- Malaysia

- /

- Real Estate

- /

- KLSE:LAGENDA

Lagenda Properties Berhad (KLSE:LAGENDA) Has Affirmed Its Dividend Of MYR0.03

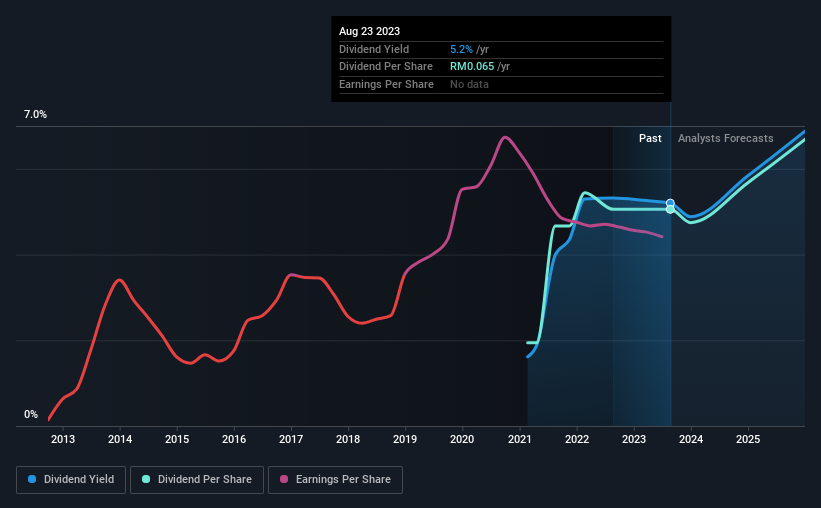

The board of Lagenda Properties Berhad (KLSE:LAGENDA) has announced that it will pay a dividend on the 25th of September, with investors receiving MYR0.03 per share. The dividend yield will be 5.2% based on this payment which is still above the industry average.

View our latest analysis for Lagenda Properties Berhad

Lagenda Properties Berhad's Earnings Easily Cover The Distributions

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. However, Lagenda Properties Berhad's earnings easily cover the dividend. This means that most of its earnings are being retained to grow the business.

The next year is set to see EPS grow by 54.4%. Assuming the dividend continues along recent trends, we think the payout ratio could be 23% by next year, which is in a pretty sustainable range.

Lagenda Properties Berhad Is Still Building Its Track Record

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. The dividend has gone from an annual total of MYR0.025 in 2021 to the most recent total annual payment of MYR0.065. This means that it has been growing its distributions at 61% per annum over that time. Lagenda Properties Berhad has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

The Dividend Looks Likely To Grow

The company's investors will be pleased to have been receiving dividend income for some time. Lagenda Properties Berhad has impressed us by growing EPS at 18% per year over the past five years. A low payout ratio and decent growth suggests that the company is reinvesting well, and it also has plenty of room to increase the dividend over time.

We Really Like Lagenda Properties Berhad's Dividend

In summary, it is good to see that the dividend is staying consistent, and we don't think there is any reason to suspect this might change over the medium term. Earnings are easily covering distributions, and the company is generating plenty of cash. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 1 warning sign for Lagenda Properties Berhad that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:LAGENDA

Lagenda Properties Berhad

An investment holding company, engages in the property development business in Malaysia.

High growth potential and good value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026