- Malaysia

- /

- Real Estate

- /

- KLSE:ECOFIRS

Here's Why EcoFirst Consolidated Bhd (KLSE:ECOFIRS) Has A Meaningful Debt Burden

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, EcoFirst Consolidated Bhd (KLSE:ECOFIRS) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for EcoFirst Consolidated Bhd

What Is EcoFirst Consolidated Bhd's Debt?

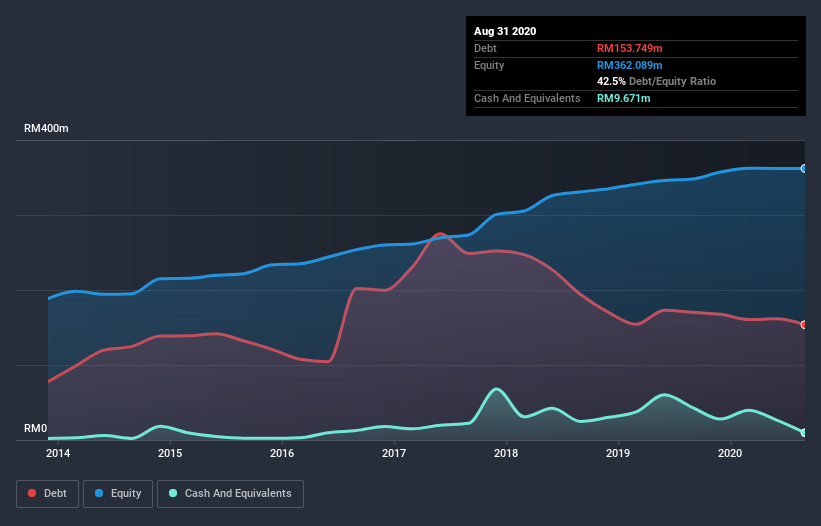

As you can see below, EcoFirst Consolidated Bhd had RM153.7m of debt at August 2020, down from RM170.2m a year prior. However, it also had RM9.67m in cash, and so its net debt is RM144.1m.

A Look At EcoFirst Consolidated Bhd's Liabilities

We can see from the most recent balance sheet that EcoFirst Consolidated Bhd had liabilities of RM151.8m falling due within a year, and liabilities of RM166.0m due beyond that. Offsetting these obligations, it had cash of RM9.67m as well as receivables valued at RM67.9m due within 12 months. So it has liabilities totalling RM240.2m more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of RM316.2m, so it does suggest shareholders should keep an eye on EcoFirst Consolidated Bhd's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

EcoFirst Consolidated Bhd's debt is 4.6 times its EBITDA, and its EBIT cover its interest expense 3.7 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Another concern for investors might be that EcoFirst Consolidated Bhd's EBIT fell 11% in the last year. If things keep going like that, handling the debt will about as easy as bundling an angry house cat into its travel box. When analysing debt levels, the balance sheet is the obvious place to start. But it is EcoFirst Consolidated Bhd's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Looking at the most recent three years, EcoFirst Consolidated Bhd recorded free cash flow of 43% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

On the face of it, EcoFirst Consolidated Bhd's EBIT growth rate left us tentative about the stock, and its net debt to EBITDA was no more enticing than the one empty restaurant on the busiest night of the year. Having said that, its ability to convert EBIT to free cash flow isn't such a worry. Overall, we think it's fair to say that EcoFirst Consolidated Bhd has enough debt that there are some real risks around the balance sheet. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Take risks, for example - EcoFirst Consolidated Bhd has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade EcoFirst Consolidated Bhd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EcoFirst Consolidated Bhd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:ECOFIRS

EcoFirst Consolidated Bhd

An investment holding company, engages in the property construction, development, investment, and management businesses in Malaysia.

Excellent balance sheet and good value.

Market Insights

Community Narratives