This article will reflect on the compensation paid to Ameer Bin Shaik Mydin who has served as CEO of Censof Holdings Berhad (KLSE:CENSOF) since 2014. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Censof Holdings Berhad

How Does Total Compensation For Ameer Bin Shaik Mydin Compare With Other Companies In The Industry?

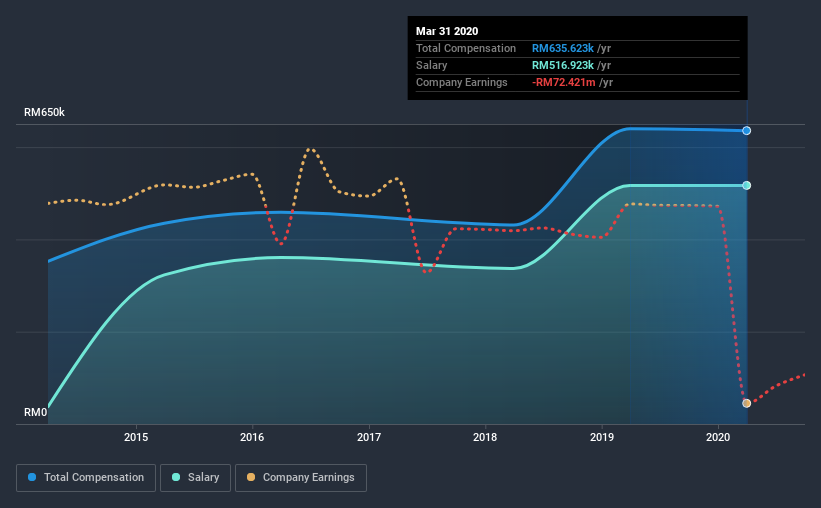

At the time of writing, our data shows that Censof Holdings Berhad has a market capitalization of RM133m, and reported total annual CEO compensation of RM636k for the year to March 2020. This means that the compensation hasn't changed much from last year. In particular, the salary of RM516.9k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below RM804m, reported a median total CEO compensation of RM145k. Hence, we can conclude that Ameer Bin Shaik Mydin is remunerated higher than the industry median. What's more, Ameer Bin Shaik Mydin holds RM350k worth of shares in the company in their own name.

On an industry level, around 85% of total compensation represents salary and 15% is other remuneration. Although there is a difference in how total compensation is set, Censof Holdings Berhad more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Censof Holdings Berhad's Growth Numbers

Censof Holdings Berhad has reduced its earnings per share by 89% a year over the last three years. It achieved revenue growth of 38% over the last year.

The reduction in EPS, over three years, is arguably concerning. But on the other hand, revenue growth is strong, suggesting a brighter future. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Censof Holdings Berhad Been A Good Investment?

Given the total shareholder loss of 8.6% over three years, many shareholders in Censof Holdings Berhad are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be lessto generous with CEO compensation.

To Conclude...

As we noted earlier, Censof Holdings Berhad pays its CEO higher than the norm for similar-sized companies belonging to the same industry. It concerns us that EPS growth for the company is negative, while share price gains did not materialize over the last three years. On a more positive note, the company has produced a more positive revenue growth more recently. Suffice it to say, we don't think the CEO is underpaid!

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 3 warning signs for Censof Holdings Berhad (1 is a bit unpleasant!) that you should be aware of before investing here.

Important note: Censof Holdings Berhad is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade Censof Holdings Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:CENSOF

Censof Holdings Berhad

An investment holding company, engages in the design, development, implementation, and marketing of financial management software in Malaysia, Singapore, and Indonesia.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

KLA Corporation (KLAC) The Precision Arbitrator: Securing the AI Frontier

Samsung Electronics (005930.KS) The Empire Strikes Back: Samsung’s HBM4 Breakthrough

SK Hynix Inc. (000660) The AI Memory King: Riding the HBM Supercycle

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion