- Netherlands

- /

- Banks

- /

- ENXTAM:INGA

Euronext Amsterdam's Top 3 Dividend Stocks For Steady Income

Reviewed by Simply Wall St

Amidst a backdrop of global economic uncertainty and fluctuating markets, the Dutch stock market has shown resilience, with the pan-European STOXX Europe 600 Index ending 3.52% lower on renewed fears about a deterioration in the outlook for global economic growth. In this environment, dividend stocks can offer a steady income stream and provide some stability to investors' portfolios. When evaluating dividend stocks, it's crucial to consider factors such as consistent earnings performance, strong cash flow, and a history of reliable dividend payments—qualities that can help navigate through volatile market conditions.

Top 5 Dividend Stocks In The Netherlands

| Name | Dividend Yield | Dividend Rating |

| Koninklijke Heijmans (ENXTAM:HEIJM) | 3.84% | ★★★★☆☆ |

| Aalberts (ENXTAM:AALB) | 3.34% | ★★★★☆☆ |

| Randstad (ENXTAM:RAND) | 5.38% | ★★★★☆☆ |

| ABN AMRO Bank (ENXTAM:ABN) | 9.91% | ★★★★☆☆ |

| Signify (ENXTAM:LIGHT) | 7.56% | ★★★★☆☆ |

| ING Groep (ENXTAM:INGA) | 6.84% | ★★★★☆☆ |

| Acomo (ENXTAM:ACOMO) | 6.61% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

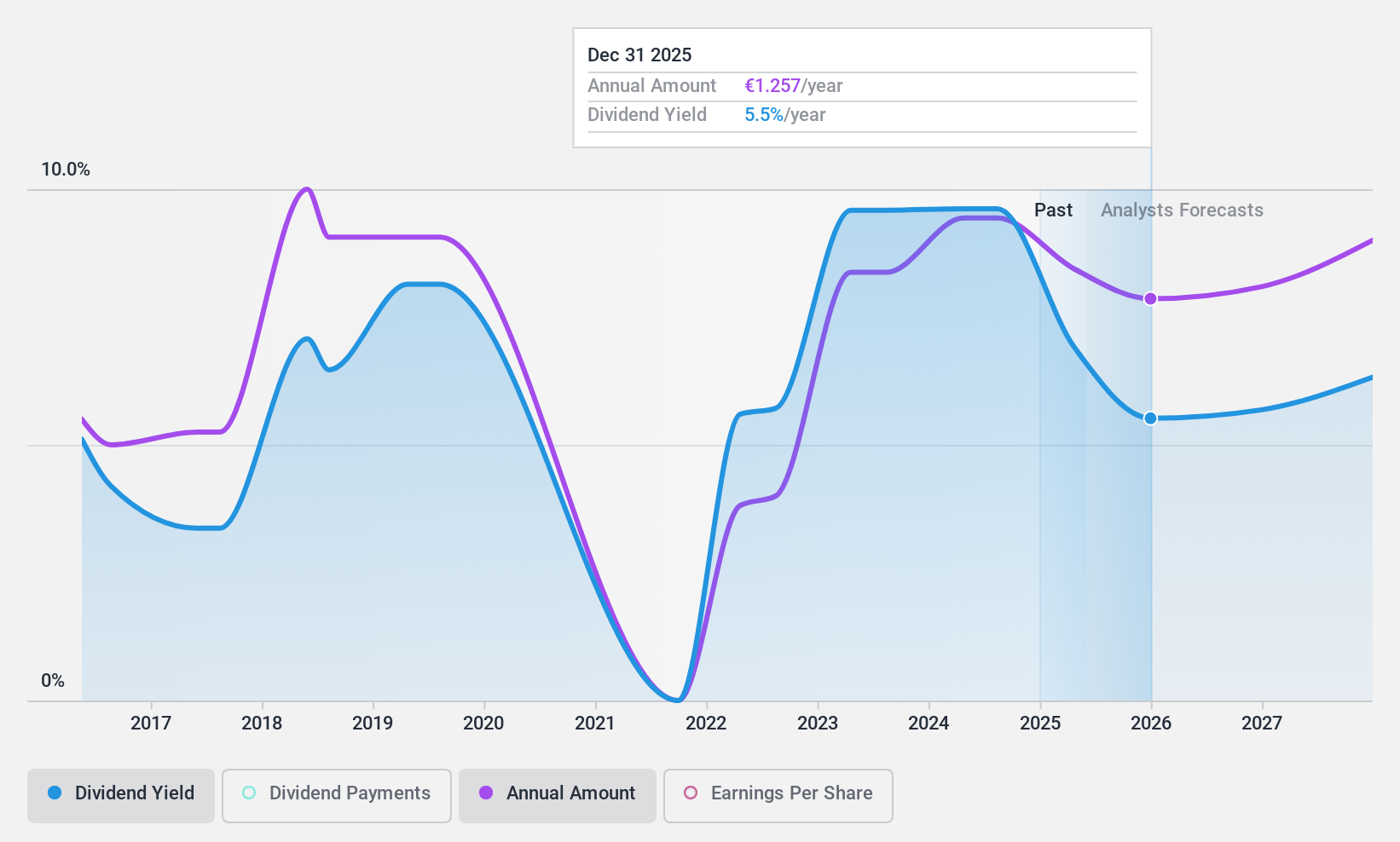

ABN AMRO Bank (ENXTAM:ABN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a range of banking products and financial services to retail, private, and business clients both in the Netherlands and internationally, with a market cap of €12.69 billion.

Operations: ABN AMRO Bank's revenue segments include €3.46 billion from Corporate Banking, €1.55 billion from Wealth Management, and €4.02 billion from Personal & Business Banking.

Dividend Yield: 9.9%

ABN AMRO Bank's dividend payments, while currently covered by earnings with a payout ratio of 50.5%, have been unreliable and volatile over the past nine years. Recent events include a reduction in the interim dividend to €0.60 per share, reflecting cautious financial management amid slightly declining net income (EUR 1.32 billion) compared to last year (EUR 1.39 billion). The bank's dividends are projected to remain covered by earnings in the next three years despite potential earnings declines.

- Click here to discover the nuances of ABN AMRO Bank with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, ABN AMRO Bank's share price might be too pessimistic.

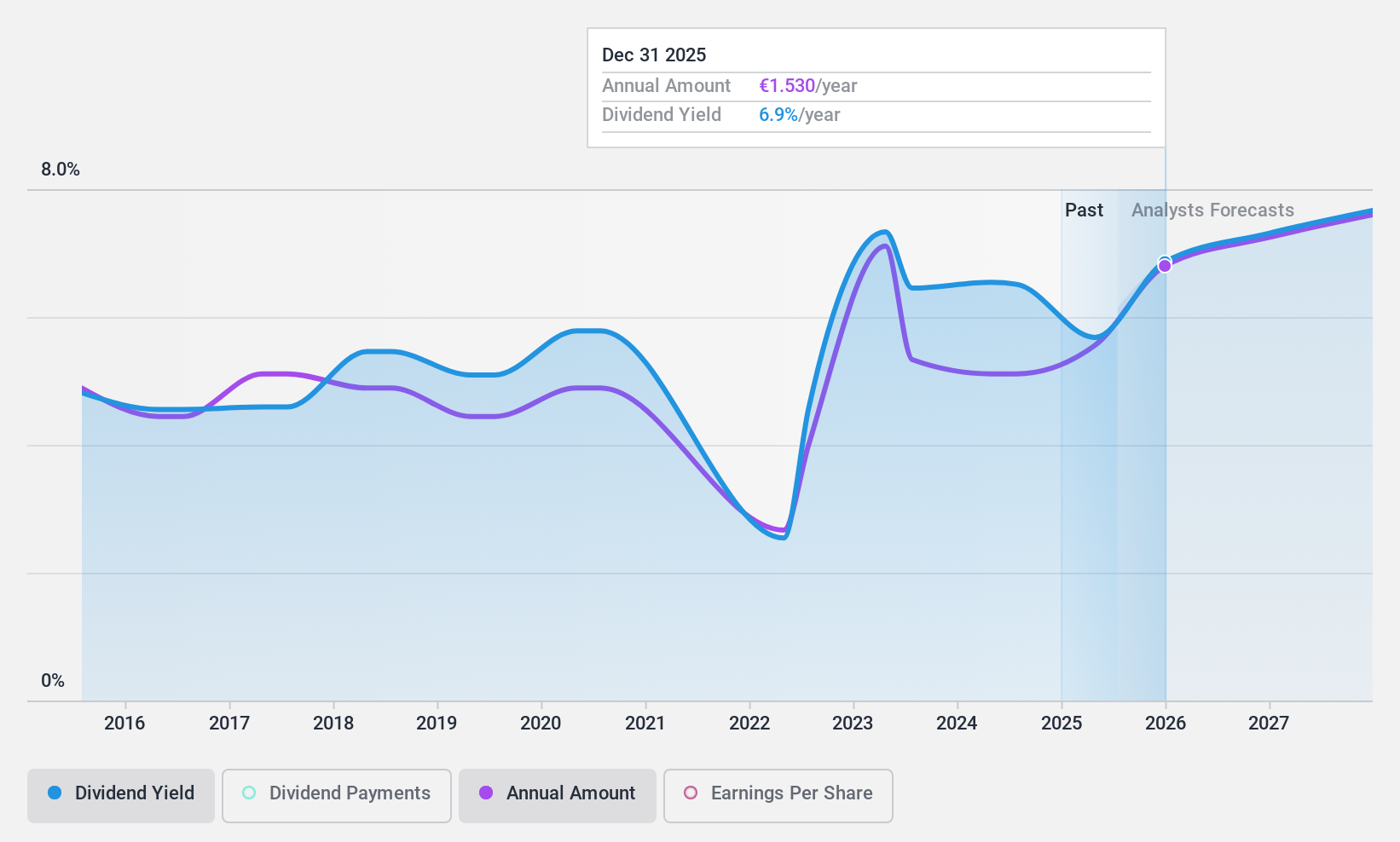

Acomo (ENXTAM:ACOMO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Acomo N.V., with a market cap of €515.35 million, is involved in sourcing, trading, processing, packaging, and distributing conventional and organic food ingredients and solutions for the food and beverage industry across the Netherlands, Europe, North America, and internationally.

Operations: Acomo N.V. generates revenue from various segments, including Tea (€124.04 million), Edible Seeds (€246.52 million), Food Solutions (€23.47 million), Spices and Nuts (€445.76 million), and Organic Ingredients (€429.28 million).

Dividend Yield: 6.6%

Acomo's recent earnings report shows a slight increase in sales to €668.2 million but a decline in net income to €17.94 million, impacting its dividend sustainability. With a high payout ratio of 95.7%, dividends are not well covered by earnings despite being covered by cash flows (51%). The dividend yield is attractive at 6.61% but has been volatile over the past decade and unreliable, with significant annual drops exceeding 20%.

- Click to explore a detailed breakdown of our findings in Acomo's dividend report.

- Our valuation report unveils the possibility Acomo's shares may be trading at a premium.

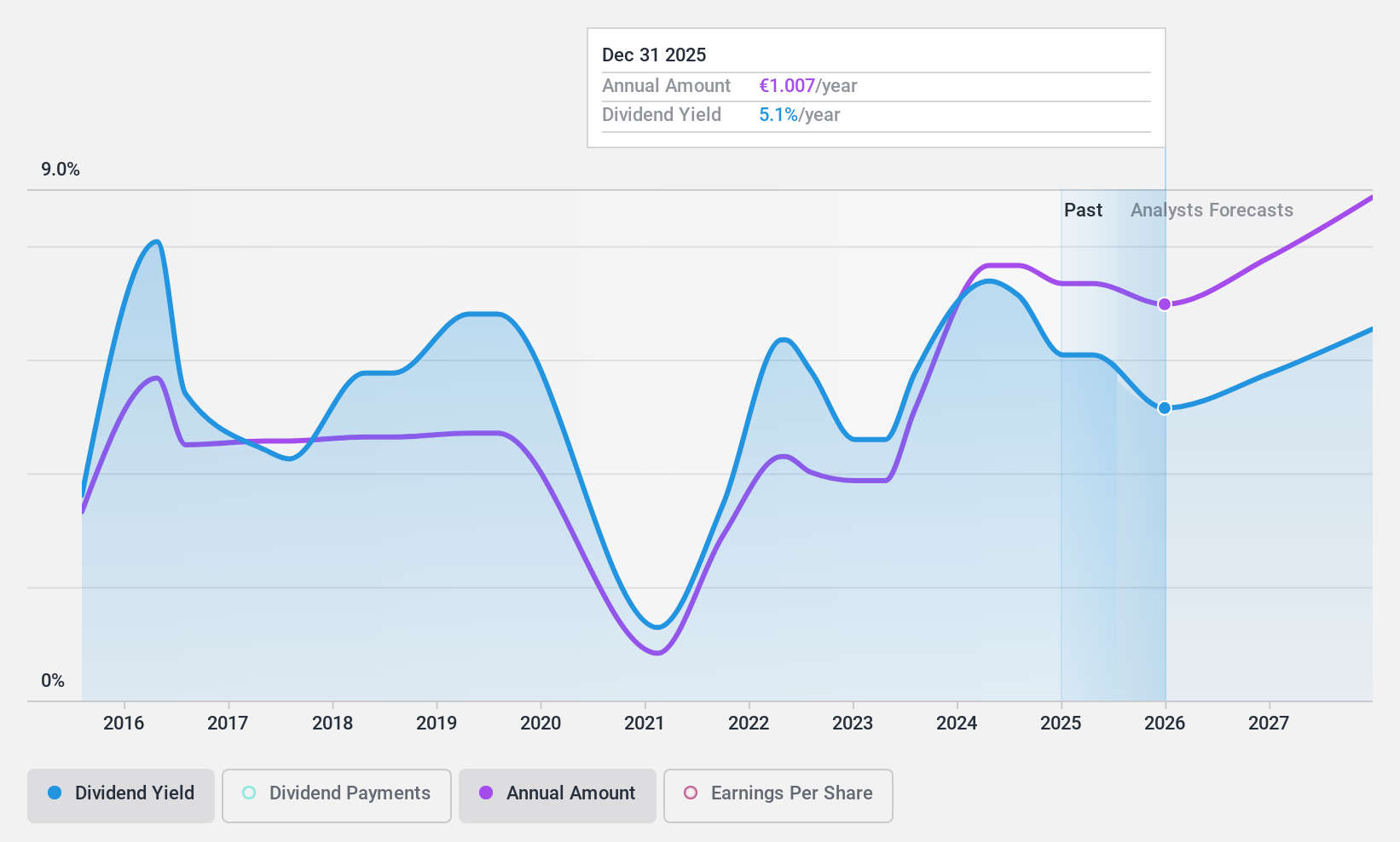

ING Groep (ENXTAM:INGA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ING Groep N.V. offers a range of banking products and services across the Netherlands, Belgium, Germany, other parts of Europe, and internationally, with a market cap of €51.33 billion.

Operations: ING Groep N.V.'s revenue segments include Retail Banking in the Netherlands (€4.97 billion), Belgium (€2.61 billion), and Germany (€2.97 billion), as well as Wholesale Banking (€6.69 billion) and Corporate Line Banking (€334 million).

Dividend Yield: 6.8%

ING Groep's recent buyback of 127.4 million shares for €2.03 billion reflects a commitment to returning capital to shareholders, enhancing its dividend appeal. However, with net income declining from €2.16 billion to €1.78 billion in Q2 2024 and a payout ratio of 69.8%, the sustainability of its dividends may be questioned despite a high yield of 6.84%. The dividend has been volatile over the past nine years, reducing reliability for investors seeking stable income streams.

- Get an in-depth perspective on ING Groep's performance by reading our dividend report here.

- The valuation report we've compiled suggests that ING Groep's current price could be quite moderate.

Seize The Opportunity

- Get an in-depth perspective on all 7 Top Euronext Amsterdam Dividend Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:INGA

ING Groep

Provides various banking products and services in the Netherlands, Belgium, Germany, rest of Europe, and internationally.

Excellent balance sheet average dividend payer.