- Malaysia

- /

- Real Estate

- /

- KLSE:SPSETIA

The 27% return delivered to S P Setia Berhad's (KLSE:SPSETIA) shareholders actually lagged YoY earnings growth

While S P Setia Berhad (KLSE:SPSETIA) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 14% in the last quarter. But looking back over the last year, the returns have actually been rather pleasing! Looking at the full year, the company has easily bested an index fund by gaining 26%.

Since the stock has added RM437m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for S P Setia Berhad

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

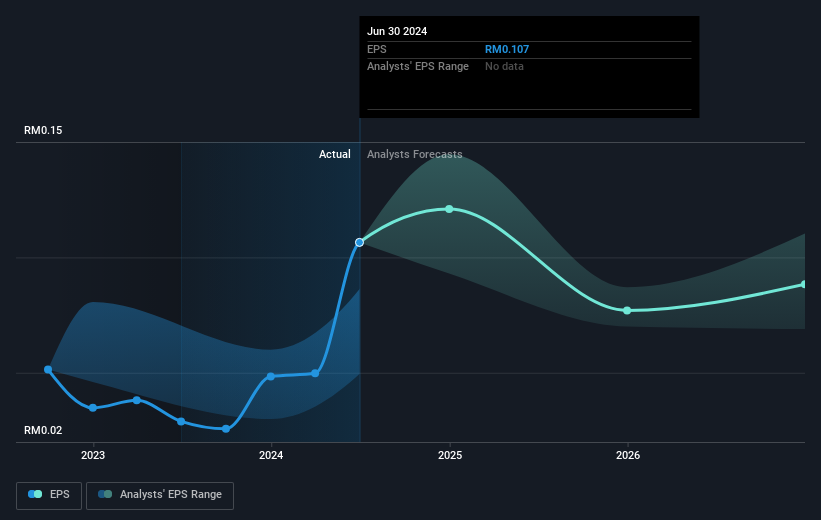

S P Setia Berhad was able to grow EPS by 268% in the last twelve months. This EPS growth is significantly higher than the 26% increase in the share price. Therefore, it seems the market isn't as excited about S P Setia Berhad as it was before. This could be an opportunity.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It is of course excellent to see how S P Setia Berhad has grown profits over the years, but the future is more important for shareholders. This free interactive report on S P Setia Berhad's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that S P Setia Berhad shareholders have received a total shareholder return of 27% over the last year. Of course, that includes the dividend. Notably the five-year annualised TSR loss of 2% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand S P Setia Berhad better, we need to consider many other factors. For example, we've discovered 4 warning signs for S P Setia Berhad (2 shouldn't be ignored!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SPSETIA

S P Setia Berhad

An investment holding company, operates as a property development and investment company in Malaysia, Singapore, Australia, Vietnam, Japan, and the United Kingdom.

Flawless balance sheet with solid track record.