- Malaysia

- /

- Real Estate

- /

- KLSE:OCR

Shareholders May Not Be So Generous With OCR Group Berhad's (KLSE:OCR) CEO Compensation And Here's Why

Key Insights

- OCR Group Berhad will host its Annual General Meeting on 29th of May

- Total pay for CEO Billy Ong includes RM600.0k salary

- Total compensation is similar to the industry average

- OCR Group Berhad's three-year loss to shareholders was 61% while its EPS grew by 33% over the past three years

The underwhelming share price performance of OCR Group Berhad (KLSE:OCR) in the past three years would have disappointed many shareholders. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. The AGM coming up on the 29th of May could be an opportunity for shareholders to bring these concerns to the board's attention. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

View our latest analysis for OCR Group Berhad

Comparing OCR Group Berhad's CEO Compensation With The Industry

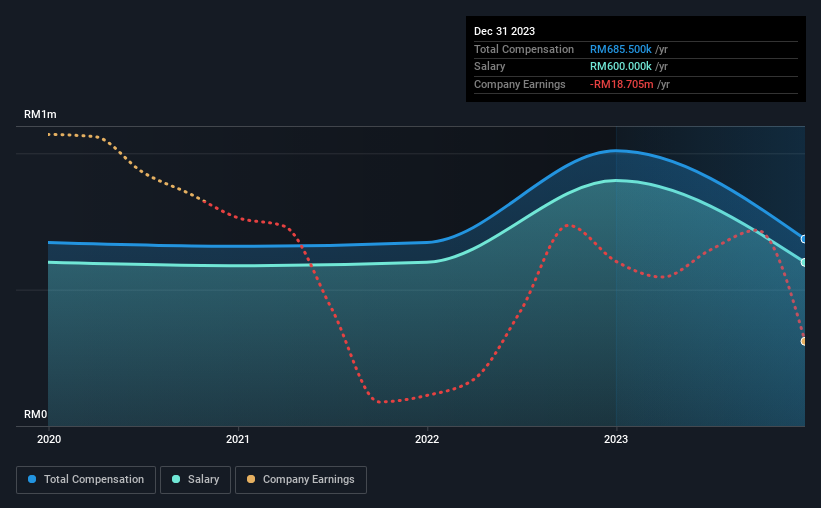

Our data indicates that OCR Group Berhad has a market capitalization of RM118m, and total annual CEO compensation was reported as RM686k for the year to December 2023. That's a notable decrease of 32% on last year. In particular, the salary of RM600.0k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the Malaysian Real Estate industry with market capitalizations under RM939m, the reported median total CEO compensation was RM657k. So it looks like OCR Group Berhad compensates Billy Ong in line with the median for the industry. What's more, Billy Ong holds RM296k worth of shares in the company in their own name.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | RM600k | RM900k | 88% |

| Other | RM86k | RM109k | 12% |

| Total Compensation | RM686k | RM1.0m | 100% |

On an industry level, around 74% of total compensation represents salary and 26% is other remuneration. OCR Group Berhad pays out 88% of remuneration in the form of a salary, significantly higher than the industry average. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at OCR Group Berhad's Growth Numbers

OCR Group Berhad's earnings per share (EPS) grew 33% per year over the last three years. Its revenue is down 29% over the previous year.

This demonstrates that the company has been improving recently and is good news for the shareholders. While it would be good to see revenue growth, profits matter more in the end. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has OCR Group Berhad Been A Good Investment?

With a total shareholder return of -61% over three years, OCR Group Berhad shareholders would by and large be disappointed. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 5 warning signs (and 3 which are potentially serious) in OCR Group Berhad we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:OCR

OCR Group Berhad

An investment holding company, engages in the property development, construction, project management consultation, and related businesses in Malaysia.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)