- Malaysia

- /

- Semiconductors

- /

- KLSE:OPPSTAR

Earnings Not Telling The Story For Oppstar Berhad (KLSE:OPPSTAR) After Shares Rise 33%

Despite an already strong run, Oppstar Berhad (KLSE:OPPSTAR) shares have been powering on, with a gain of 33% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 31% over that time.

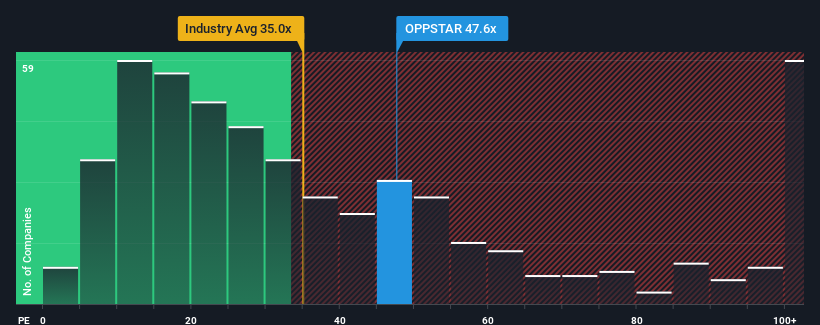

After such a large jump in price, Oppstar Berhad may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 47.6x, since almost half of all companies in Malaysia have P/E ratios under 16x and even P/E's lower than 10x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, Oppstar Berhad's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Oppstar Berhad

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Oppstar Berhad's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 36% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 148% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next year should generate growth of 9.2% as estimated by the two analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 17%, which is noticeably more attractive.

In light of this, it's alarming that Oppstar Berhad's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Oppstar Berhad's P/E

Shares in Oppstar Berhad have built up some good momentum lately, which has really inflated its P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Oppstar Berhad's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Oppstar Berhad (1 is a bit concerning!) that you should be aware of before investing here.

If you're unsure about the strength of Oppstar Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Oppstar Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:OPPSTAR

Oppstar Berhad

Provides IC design and related services in Malaysia, the People’s Republic of China, Japan, and Singapore.

Flawless balance sheet with reasonable growth potential.