- Malaysia

- /

- Real Estate

- /

- KLSE:CRESNDO

Crescendo Corporation Berhad (KLSE:CRESNDO) Has Affirmed Its Dividend Of MYR0.02

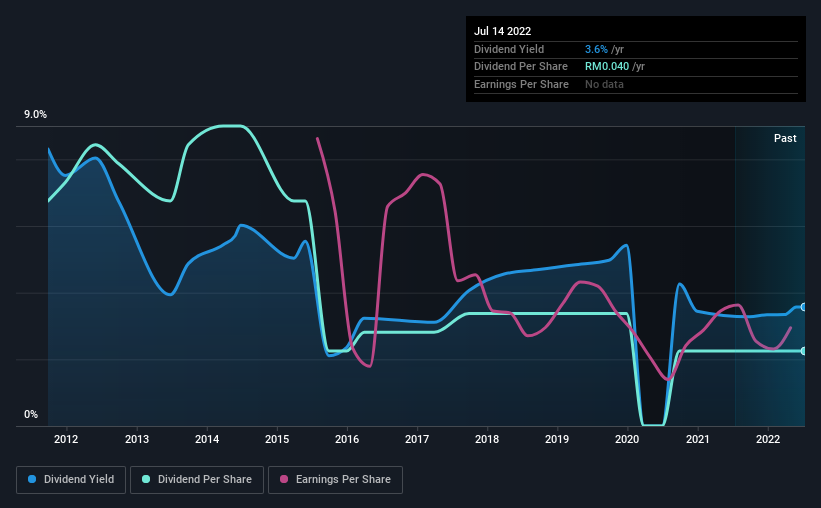

The board of Crescendo Corporation Berhad (KLSE:CRESNDO) has announced that it will pay a dividend on the 29th of August, with investors receiving MYR0.02 per share. This payment means that the dividend yield will be 3.6%, which is around the industry average.

View our latest analysis for Crescendo Corporation Berhad

Crescendo Corporation Berhad's Payment Has Solid Earnings Coverage

Solid dividend yields are great, but they only really help us if the payment is sustainable. The last dividend was quite easily covered by Crescendo Corporation Berhad's earnings. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

EPS is set to fall by 16.5% over the next 12 months if recent trends continue. Assuming the dividend continues along recent trends, we believe the payout ratio could be 45%, which we are pretty comfortable with and we think is feasible on an earnings basis.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2012, the annual payment back then was MYR0.12, compared to the most recent full-year payment of MYR0.04. This works out to a decline of approximately 67% over that time. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Dividend Has Limited Growth Potential

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. Earnings per share has been sinking by 17% over the last five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

Our Thoughts On Crescendo Corporation Berhad's Dividend

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Crescendo Corporation Berhad's payments, as there could be some issues with sustaining them into the future. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come across 3 warning signs for Crescendo Corporation Berhad you should be aware of, and 1 of them shouldn't be ignored. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CRESNDO

Crescendo Corporation Berhad

An investment holding company, invests in, develops, constructs, and manages properties in Malaysia.

Excellent balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026