- Malaysia

- /

- Real Estate

- /

- KLSE:CHHB

Can You Imagine How Country Heights Holdings Berhad's (KLSE:CHHB) Shareholders Feel About The 27% Share Price Increase?

Stock pickers are generally looking for stocks that will outperform the broader market. Buying under-rated businesses is one path to excess returns. For example, the Country Heights Holdings Berhad (KLSE:CHHB) share price is up 27% in the last 5 years, clearly besting the market decline of around 5.0% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 17%.

View our latest analysis for Country Heights Holdings Berhad

Country Heights Holdings Berhad wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years Country Heights Holdings Berhad saw its revenue shrink by 11% per year. Even though revenue hasn't increased, the stock actually gained 5%, per year, during the same period. It's probably worth checking other factors such as the profitability, to try to understand the share price action. It may not be reflecting the revenue.

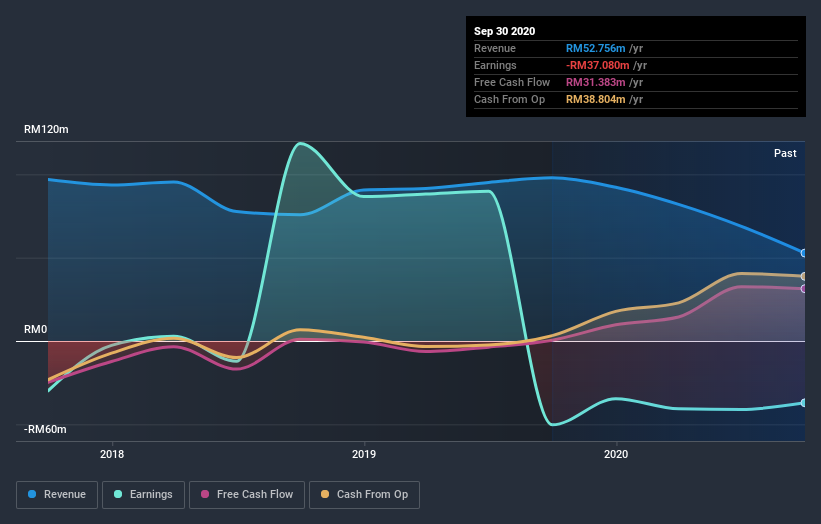

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Country Heights Holdings Berhad's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Country Heights Holdings Berhad shareholders have received a total shareholder return of 17% over the last year. That gain is better than the annual TSR over five years, which is 5%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Country Heights Holdings Berhad has 1 warning sign we think you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

When trading Country Heights Holdings Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:CHHB

Country Heights Holdings Berhad

Engages in the property development, investment, hotel and resort management, healthcare, event planning and exhibitions, and timeshare businesses in Malaysia and South Africa.

Acceptable track record with mediocre balance sheet.