- Netherlands

- /

- Banks

- /

- ENXTAM:INGA

A Closer Look at ING Groep (ENXTAM:INGA) Valuation After Steady Share Price Gains

Reviewed by Simply Wall St

There hasn’t been a breaking news event or headline-grabbing shift around ING Groep (ENXTAM:INGA) this week. Sometimes, though, it’s the quiet moves that raise the big questions for investors. Maybe you’re wondering if the steady climb in the share price signals underlying strength, or if we’re just witnessing a pause before the next turn. In these moments, it’s easy to overlook a stock like ING Groep. Still, its numbers and valuation call for a closer look.

Over the past year, ING Groep has quietly built momentum, with its stock returning almost 39%. Looking further back, returns have been even stronger, and the past few months have seen new gains, up more than 13% in just one quarter. Even without a major catalyst, this consistent growth hints at changing investor sentiment and possibly a shift in how the market values its earnings and potential in the European banking landscape.

So after this sustained upward trend, is ING Groep an undervalued opportunity right now or are markets already baking in its future growth story?

Most Popular Narrative: 25% Undervalued

According to the most popular narrative, ING Groep is currently trading at a significant discount to its calculated fair value. This perspective suggests that the stock could represent an undervalued opportunity for investors willing to look beyond recent performance.

“Additionally, ING is among the sector leaders when it comes to trying to pivot away from NII as the predominant factor of profits. Instead, the industry in general and the Dutch bankers in particular aim to reap an ever higher share of income from fees for various services, be it client wealth management, M&A activities, debt underwriting, and so on. The past quarter demonstrates that ING has made ground in this effort at exactly the right time, while still standing to profit from the aforementioned EU investment initiative.”

Want to peek inside the valuation engine that drives the big gap between market price and fair value? The narrative behind this bold target is powered by eye-catching growth assumptions and profit margins that most banks can only dream about. Curious what is fueling this optimism and how long it might last? You will want to dig into the full story behind this bullish outlook.

Result: Fair Value of €27.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ING’s progress still faces pressure from lower interest rates and the potential for renewed global trade tensions, which could weigh on European banks.

Find out about the key risks to this ING Groep narrative.Another View: Market Signals a Premium

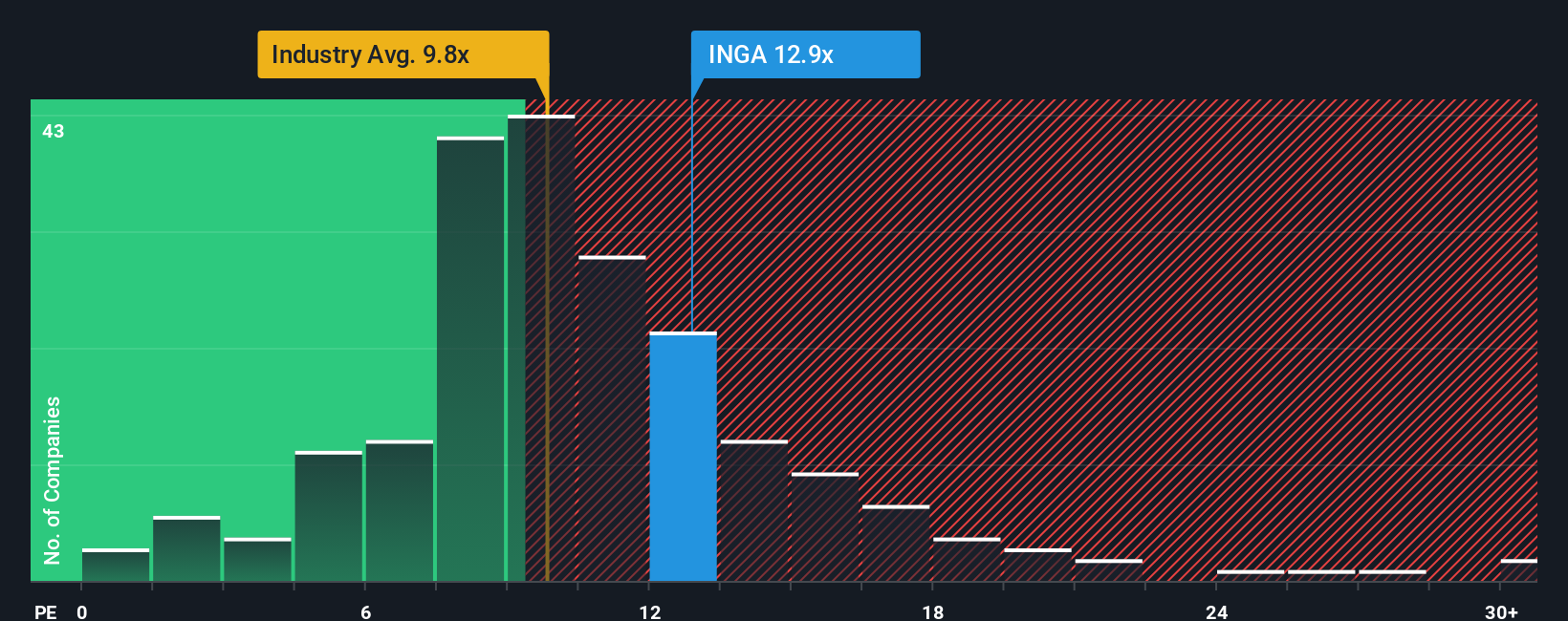

Taking a different approach, valuation based on earnings ratios paints a less optimistic story. By industry standards, ING Groep looks slightly expensive, which suggests that current market expectations might already be high. Can the fundamentals justify ongoing optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ING Groep Narrative

If you see things differently or want to dive into the numbers yourself, you can build your own narrative in just a few minutes. Do it your way.

A great starting point for your ING Groep research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Stock Ideas?

Don’t miss your chance to move ahead of the crowd. The Simply Wall Street Screener brings you a world of fresh opportunities tailored for forward-thinking investors.

- Uncover hidden gems with game-changing potential when you target companies known for AI penny stocks shaping tomorrow’s tech landscape.

- Capture reliable income streams by tracking down shares that consistently reward with high payouts using our gateway to dividend stocks with yields > 3%.

- Find strong performers undervalued by the market and set yourself up for growth by screening the latest undervalued stocks based on cash flows opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTAM:INGA

ING Groep

Provides various banking products and services in the Netherlands, Belgium, Germany, rest of Europe, and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.