- Netherlands

- /

- Banks

- /

- ENXTAM:ABN

European Dividend Stocks To Consider Now

Reviewed by Simply Wall St

As European markets experience a positive uptick, with the pan-European STOXX Europe 600 Index rising by 2.35% and major single-country indexes also posting gains, investors are keenly observing how subdued inflation rates could influence future economic stability in the region. In this context, dividend stocks emerge as an attractive option for those looking to balance potential growth with steady income, offering a buffer against market volatility while capitalizing on Europe's current economic climate.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.32% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.48% | ★★★★★★ |

| Sulzer (SWX:SUN) | 3.03% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.12% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.86% | ★★★★★★ |

| Evolution (OM:EVO) | 4.75% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.19% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.10% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.48% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.68% | ★★★★★★ |

Click here to see the full list of 217 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

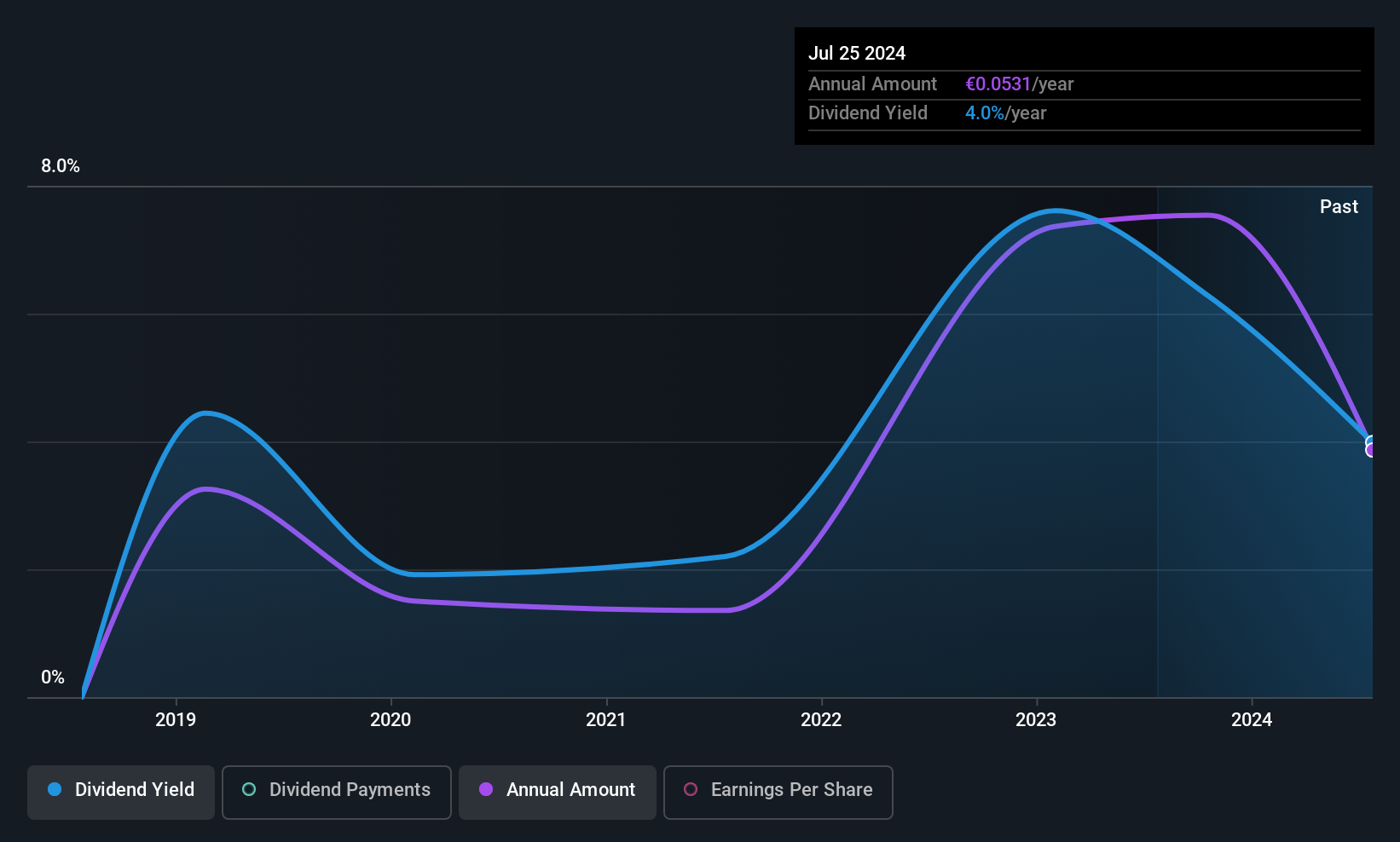

ABN AMRO Bank (ENXTAM:ABN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a range of banking products and financial services to retail, private, and business clients across the Netherlands and globally, with a market cap of approximately €23.99 billion.

Operations: ABN AMRO Bank N.V.'s revenue is primarily derived from Personal & Business Banking (€3.92 billion), Corporate Banking (€3.19 billion), and Wealth Management (€1.63 billion).

Dividend Yield: 4.6%

ABN AMRO Bank's dividend strategy includes distributing up to 100% of net profit through 2028, with at least half as cash dividends. Despite a volatile dividend history, current and forecasted payout ratios around 50% suggest coverage by earnings. However, its dividend yield of 4.63% falls short of top-tier Dutch payers. Recent earnings showed declines in net interest income and net income year-over-year, while M&A rumors could impact future stability.

- Take a closer look at ABN AMRO Bank's potential here in our dividend report.

- Our valuation report unveils the possibility ABN AMRO Bank's shares may be trading at a premium.

ZCCM Investments Holdings (ENXTPA:MLZAM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ZCCM Investments Holdings Plc is a diversified mining investment and operations company based in Zambia with international reach, and it has a market capitalization of €386.04 million.

Operations: ZCCM Investments Holdings Plc generates its revenue through diversified mining investments and operations both within Zambia and on an international scale.

Dividend Yield: 5.1%

ZCCM Investments Holdings recently amended its Articles of Association to enhance corporate governance and streamline operations, which may positively impact shareholder engagement. Despite a volatile dividend history over the past decade, the company's dividends are well-covered by earnings and cash flows, with payout ratios of 1.3% and 29.6%, respectively. However, recent financial performance showed a significant net loss for the half year ending June 2025, raising concerns about future dividend sustainability amidst ongoing operational reforms at key subsidiaries.

- Click here to discover the nuances of ZCCM Investments Holdings with our detailed analytical dividend report.

- The analysis detailed in our ZCCM Investments Holdings valuation report hints at an inflated share price compared to its estimated value.

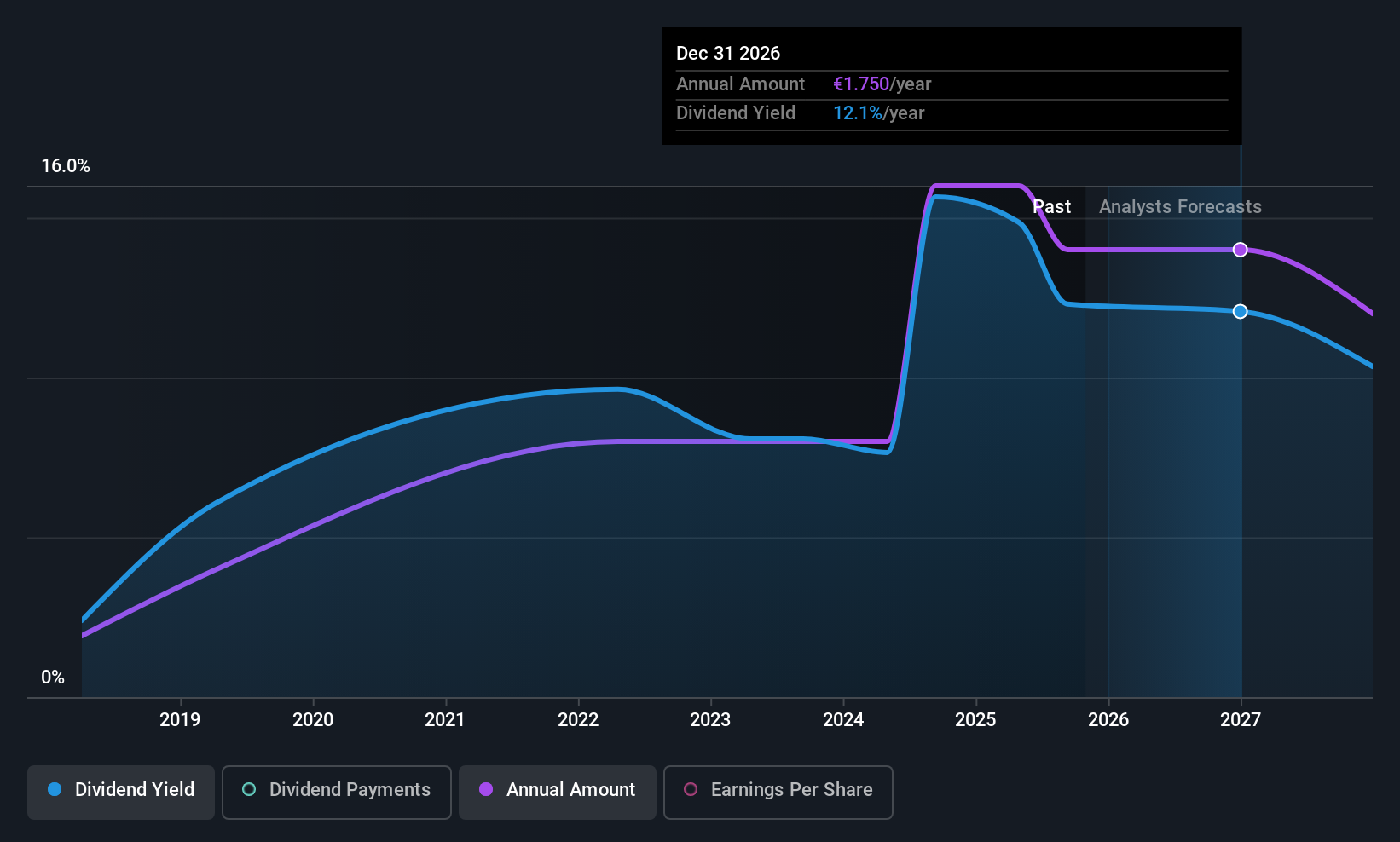

FBD Holdings (ISE:EG7)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FBD Holdings plc, with a market cap of €561.45 million, operates through its subsidiaries to provide general insurance underwriting services to farmers, private individuals, and business owners in Ireland.

Operations: FBD Holdings generates revenue primarily from its general insurance segment, amounting to €479.78 million.

Dividend Yield: 11.3%

FBD Holdings' dividend yield of 11.29% ranks among the top in Ireland, but its sustainability is questionable due to a high cash payout ratio of 135.1%. While dividends are covered by earnings with a payout ratio of 67.2%, they are not well-supported by free cash flows, raising concerns about reliability given their historical volatility and lack of growth consistency over the past decade. Recent board changes may influence future strategic directions impacting dividend policies.

- Unlock comprehensive insights into our analysis of FBD Holdings stock in this dividend report.

- Our valuation report unveils the possibility FBD Holdings' shares may be trading at a discount.

Next Steps

- Access the full spectrum of 217 Top European Dividend Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ABN

ABN AMRO Bank

Provides various banking products and financial services to retail, private, and business clients in the Netherlands, rest of Europe, the United States, Asia, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026