- Malaysia

- /

- Specialty Stores

- /

- KLSE:INNATURE

InNature Berhad Beat Analyst Estimates: See What The Consensus Is Forecasting For This Year

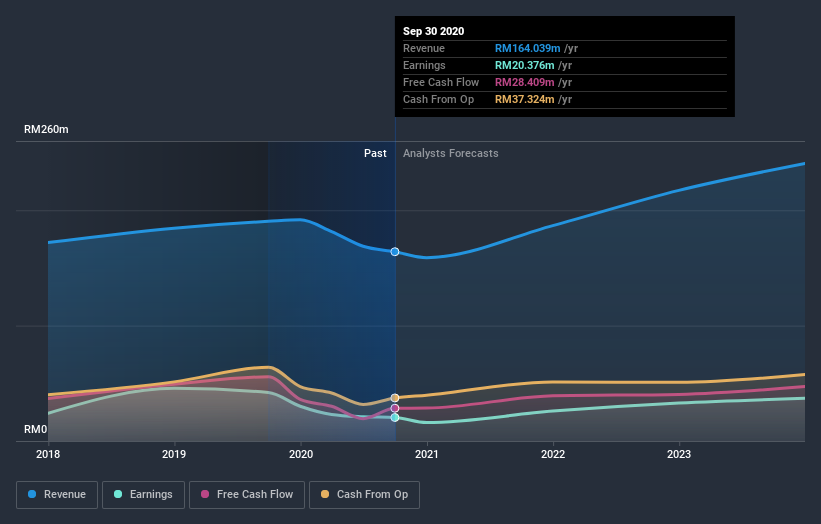

InNature Berhad (KLSE:INNATURE) defied analyst predictions to release its yearly results, which were ahead of market expectations. The company beat both earnings and revenue forecasts, with revenue of RM164m, some 3.2% above estimates, and statutory earnings per share (EPS) coming in at RM0.029, 21% ahead of expectations. Earnings are an important time for investors, as they can track a company's performance, look at what the analyst is forecasting for next year, and see if there's been a change in sentiment towards the company. We thought readers would find it interesting to see the analyst latest (statutory) post-earnings forecasts for next year.

See our latest analysis for InNature Berhad

After the latest results, the one analyst covering InNature Berhad are now predicting revenues of RM186.7m in 2021. If met, this would reflect a meaningful 14% improvement in sales compared to the last 12 months. Per-share earnings are expected to step up 12% to RM0.037. Yet prior to the latest earnings, the analyst had been anticipated revenues of RM183.2m and earnings per share (EPS) of RM0.033 in 2021. Although the revenue estimates have not really changed, we can see there's been a solid gain to earnings per share expectations, suggesting that the analyst has become more bullish after the latest result.

The consensus price target rose 8.7% to RM0.65, suggesting that higher earnings estimates flow through to the stock's valuation as well.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. One thing stands out from these estimates, which is that InNature Berhad is forecast to grow faster in the future than it has in the past, with revenues expected to grow 14%. If achieved, this would be a much better result than the 1.0% annual decline over the past three years. Compare this against analyst estimates for the wider industry, which suggest that (in aggregate) industry revenues are expected to grow 19% next year. So although InNature Berhad's revenue growth is expected to improve, it is still expected to grow slower than the industry.

The Bottom Line

The most important thing here is that the analyst upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards InNature Berhad following these results. On the plus side, there were no major changes to revenue estimates; although forecasts imply revenues will perform worse than the wider industry. There was also a nice increase in the price target, with the analyst clearly feeling that the intrinsic value of the business is improving.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have analyst estimates for InNature Berhad going out as far as 2023, and you can see them free on our platform here.

Plus, you should also learn about the 2 warning signs we've spotted with InNature Berhad .

If you’re looking to trade InNature Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade InNature Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:INNATURE

InNature Berhad

An investment holding company, retails cosmetics and personal care products in Malaysia, Vietnam, and Cambodia.

Flawless balance sheet with reasonable growth potential.