- Netherlands

- /

- Banks

- /

- ENXTAM:INGA

ING Bank (ENXTAM:INGA): Valuation Insights Following Strong Q3 Earnings and New Shareholder Payouts

Reviewed by Simply Wall St

ING Groep (ENXTAM:INGA) has drawn investor focus following its third quarter earnings release, which highlighted solid growth in fee income along with ongoing strength in the lending business. The company also unveiled a substantial new cash distribution program.

See our latest analysis for ING Groep.

ING Groep’s run of upbeat headlines, from a resilient third quarter and strong new buyback to incoming leadership changes, has powered real momentum, with the stock’s share price up nearly 38% so far this year. Long-term investors have enjoyed even stronger gains, with total shareholder return hitting 44% over the last twelve months and a remarkable 365% in five years. This has reinforced growing confidence in ING’s direction and growth potential.

If ING’s latest moves have you thinking bigger, this is the perfect moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

Yet with ING shares riding high and investor enthusiasm growing, the key question remains: are we now seeing a compelling value opportunity, or is the company’s momentum already fully reflected in the current price?

Most Popular Narrative: 25% Undervalued

According to PittTheYounger, the narrative’s fair value estimate comes in well above the last close at €20.94. This suggests a large gap between ING Groep’s current share price and its underlying long-term potential. The narrative’s fair value calculation uses a forward-looking discount rate and reflects optimism about the bank's evolving income streams and sector tailwinds.

First, there is the pan-European drive among governments to invest heavily in public infrastructure that is screaming out for repairs and refurbishment after decades of neglect. Public investment, in turn, is one of the key stimulants of economic activity. This provides banks with more and better opportunities to lend, while steepening the rate curve at the same time. As a result, NII is enhanced.

Curious what bold assumptions unlock ING’s higher value in this narrative? The secret sauce: a shift in income mix and strategic bets on future growth. Discover the detailed logic and forecast numbers backing up this ambitious fair value.

Result: Fair Value of €27.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sharper-than-expected slowdown in public investment or further cuts in European interest rates could quickly challenge ING’s bullish valuation case.

Find out about the key risks to this ING Groep narrative.

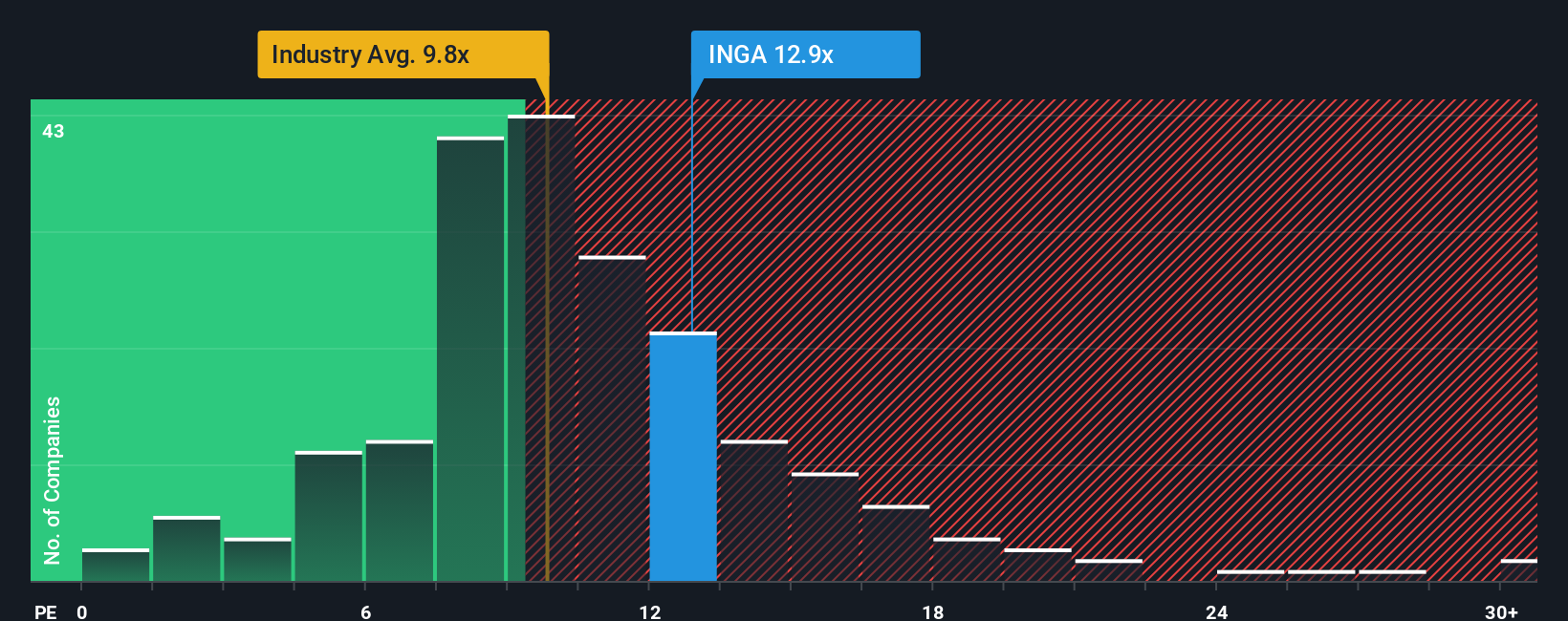

Another View: Market Multiples Disagree

Looking at ING Groep from a different lens, its price-to-earnings ratio sits at 12.8x, which is higher than both the European banks industry average of 9.9x and the peer average of 9.1x. The fair ratio stands at 13.1x, suggesting the market could drift closer. This premium raises the question: does the market anticipate brighter prospects, or is it just overpaying for recent momentum?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ING Groep Narrative

Not convinced by the prevailing narratives or looking to chart your own perspective? Dive into the data yourself and see what story you uncover in just a few minutes. Do it your way

A great starting point for your ING Groep research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your investing potential to just one stock. Take charge of your financial future and see which standout opportunities are rising on Simply Wall Street right now.

- Accelerate your returns by targeting value plays with strong upside. Start with these 852 undervalued stocks based on cash flows and see what’s beating the market on future cash flows.

- Capture the fast-moving digital revolution when you tap into these 26 AI penny stocks reshaping industries and driving innovation around the globe.

- Take a fresh look at consistent cash generators. Lock in steady income by searching through these 21 dividend stocks with yields > 3% with high yields and quality payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:INGA

ING Groep

Provides various banking products and services in the Netherlands, Belgium, Germany, rest of Europe, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives