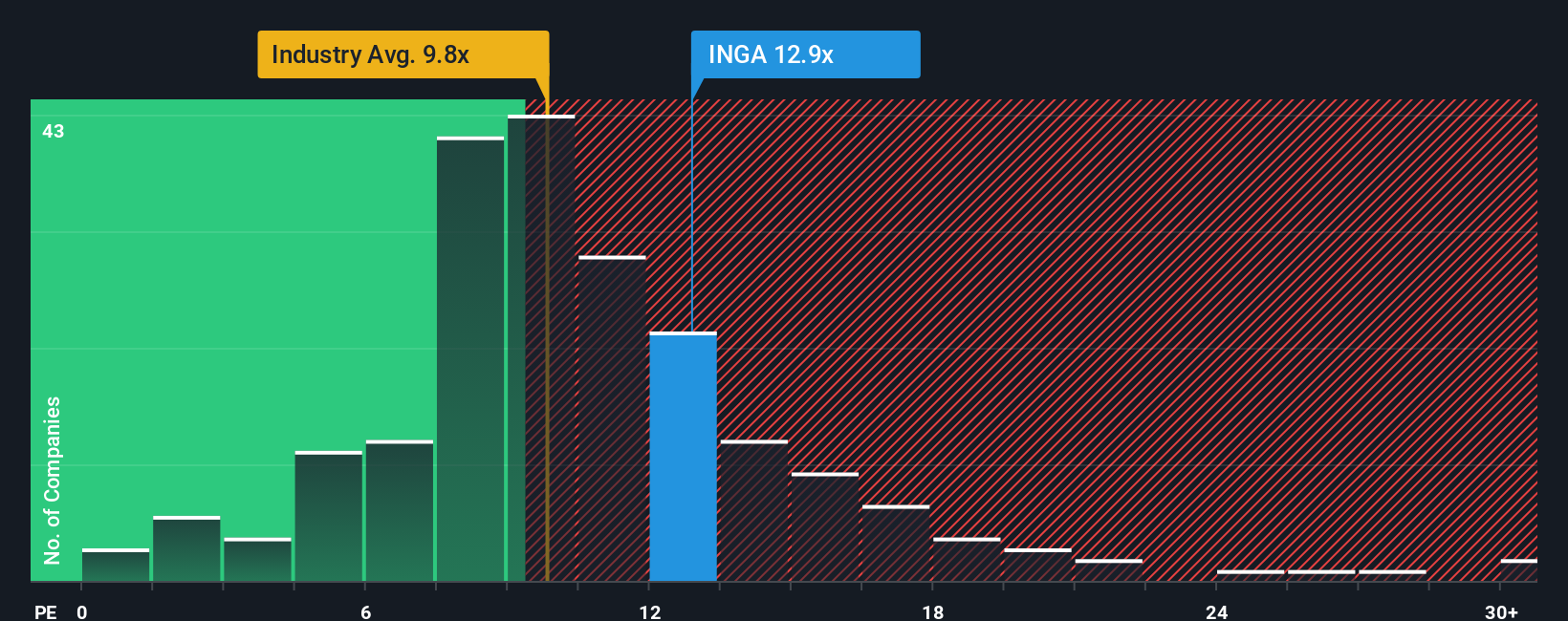

While some see ING Groep's shares as undervalued, our analysis using price-to-earnings ratios tells a different story. ING’s ratio is 13 times earnings, which is notably higher than the fair ratio of 12.3 as well as the industry average of 10.1 and peer average of 9.6. This difference suggests a premium is already reflected in the price and highlights potential downside risk if market sentiment shifts. Is the optimism justified or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ING Groep Narrative

If you see things differently or want to do your own deep dive into ING Groep’s numbers, you can build your own perspective in just a few minutes: Do it your way.

A great starting point for your ING Groep research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Your Next Move? Unmissable Investment Ideas

Don’t let great opportunities slip past. Broaden your portfolio by tapping into powerful trends and future-focused stocks using the Simply Wall Street Screener today.

- Unlock yield potential and steady returns by scanning these 15 dividend stocks with yields > 3% offering robust payouts above 3% for income-focused investors.

- Spot innovation around every corner as you check out these 26 AI penny stocks driving real breakthroughs with artificial intelligence at their core.

- Capitalize on market disruption and spot value gaps by uncovering these 877 undervalued stocks based on cash flows that analysts might be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:INGA

ING Groep

Provides various banking products and services in the Netherlands, Belgium, Germany, rest of Europe, and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives