- Malaysia

- /

- Industrial REITs

- /

- KLSE:ATRIUM

Does Atrium Real Estate Investment Trust's (KLSE:ATRIUM) Share Price Gain of 12% Match Its Business Performance?

The simplest way to invest in stocks is to buy exchange traded funds. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Atrium Real Estate Investment Trust (KLSE:ATRIUM) share price is 12% higher than it was a year ago, much better than the market return of around 3.9% (not including dividends) in the same period. So that should have shareholders smiling. Having said that, the longer term returns aren't so impressive, with stock gaining just 5.5% in three years.

View our latest analysis for Atrium Real Estate Investment Trust

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last twelve months, Atrium Real Estate Investment Trust actually shrank its EPS by 26%.

Given the share price gain, we doubt the market is measuring progress with EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

We haven't seen Atrium Real Estate Investment Trust increase dividend payments yet, so the yield probably hasn't helped drive the share higher. Rather, we'd posit that the revenue increase of 70% might be more meaningful. After all, it's not necessarily a bad thing if a business sacrifices profits today in pursuit of profit tomorrow (metaphorically speaking).

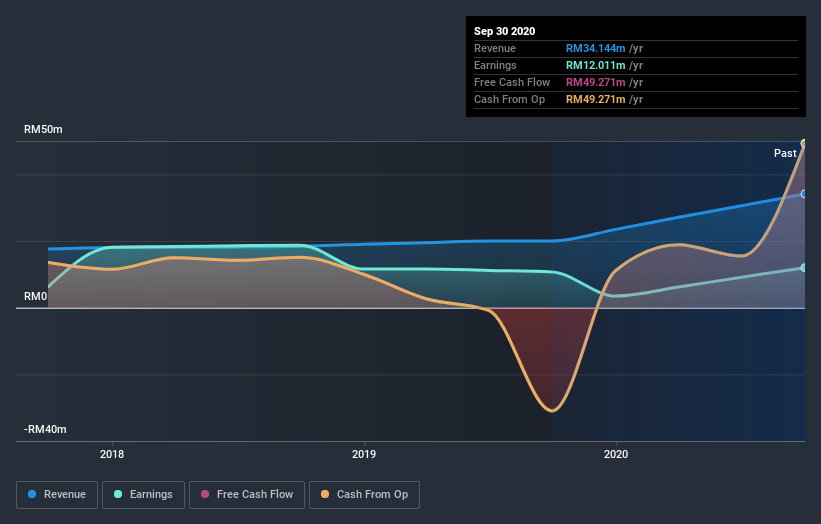

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Atrium Real Estate Investment Trust's TSR for the last year was 20%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's good to see that Atrium Real Estate Investment Trust has rewarded shareholders with a total shareholder return of 20% in the last twelve months. Of course, that includes the dividend. That gain is better than the annual TSR over five years, which is 8%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 5 warning signs for Atrium Real Estate Investment Trust (1 is significant!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

When trading Atrium Real Estate Investment Trust or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:ATRIUM

Atrium Real Estate Investment Trust

Atrium REIT is an industrial asset focused real estate investment trust constituted by a Trust Deed entered into on 20 November 2006, amended by the First Supplementary Deed dated 25 November 2008 and the Restated Deed dated 24 March 2016 between CIMB Commerce Trustee Berhad (formerly known as BHLB Trustee Berhad) as the Trustee and Atrium REIT Managers Sdn Bhd as the Manager (collective known as “First Deed”).

Good value with proven track record and pays a dividend.

Market Insights

Community Narratives