- Malaysia

- /

- Tech Hardware

- /

- KLSE:IRIS

Did You Miss IRIS Corporation Berhad's (KLSE:IRIS) Impressive 193% Share Price Gain?

Unfortunately, investing is risky - companies can and do go bankrupt. But if you pick the right stock, you can make a lot more than 100%. Take, for example IRIS Corporation Berhad (KLSE:IRIS). Its share price is already up an impressive 193% in the last twelve months. Also pleasing for shareholders was the 55% gain in the last three months. Also impressive, the stock is up 84% over three years, making long term shareholders happy, too.

See our latest analysis for IRIS Corporation Berhad

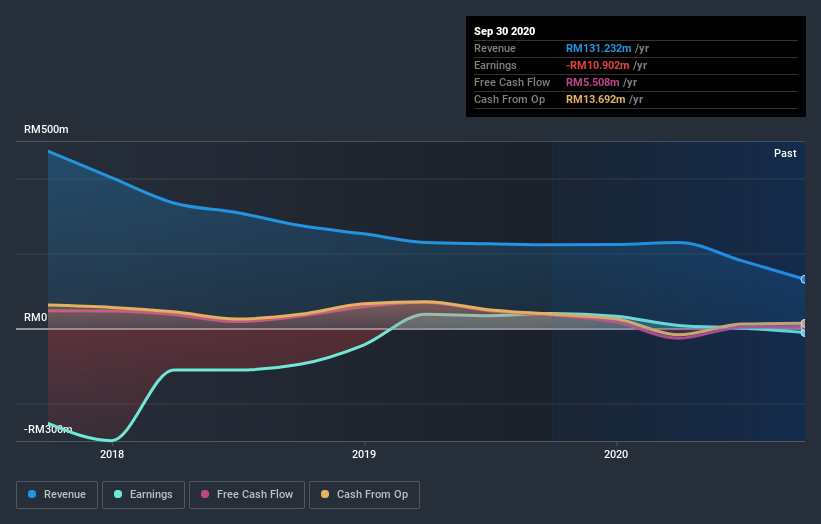

Given that IRIS Corporation Berhad didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year IRIS Corporation Berhad saw its revenue shrink by 41%. We're a little surprised to see the share price pop 193% in the last year. This is a good example of how buyers can push up prices even before the fundamental metrics show much growth. Of course, it could be that the market expected this revenue drop.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that IRIS Corporation Berhad shareholders have received a total shareholder return of 193% over one year. That's better than the annualised return of 15% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for IRIS Corporation Berhad that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you decide to trade IRIS Corporation Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:IRIS

IRIS Corporation Berhad

Provides technology consulting solutions in Malaysia, Asia, Oceania, Africa, and North America.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026