Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Celcomdigi Berhad (KLSE:CDB) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Celcomdigi Berhad

What Is Celcomdigi Berhad's Net Debt?

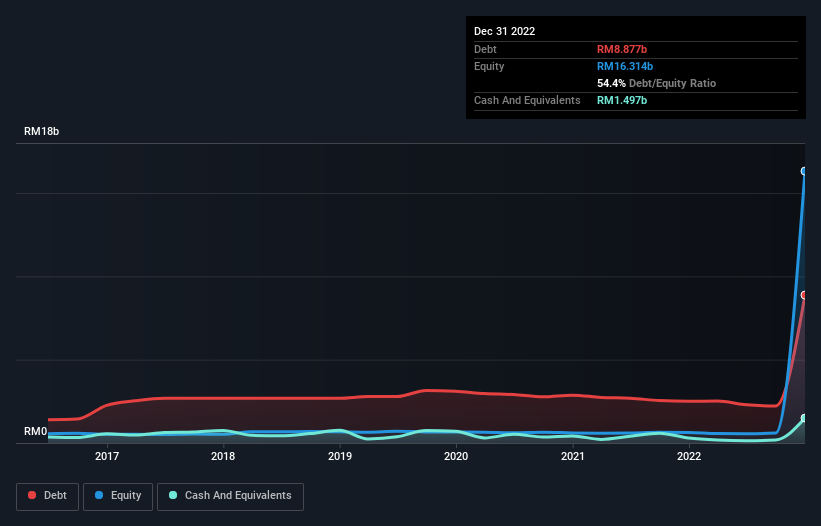

As you can see below, at the end of December 2022, Celcomdigi Berhad had RM8.88b of debt, up from RM2.50b a year ago. Click the image for more detail. However, because it has a cash reserve of RM1.50b, its net debt is less, at about RM7.38b.

How Strong Is Celcomdigi Berhad's Balance Sheet?

We can see from the most recent balance sheet that Celcomdigi Berhad had liabilities of RM8.36b falling due within a year, and liabilities of RM12.9b due beyond that. Offsetting these obligations, it had cash of RM1.50b as well as receivables valued at RM2.25b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM17.5b.

This deficit isn't so bad because Celcomdigi Berhad is worth a massive RM51.6b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

We'd say that Celcomdigi Berhad's moderate net debt to EBITDA ratio ( being 2.2), indicates prudence when it comes to debt. And its strong interest cover of 10.2 times, makes us even more comfortable. Importantly Celcomdigi Berhad's EBIT was essentially flat over the last twelve months. We would prefer to see some earnings growth, because that always helps diminish debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Celcomdigi Berhad's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Celcomdigi Berhad produced sturdy free cash flow equating to 69% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Celcomdigi Berhad's interest cover was a real positive on this analysis, as was its conversion of EBIT to free cash flow. On the other hand, its net debt to EBITDA makes us a little less comfortable about its debt. When we consider all the elements mentioned above, it seems to us that Celcomdigi Berhad is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 4 warning signs for Celcomdigi Berhad (1 shouldn't be ignored!) that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CDB

Celcomdigi Berhad

An investment holding company, provides mobile communication services and related products in Malaysia.

Mediocre balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)