CJ Century Logistics Holdings Berhad (KLSE:CJCEN) Has A Somewhat Strained Balance Sheet

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, CJ Century Logistics Holdings Berhad (KLSE:CJCEN) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for CJ Century Logistics Holdings Berhad

How Much Debt Does CJ Century Logistics Holdings Berhad Carry?

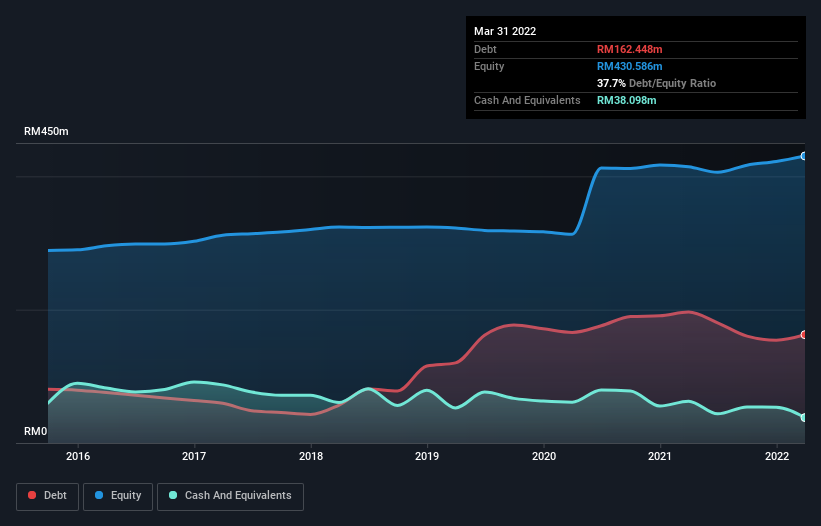

As you can see below, CJ Century Logistics Holdings Berhad had RM162.4m of debt at March 2022, down from RM196.5m a year prior. However, it also had RM38.1m in cash, and so its net debt is RM124.4m.

A Look At CJ Century Logistics Holdings Berhad's Liabilities

According to the last reported balance sheet, CJ Century Logistics Holdings Berhad had liabilities of RM203.7m due within 12 months, and liabilities of RM136.2m due beyond 12 months. Offsetting this, it had RM38.1m in cash and RM240.0m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM61.8m.

While this might seem like a lot, it is not so bad since CJ Century Logistics Holdings Berhad has a market capitalization of RM265.0m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

CJ Century Logistics Holdings Berhad has net debt worth 2.2 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 4.6 times the interest expense. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. One way CJ Century Logistics Holdings Berhad could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 18%, as it did over the last year. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if CJ Century Logistics Holdings Berhad can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Considering the last three years, CJ Century Logistics Holdings Berhad actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

CJ Century Logistics Holdings Berhad's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered cast it in a significantly better light. For example its EBIT growth rate was refreshing. Looking at all the angles mentioned above, it does seem to us that CJ Century Logistics Holdings Berhad is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 3 warning signs for CJ Century Logistics Holdings Berhad you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you're looking to trade CJ Century Logistics Holdings Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CJCEN

CJ Century Logistics Holdings Berhad

An investment holding company, provides supply chain solutions in Malaysia.

Excellent balance sheet and slightly overvalued.