- Malaysia

- /

- Retail REITs

- /

- KLSE:IGBREIT

Earnings Beat: Here's What IGB Real Estate Investment Trust (KLSE:IGBREIT) Analysts Are Forecasting For This Year

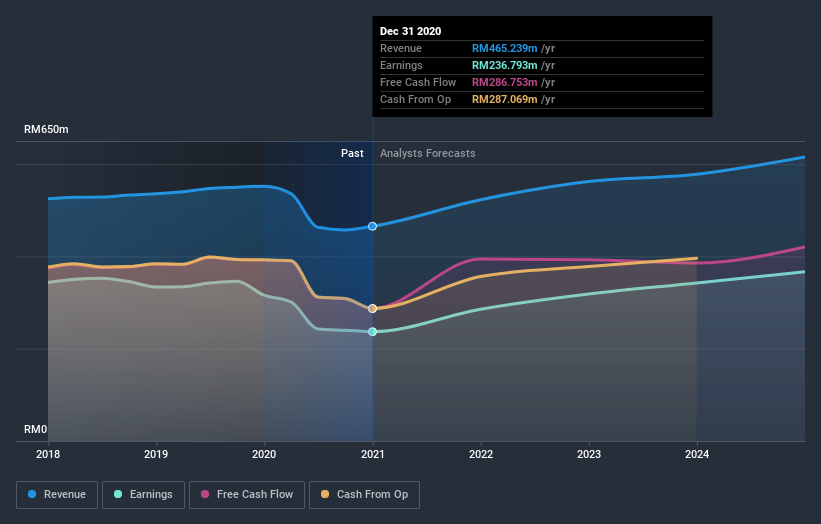

A week ago, IGB Real Estate Investment Trust (KLSE:IGBREIT) came out with a strong set of full-year numbers that could potentially lead to a re-rate of the stock. Results were good overall, with revenues beating analyst predictions by 6.8% to hit RM465m. Statutory earnings per share (EPS) came in at RM0.067, some 7.3% above whatthe analysts had expected. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

See our latest analysis for IGB Real Estate Investment Trust

After the latest results, the eleven analysts covering IGB Real Estate Investment Trust are now predicting revenues of RM522.8m in 2021. If met, this would reflect a meaningful 12% improvement in sales compared to the last 12 months. Statutory earnings per share are predicted to grow 19% to RM0.079. Before this earnings report, the analysts had been forecasting revenues of RM538.9m and earnings per share (EPS) of RM0.084 in 2021. The analysts are less bullish than they were before these results, given the reduced revenue forecasts and the small dip in earnings per share expectations.

The analysts made no major changes to their price target of RM1.80, suggesting the downgrades are not expected to have a long-term impact on IGB Real Estate Investment Trust's valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values IGB Real Estate Investment Trust at RM2.09 per share, while the most bearish prices it at RM1.60. Still, with such a tight range of estimates, it suggeststhe analysts have a pretty good idea of what they think the company is worth.

Of course, another way to look at these forecasts is to place them into context against the industry itself. The analysts are definitely expecting IGB Real Estate Investment Trust's growth to accelerate, with the forecast 12% growth ranking favourably alongside historical growth of 0.07% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 6.3% next year. Factoring in the forecast acceleration in revenue, it's pretty clear that IGB Real Estate Investment Trust is expected to grow much faster than its industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for IGB Real Estate Investment Trust. Regrettably, they also downgraded their revenue estimates, but the latest forecasts still imply the business will grow faster than the wider industry. The consensus price target held steady at RM1.80, with the latest estimates not enough to have an impact on their price targets.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have forecasts for IGB Real Estate Investment Trust going out to 2024, and you can see them free on our platform here.

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with IGB Real Estate Investment Trust , and understanding this should be part of your investment process.

When trading IGB Real Estate Investment Trust or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:IGBREIT

IGB Real Estate Investment Trust

Established on 25 July 2012, IGB REIT is a Malaysia-domiciled real estate investment trust.

Excellent balance sheet average dividend payer.