- Malaysia

- /

- Semiconductors

- /

- KLSE:MI

Can You Imagine How Jubilant Mi Technovation Berhad's (KLSE:MI) Shareholders Feel About Its 144% Share Price Gain?

Unfortunately, investing is risky - companies can and do go bankrupt. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Mi Technovation Berhad (KLSE:MI) share price had more than doubled in just one year - up 144%. And in the last month, the share price has gained -4.0%. Mi Technovation Berhad hasn't been listed for long, so it's still not clear if it is a long term winner.

View our latest analysis for Mi Technovation Berhad

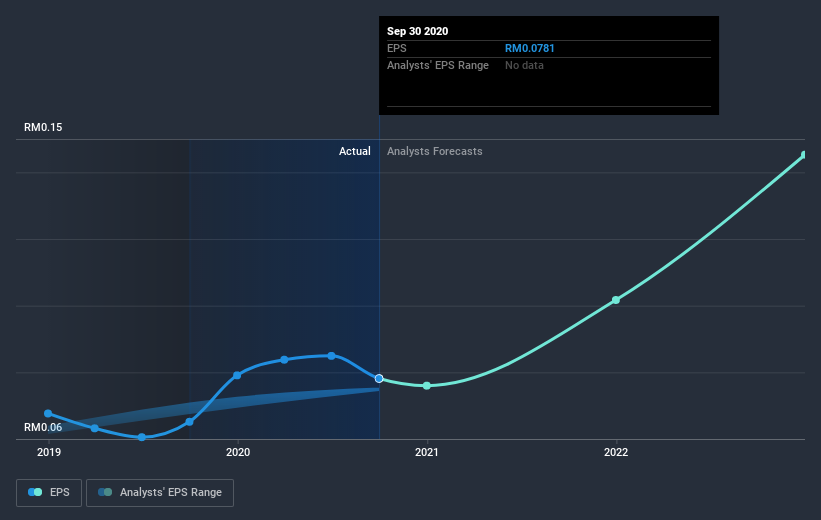

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Mi Technovation Berhad was able to grow EPS by 20% in the last twelve months. This EPS growth is significantly lower than the 144% increase in the share price. So it's fair to assume the market has a higher opinion of the business than it a year ago. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 62.07.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Mi Technovation Berhad has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Mi Technovation Berhad's TSR for the last year was 148%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Mi Technovation Berhad shareholders have gained 148% over the last year, including dividends. That's better than the more recent three month gain of 14%, implying that share price has plateaued recently. Having said that, we doubt shareholders would be concerned. It seems the market is simply waiting on more information, because if the business delivers so will the share price (eventually). It's always interesting to track share price performance over the longer term. But to understand Mi Technovation Berhad better, we need to consider many other factors. Even so, be aware that Mi Technovation Berhad is showing 2 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

Of course Mi Technovation Berhad may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

When trading Mi Technovation Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:MI

Mi Technovation Berhad

An investment holding company, engages in the design, development, manufacturing, and sales of semiconductor manufacturing equipment in Southeast Asia, Northeast Asia, and North America.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives