- Malaysia

- /

- Real Estate

- /

- KLSE:ECOFIRS

EcoFirst Consolidated Bhd's (KLSE:ECOFIRS) Stock Has Fared Decently: Is the Market Following Strong Financials?

EcoFirst Consolidated Bhd's (KLSE:ECOFIRS) stock is up by 3.9% over the past three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. Particularly, we will be paying attention to EcoFirst Consolidated Bhd's ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

View our latest analysis for EcoFirst Consolidated Bhd

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for EcoFirst Consolidated Bhd is:

4.4% = RM16m ÷ RM362m (Based on the trailing twelve months to August 2020).

The 'return' is the yearly profit. Another way to think of that is that for every MYR1 worth of equity, the company was able to earn MYR0.04 in profit.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

EcoFirst Consolidated Bhd's Earnings Growth And 4.4% ROE

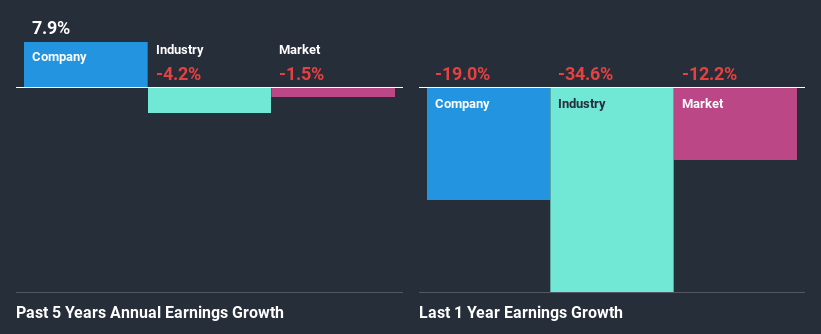

It is hard to argue that EcoFirst Consolidated Bhd's ROE is much good in and of itself. Still, the company's ROE is higher than the average industry ROE of 2.9% so that's certainly interesting. And more so given that EcoFirst Consolidated Bhd has grown its net income at an acceptable rate of 7.9%. That being said, the company does have a low ROE to begin with, just that its higher than the industry average. Therefore, the growth in earnings could also be the result of other factors. For instance, the company has a low payout ratio or is being managed efficiently

When you consider the fact that the industry earnings have shrunk at a rate of 4.2% in the same period, the company's net income growth is pretty remarkable.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if EcoFirst Consolidated Bhd is trading on a high P/E or a low P/E, relative to its industry.

Is EcoFirst Consolidated Bhd Using Its Retained Earnings Effectively?

Conclusion

In total, we are pretty happy with EcoFirst Consolidated Bhd's performance. Specifically, we like that it has been reinvesting a high portion of its profits at a moderate rate of return, resulting in earnings expansion. If the company continues to grow its earnings the way it has, that could have a positive impact on its share price given how earnings per share influence long-term share prices. Remember, the price of a stock is also dependent on the perceived risk. Therefore investors must keep themselves informed about the risks involved before investing in any company. You can see the 2 risks we have identified for EcoFirst Consolidated Bhd by visiting our risks dashboard for free on our platform here.

If you decide to trade EcoFirst Consolidated Bhd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EcoFirst Consolidated Bhd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:ECOFIRS

EcoFirst Consolidated Bhd

An investment holding company, engages in the property construction, development, investment, and management businesses in Malaysia.

Excellent balance sheet and good value.

Market Insights

Community Narratives