As European markets continue to show strength, with the pan-European STOXX Europe 600 Index and major stock indices posting gains, investors are increasingly looking for stable income sources amidst fluctuating economic indicators. In such an environment, dividend stocks can offer a reliable stream of income and potential for capital appreciation, making them an attractive option for those seeking stability in their investment portfolios.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.37% | ★★★★★★ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.90% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.35% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.84% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.89% | ★★★★★☆ |

| Evolution (OM:EVO) | 4.71% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.18% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.47% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.64% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.59% | ★★★★★★ |

Click here to see the full list of 224 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

Intesa Sanpaolo (BIT:ISP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Intesa Sanpaolo S.p.A. is a financial services company offering a range of products in Italy, Central/Eastern Europe, the Middle East, and North Africa with a market cap of approximately €100.55 billion.

Operations: Intesa Sanpaolo's revenue is primarily derived from Domestic Commercial Banking (€10.77 billion), IMI Corporate & Investment Banking (€4.36 billion), Private Banking (€3.34 billion), International Banks (€3.10 billion), Insurance (€1.75 billion), Management Center (€1.67 billion), and Asset Management (€990 million).

Dividend Yield: 6%

Intesa Sanpaolo offers an attractive dividend yield of 6%, placing it in the top tier among Italian dividend payers. Despite a volatile and unreliable dividend history over the past decade, its current payout ratio of 33.4% suggests dividends are well covered by earnings, with future coverage expected to remain sustainable. However, investors should be cautious of ISP's high level of bad loans at 2.1%. The stock trades at a favorable P/E ratio of 11x compared to the Italian market average.

- Click here and access our complete dividend analysis report to understand the dynamics of Intesa Sanpaolo.

- Insights from our recent valuation report point to the potential overvaluation of Intesa Sanpaolo shares in the market.

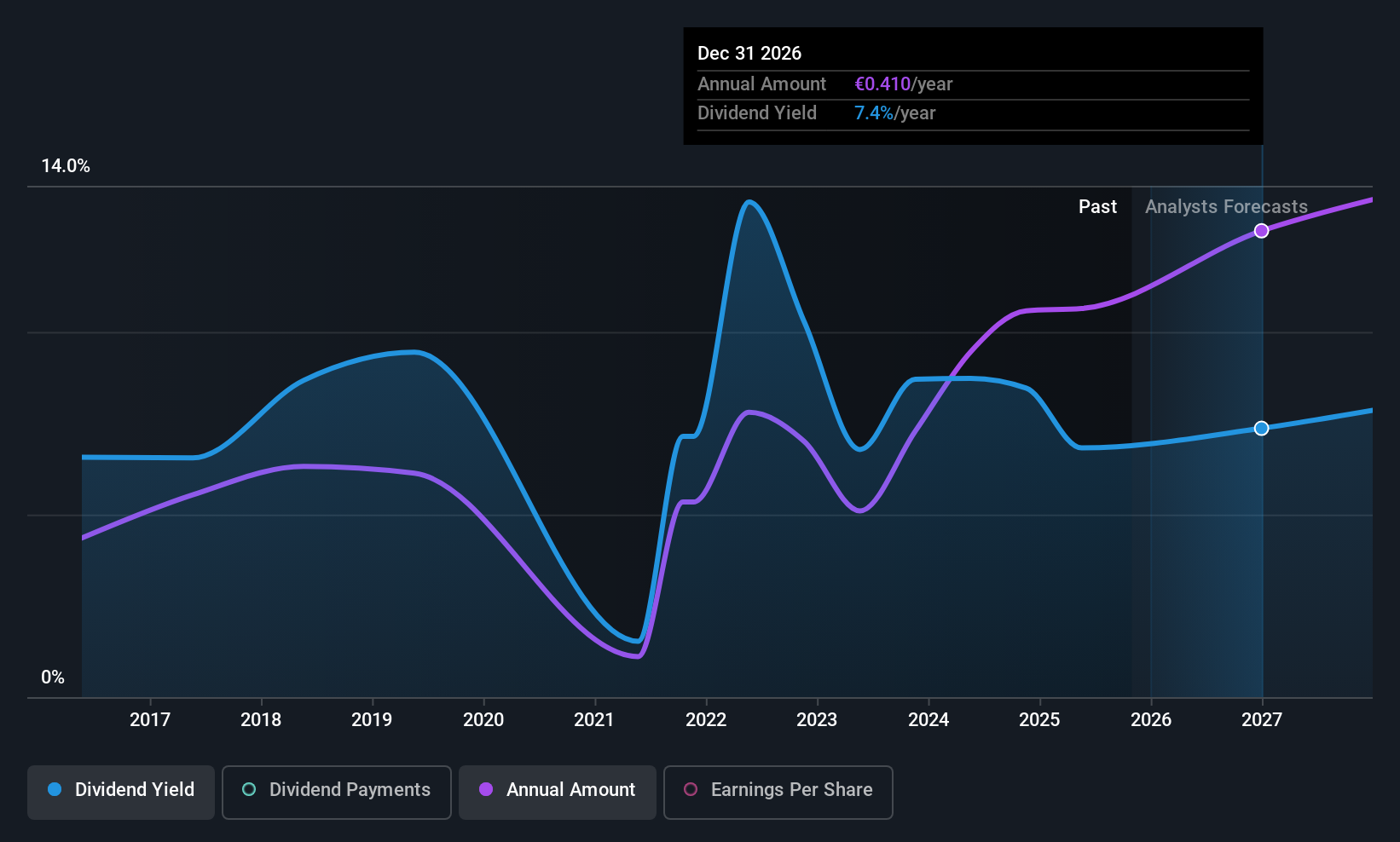

ABN AMRO Bank (ENXTAM:ABN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a range of banking products and financial services to retail, private, and business clients across the Netherlands, Europe, the United States, Asia, and internationally with a market cap of €21.29 billion.

Operations: ABN AMRO Bank's revenue is primarily derived from Personal & Business Banking (€4.01 billion), Corporate Banking (€3.16 billion), and Wealth Management (€1.55 billion).

Dividend Yield: 5.2%

ABN AMRO Bank's dividend yield of 5.22% is slightly below the top tier in the Dutch market, and its historical dividend payments have been volatile and unreliable over the past decade. Despite this, dividends are currently covered by earnings with a payout ratio of 50.2%, and future coverage remains sustainable. The bank trades at a significant discount to its estimated fair value, but it has a low allowance for bad loans at 23%. Recent M&A rumors involving KBC Group could impact future strategies.

- Navigate through the intricacies of ABN AMRO Bank with our comprehensive dividend report here.

- The valuation report we've compiled suggests that ABN AMRO Bank's current price could be quite moderate.

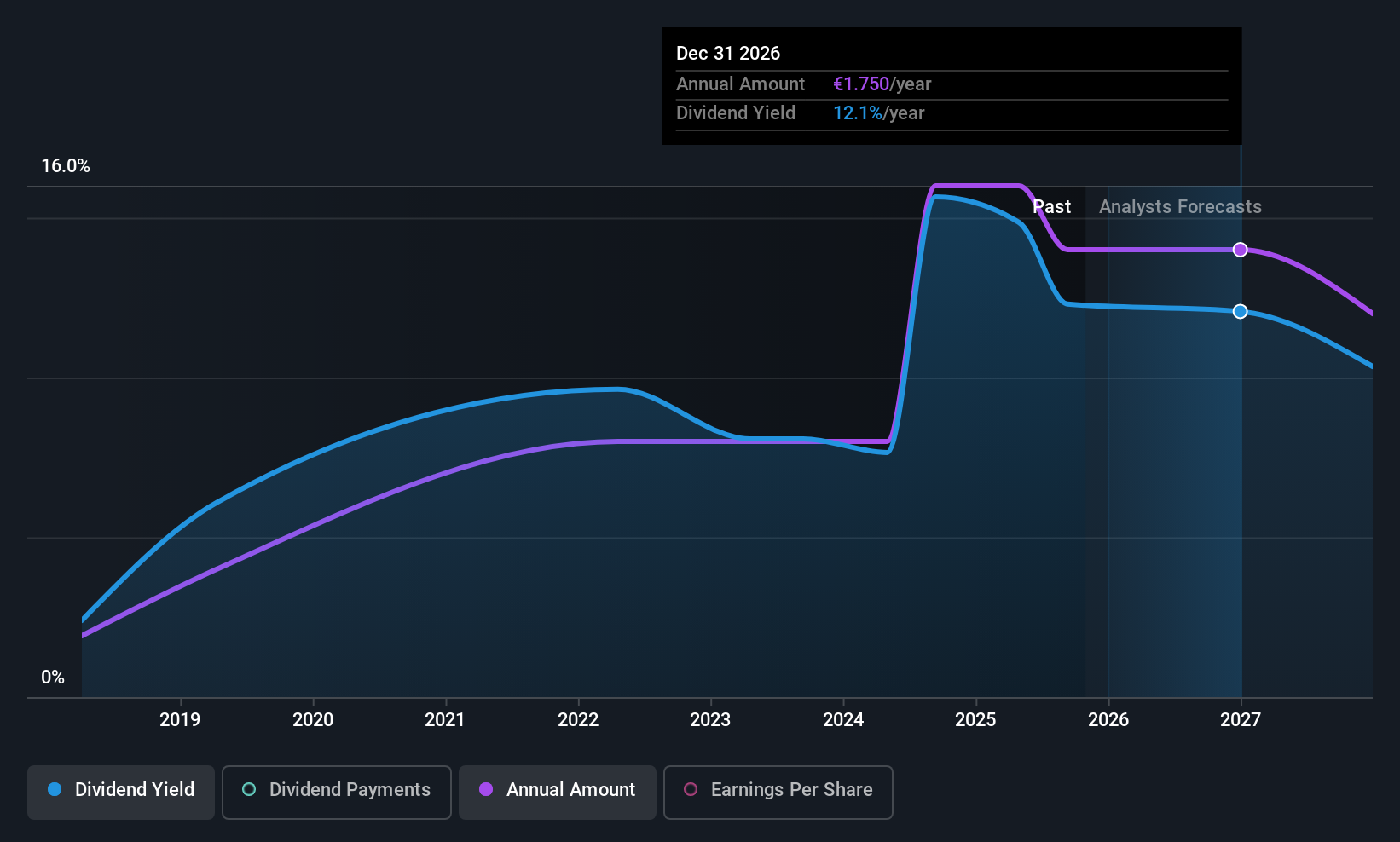

FBD Holdings (ISE:EG7)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FBD Holdings plc operates through its subsidiaries to provide general insurance underwriting services to farmers, private individuals, and business owners in Ireland, with a market cap of €525.22 million.

Operations: FBD Holdings plc generates revenue primarily from its general insurance segment, which accounts for €479.78 million, alongside a smaller contribution from other group activities totaling €4.15 million.

Dividend Yield: 12.1%

FBD Holdings recently announced a special dividend of €0.75 per share, reflecting its strategy to manage excess capital while maintaining a sustainable annual dividend. Despite the attractive yield, historical dividends have been volatile and unreliable. The company's recent earnings report showed a decline in net income and EPS compared to last year, raising concerns about future payout sustainability. Recent board changes include appointing Paul Stanley as an Independent Non-Executive Director and Audit Committee Chair at FBD Insurance plc.

- Click here to discover the nuances of FBD Holdings with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of FBD Holdings shares in the market.

Key Takeaways

- Unlock more gems! Our Top European Dividend Stocks screener has unearthed 221 more companies for you to explore.Click here to unveil our expertly curated list of 224 Top European Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ISP

Intesa Sanpaolo

Provides various financial products and services in Italy, Central/Eastern Europe, the Middle East, and North Africa.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives