HeiTech Padu Berhad (KLSE:HTPADU) delivers shareholders stellar 271% return over 1 year, surging 15% in the last week alone

It hasn't been the best quarter for HeiTech Padu Berhad (KLSE:HTPADU) shareholders, since the share price has fallen 11% in that time. On the other hand, over the last twelve months the stock has delivered rather impressive returns. We're very pleased to report the share price shot up 271% in that time. So we think most shareholders won't be too upset about the recent fall. More important, going forward, is how the business itself is going.

Since it's been a strong week for HeiTech Padu Berhad shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for HeiTech Padu Berhad

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year HeiTech Padu Berhad grew its earnings per share, moving from a loss to a profit.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

Unfortunately HeiTech Padu Berhad's fell 7.0% over twelve months. So the fundamental metrics don't provide an obvious explanation for the share price gain.

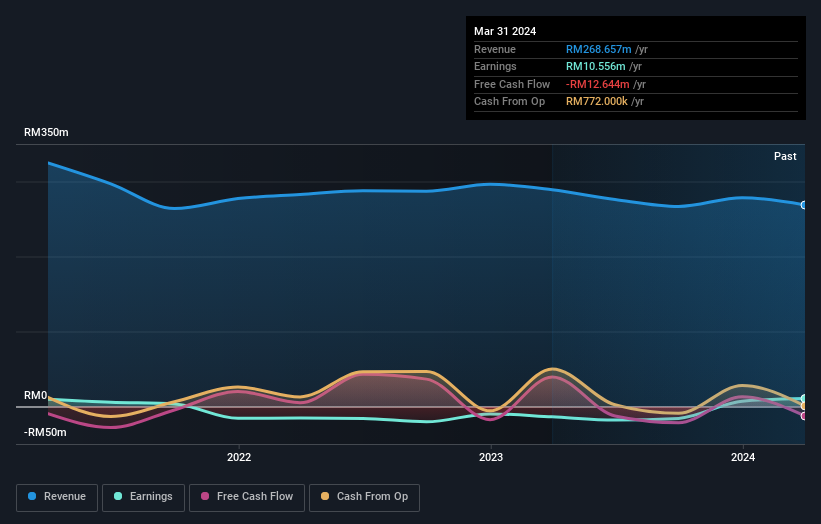

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on HeiTech Padu Berhad's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that HeiTech Padu Berhad has rewarded shareholders with a total shareholder return of 271% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 13% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for HeiTech Padu Berhad (of which 1 doesn't sit too well with us!) you should know about.

We will like HeiTech Padu Berhad better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if HeiTech Padu Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HTPADU

HeiTech Padu Berhad

Provides systems integration, data center management, disaster recovery, information technology, and network related services in Malaysia, Australia, and Indonesia.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives