- Malaysia

- /

- Semiconductors

- /

- KLSE:OPPSTAR

With A 25% Price Drop For Oppstar Berhad (KLSE:OPPSTAR) You'll Still Get What You Pay For

The Oppstar Berhad (KLSE:OPPSTAR) share price has fared very poorly over the last month, falling by a substantial 25%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 34% share price drop.

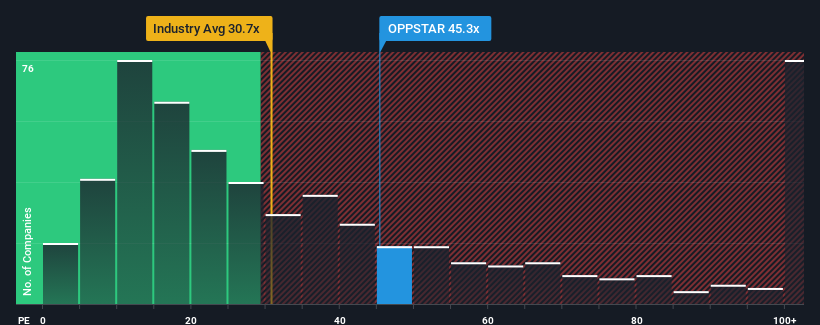

Although its price has dipped substantially, given close to half the companies in Malaysia have price-to-earnings ratios (or "P/E's") below 17x, you may still consider Oppstar Berhad as a stock to avoid entirely with its 45.3x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Oppstar Berhad could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Oppstar Berhad

Is There Enough Growth For Oppstar Berhad?

Oppstar Berhad's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered a frustrating 43% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 98% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 36% each year over the next three years. With the market only predicted to deliver 15% per year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Oppstar Berhad's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Oppstar Berhad's P/E

A significant share price dive has done very little to deflate Oppstar Berhad's very lofty P/E. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Oppstar Berhad maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - Oppstar Berhad has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on Oppstar Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:OPPSTAR

Oppstar Berhad

Provides IC design and related services in Malaysia, the People’s Republic of China, Japan, and Singapore.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives