- Malaysia

- /

- Specialty Stores

- /

- KLSE:MRDIY

Be Sure To Check Out Mr D.I.Y. Group (M) Berhad (KLSE:MRDIY) Before It Goes Ex-Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Mr D.I.Y. Group (M) Berhad (KLSE:MRDIY) is about to trade ex-dividend in the next three days. The ex-dividend date is usually set to be two business days before the record date, which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. In other words, investors can purchase Mr D.I.Y. Group (M) Berhad's shares before the 6th of June in order to be eligible for the dividend, which will be paid on the 8th of July.

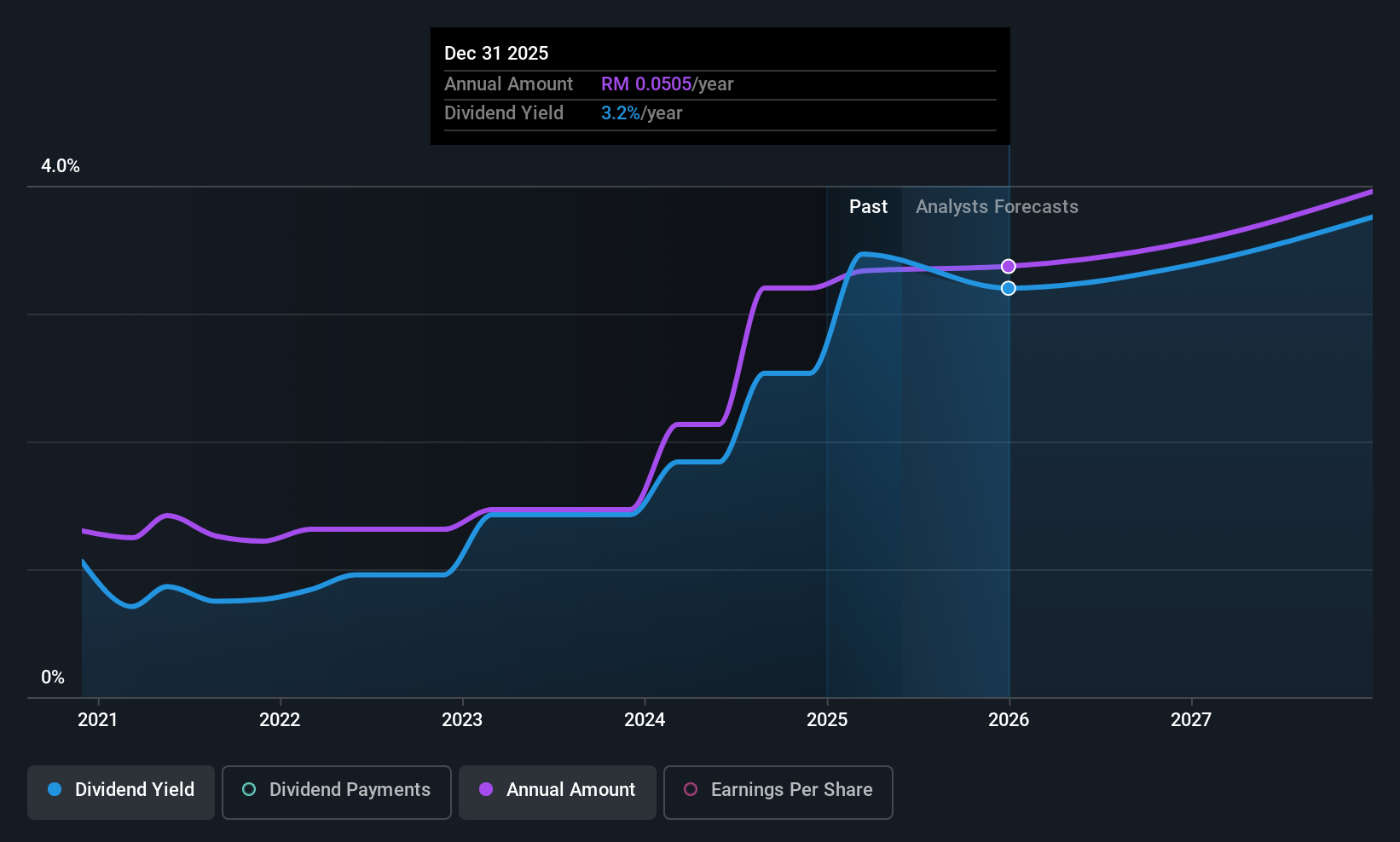

The company's upcoming dividend is RM00.014 a share, following on from the last 12 months, when the company distributed a total of RM0.05 per share to shareholders. Looking at the last 12 months of distributions, Mr D.I.Y. Group (M) Berhad has a trailing yield of approximately 3.2% on its current stock price of RM01.58. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to investigate whether Mr D.I.Y. Group (M) Berhad can afford its dividend, and if the dividend could grow.

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. It paid out 85% of its earnings as dividends last year, which is not unreasonable, but limits reinvestment in the business and leaves the dividend vulnerable to a business downturn. We'd be concerned if earnings began to decline. A useful secondary check can be to evaluate whether Mr D.I.Y. Group (M) Berhad generated enough free cash flow to afford its dividend. Over the last year it paid out 55% of its free cash flow as dividends, within the usual range for most companies.

It's positive to see that Mr D.I.Y. Group (M) Berhad's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

See our latest analysis for Mr D.I.Y. Group (M) Berhad

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If earnings fall far enough, the company could be forced to cut its dividend. Fortunately for readers, Mr D.I.Y. Group (M) Berhad's earnings per share have been growing at 13% a year for the past five years. It paid out more than three-quarters of its earnings in the last year, even though earnings per share are growing rapidly. We're surprised that management has not elected to reinvest more in the business to accelerate growth further.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Since the start of our data, five years ago, Mr D.I.Y. Group (M) Berhad has lifted its dividend by approximately 21% a year on average. Both per-share earnings and dividends have both been growing rapidly in recent times, which is great to see.

To Sum It Up

Is Mr D.I.Y. Group (M) Berhad worth buying for its dividend? Higher earnings per share generally lead to higher dividends from dividend-paying stocks over the long run. However, we'd also note that Mr D.I.Y. Group (M) Berhad is paying out more than half of its earnings and cash flow as profits, which could limit the dividend growth if earnings growth slows. In summary, while it has some positive characteristics, we're not inclined to race out and buy Mr D.I.Y. Group (M) Berhad today.

In light of that, while Mr D.I.Y. Group (M) Berhad has an appealing dividend, it's worth knowing the risks involved with this stock. In terms of investment risks, we've identified 1 warning sign with Mr D.I.Y. Group (M) Berhad and understanding them should be part of your investment process.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MRDIY

Mr D.I.Y. Group (M) Berhad

An investment holding company, engages in the retail of home improvement products, mass merchandise, games, toys, groceries, and related business and activities in Malaysia and Brunei.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in