- Malaysia

- /

- Real Estate

- /

- KLSE:RAPID

Rapid Synergy Berhad's (KLSE:RAPID) Popularity With Investors Under Threat As Stock Sinks 44%

Unfortunately for some shareholders, the Rapid Synergy Berhad (KLSE:RAPID) share price has dived 44% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 96% share price decline.

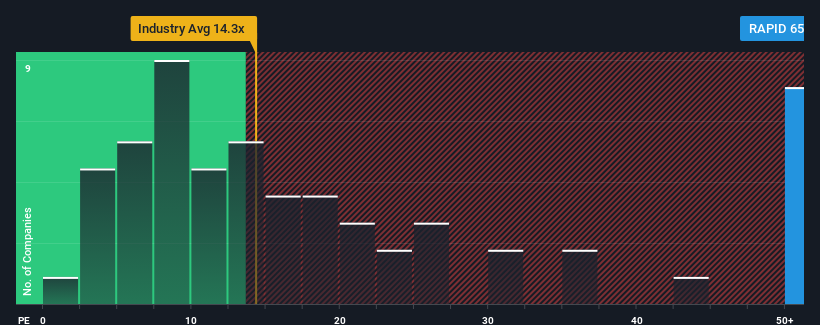

Even after such a large drop in price, given close to half the companies in Malaysia have price-to-earnings ratios (or "P/E's") below 15x, you may still consider Rapid Synergy Berhad as a stock to avoid entirely with its 65.4x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

For instance, Rapid Synergy Berhad's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for Rapid Synergy Berhad

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Rapid Synergy Berhad's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 66% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 49% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 17% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's alarming that Rapid Synergy Berhad's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

What We Can Learn From Rapid Synergy Berhad's P/E?

Even after such a strong price drop, Rapid Synergy Berhad's P/E still exceeds the rest of the market significantly. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Rapid Synergy Berhad currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Rapid Synergy Berhad (2 are significant!) that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:RAPID

Rapid Synergy Berhad

An investment holding company, engages in manufacturing and sale of precision tools, dies, and molds for the semiconductor, electrical, and electronics industries in Malaysia, rest of Asia, and North Africa.

Proven track record with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026