- Malaysia

- /

- Electronic Equipment and Components

- /

- KLSE:WAVEFRNT

ATA IMS Berhad's (KLSE:ATAIMS) CEO Compensation Is Looking A Bit Stretched At The Moment

CEO Chiu-Wan Fong has done a decent job of delivering relatively good performance at ATA IMS Berhad (KLSE:ATAIMS) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 23 September 2021. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

Check out our latest analysis for ATA IMS Berhad

How Does Total Compensation For Chiu-Wan Fong Compare With Other Companies In The Industry?

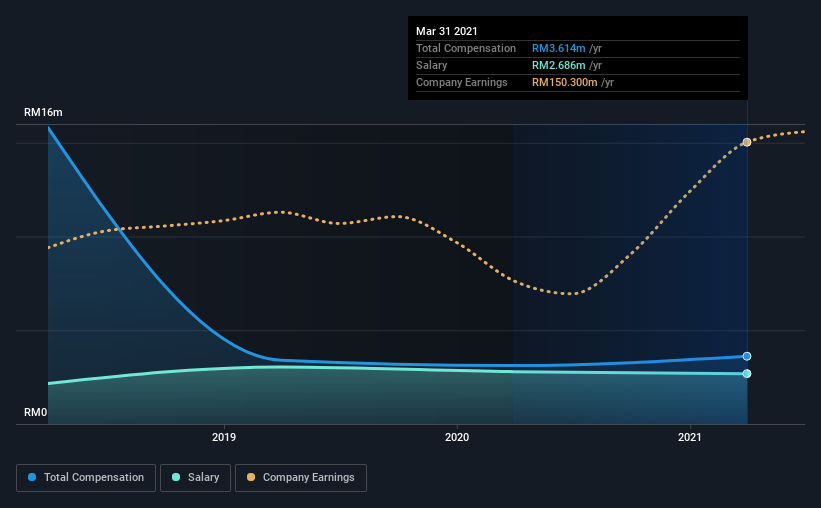

Our data indicates that ATA IMS Berhad has a market capitalization of RM3.2b, and total annual CEO compensation was reported as RM3.6m for the year to March 2021. That's a notable increase of 16% on last year. Notably, the salary which is RM2.69m, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations ranging from RM1.7b to RM6.7b, the reported median CEO total compensation was RM669k. This suggests that Chiu-Wan Fong is paid more than the median for the industry. What's more, Chiu-Wan Fong holds RM832m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | RM2.7m | RM2.8m | 74% |

| Other | RM928k | RM322k | 26% |

| Total Compensation | RM3.6m | RM3.1m | 100% |

Speaking on an industry level, nearly 74% of total compensation represents salary, while the remainder of 26% is other remuneration. ATA IMS Berhad is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

ATA IMS Berhad's Growth

ATA IMS Berhad's earnings per share (EPS) grew 11% per year over the last three years. Its revenue is up 34% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has ATA IMS Berhad Been A Good Investment?

We think that the total shareholder return of 82%, over three years, would leave most ATA IMS Berhad shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 1 warning sign for ATA IMS Berhad that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if WaveFront Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:WAVEFRNT

WaveFront Berhad

An investment holding company, provides electronics manufacturing services in Malaysia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)