Here's Why We're Watching Inix Technologies Holdings Berhad's (KLSE:INIX) Cash Burn Situation

We can readily understand why investors are attracted to unprofitable companies. By way of example, Inix Technologies Holdings Berhad (KLSE:INIX) has seen its share price rise 627% over the last year, delighting many shareholders. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

In light of its strong share price run, we think now is a good time to investigate how risky Inix Technologies Holdings Berhad's cash burn is. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

View our latest analysis for Inix Technologies Holdings Berhad

Does Inix Technologies Holdings Berhad Have A Long Cash Runway?

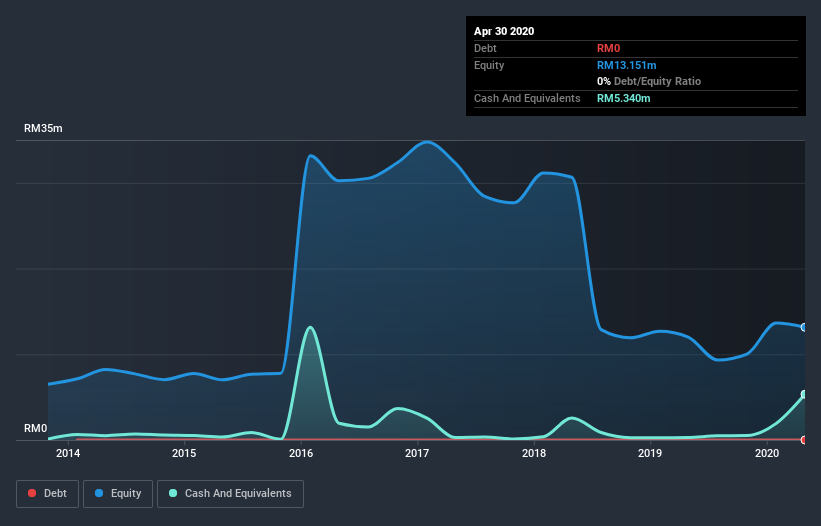

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In April 2020, Inix Technologies Holdings Berhad had RM5.3m in cash, and was debt-free. Importantly, its cash burn was RM5.2m over the trailing twelve months. Therefore, from April 2020 it had roughly 12 months of cash runway. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. The image below shows how its cash balance has been changing over the last few years.

How Well Is Inix Technologies Holdings Berhad Growing?

Some investors might find it troubling that Inix Technologies Holdings Berhad is actually increasing its cash burn, which is up 4.2% in the last year. And we must say we find it concerning that operating revenue dropped 29% over the same period. Considering both these metrics, we're a little concerned about how the company is developing. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how Inix Technologies Holdings Berhad has developed its business over time by checking this visualization of its revenue and earnings history.

How Easily Can Inix Technologies Holdings Berhad Raise Cash?

Since Inix Technologies Holdings Berhad can't yet boast improving growth metrics, the market will likely be considering how it can raise more cash if need be. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of RM140m, Inix Technologies Holdings Berhad's RM5.2m in cash burn equates to about 3.7% of its market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

Is Inix Technologies Holdings Berhad's Cash Burn A Worry?

Even though its falling revenue makes us a little nervous, we are compelled to mention that we thought Inix Technologies Holdings Berhad's cash burn relative to its market cap was relatively promising. Cash burning companies are always on the riskier side of things, but after considering all of the factors discussed in this short piece, we're not too worried about its rate of cash burn. Separately, we looked at different risks affecting the company and spotted 6 warning signs for Inix Technologies Holdings Berhad (of which 2 shouldn't be ignored!) you should know about.

Of course Inix Technologies Holdings Berhad may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Inix Technologies Holdings Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zen Tech International Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:ZENTECH

Zen Tech International Berhad

An investment holding company, provides software development, system integration, and information technology management consultancy and other related professional services in Malaysia.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026