Censof Holdings Berhad (KLSE:CENSOF) Might Be Having Difficulty Using Its Capital Effectively

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. However, after briefly looking over the numbers, we don't think Censof Holdings Berhad (KLSE:CENSOF) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Censof Holdings Berhad, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

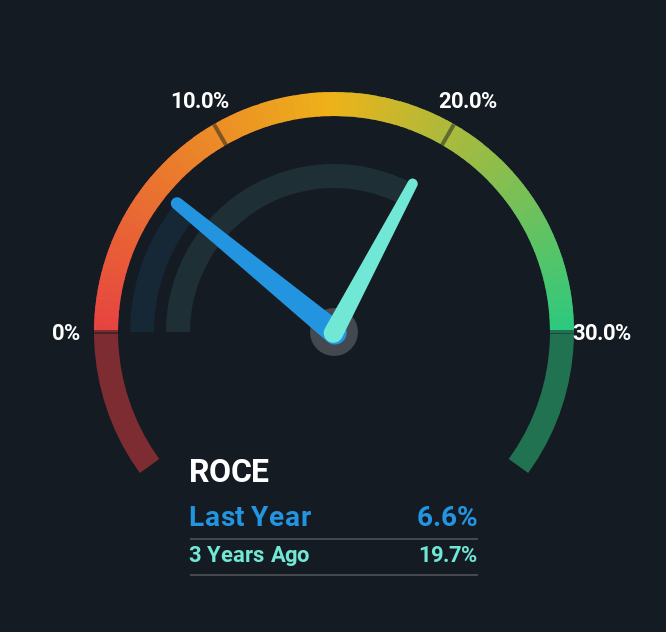

0.066 = RM7.1m ÷ (RM142m - RM33m) (Based on the trailing twelve months to June 2025).

So, Censof Holdings Berhad has an ROCE of 6.6%. Ultimately, that's a low return and it under-performs the Software industry average of 13%.

View our latest analysis for Censof Holdings Berhad

Historical performance is a great place to start when researching a stock so above you can see the gauge for Censof Holdings Berhad's ROCE against it's prior returns. If you're interested in investigating Censof Holdings Berhad's past further, check out this free graph covering Censof Holdings Berhad's past earnings, revenue and cash flow.

What Does the ROCE Trend For Censof Holdings Berhad Tell Us?

On the surface, the trend of ROCE at Censof Holdings Berhad doesn't inspire confidence. Around five years ago the returns on capital were 14%, but since then they've fallen to 6.6%. Meanwhile, the business is utilizing more capital but this hasn't moved the needle much in terms of sales in the past 12 months, so this could reflect longer term investments. It may take some time before the company starts to see any change in earnings from these investments.

What We Can Learn From Censof Holdings Berhad's ROCE

In summary, Censof Holdings Berhad is reinvesting funds back into the business for growth but unfortunately it looks like sales haven't increased much just yet. Since the stock has gained an impressive 71% over the last five years, investors must think there's better things to come. However, unless these underlying trends turn more positive, we wouldn't get our hopes up too high.

One more thing to note, we've identified 3 warning signs with Censof Holdings Berhad and understanding them should be part of your investment process.

While Censof Holdings Berhad isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CENSOF

Censof Holdings Berhad

An investment holding company, engages in the design, development, implementation, and marketing of financial management software in Malaysia, Singapore, and Indonesia.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Rocket Lab (RKLB): A Rising Challenger in the Space Economy

Coinbase and the anniversary of the Bybit hack: Lessons for Investors

Alphabet will shine

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Physical AI" Monopoly – A New Industrial Revolution

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion