- Malaysia

- /

- Infrastructure

- /

- KLSE:AIRPORT

These 4 Measures Indicate That Malaysia Airports Holdings Berhad (KLSE:AIRPORT) Is Using Debt Reasonably Well

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Malaysia Airports Holdings Berhad (KLSE:AIRPORT) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Malaysia Airports Holdings Berhad

What Is Malaysia Airports Holdings Berhad's Net Debt?

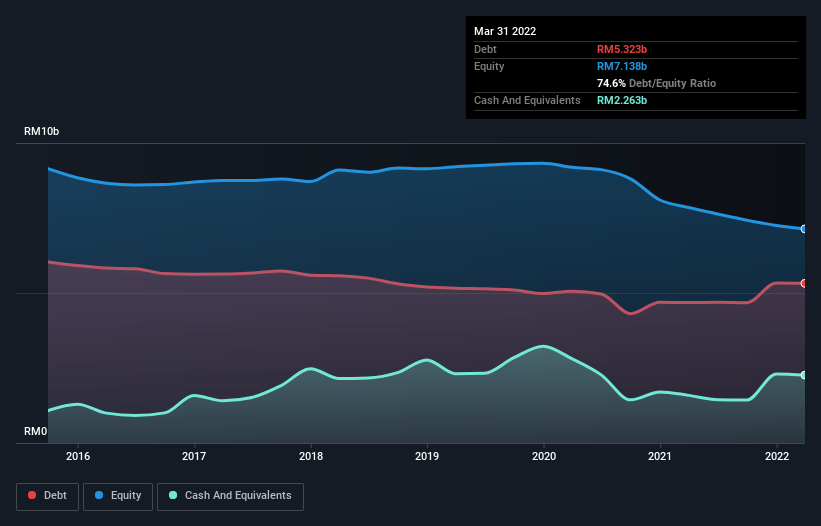

As you can see below, at the end of March 2022, Malaysia Airports Holdings Berhad had RM5.32b of debt, up from RM4.68b a year ago. Click the image for more detail. On the flip side, it has RM2.26b in cash leading to net debt of about RM3.06b.

How Healthy Is Malaysia Airports Holdings Berhad's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Malaysia Airports Holdings Berhad had liabilities of RM3.59b due within 12 months and liabilities of RM9.31b due beyond that. On the other hand, it had cash of RM2.26b and RM458.3m worth of receivables due within a year. So it has liabilities totalling RM10.2b more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of RM10.4b. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While we wouldn't worry about Malaysia Airports Holdings Berhad's net debt to EBITDA ratio of 2.7, we think its super-low interest cover of 0.87 times is a sign of high leverage. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. The silver lining is that Malaysia Airports Holdings Berhad grew its EBIT by 142% last year, which nourishing like the idealism of youth. If that earnings trend continues it will make its debt load much more manageable in the future. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Malaysia Airports Holdings Berhad's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Malaysia Airports Holdings Berhad recorded free cash flow worth a fulsome 86% of its EBIT, which is stronger than we'd usually expect. That puts it in a very strong position to pay down debt.

Our View

Malaysia Airports Holdings Berhad's interest cover was a real negative on this analysis, although the other factors we considered were considerably better. In particular, we are dazzled with its conversion of EBIT to free cash flow. It's also worth noting that Malaysia Airports Holdings Berhad is in the Infrastructure industry, which is often considered to be quite defensive. When we consider all the elements mentioned above, it seems to us that Malaysia Airports Holdings Berhad is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. While Malaysia Airports Holdings Berhad didn't make a statutory profit in the last year, its positive EBIT suggests that profitability might not be far away. Click here to see if its earnings are heading in the right direction, over the medium term.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:AIRPORT

Malaysia Airports Holdings Berhad

An investment holding company, engages in the development, management, operation, and maintenance of airports.

Solid track record with moderate growth potential.