- Malaysia

- /

- Telecom Services and Carriers

- /

- KLSE:TIMECOM

Does TIME dotCom Berhad (KLSE:TIMECOM) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like TIME dotCom Berhad (KLSE:TIMECOM). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for TIME dotCom Berhad

How Quickly Is TIME dotCom Berhad Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. TIME dotCom Berhad managed to grow EPS by 9.2% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

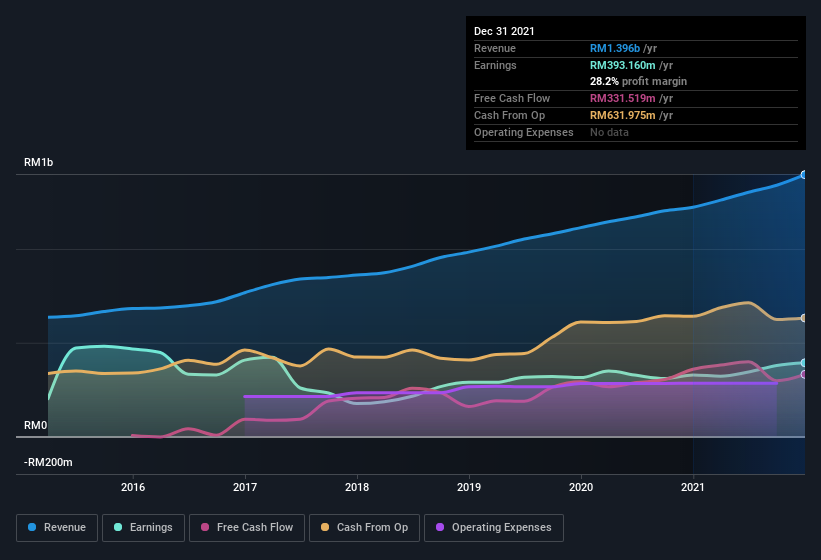

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). The good news is that TIME dotCom Berhad is growing revenues, and EBIT margins improved by 2.5 percentage points to 38%, over the last year. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for TIME dotCom Berhad?

Are TIME dotCom Berhad Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that TIME dotCom Berhad insiders have a significant amount of capital invested in the stock. Indeed, they hold RM118m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 1.5% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add TIME dotCom Berhad To Your Watchlist?

One important encouraging feature of TIME dotCom Berhad is that it is growing profits. If that's not enough on its own, there is also the rather notable levels of insider ownership. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. It is worth noting though that we have found 1 warning sign for TIME dotCom Berhad that you need to take into consideration.

Although TIME dotCom Berhad certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if TIME dotCom Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:TIMECOM

TIME dotCom Berhad

An investment holding company, provides telecommunications services in Malaysia and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives