- Malaysia

- /

- Real Estate

- /

- KLSE:KPPROP

Kerjaya Prospek Property Berhad (KLSE:KPPROP) Has Announced A Dividend Of MYR0.01

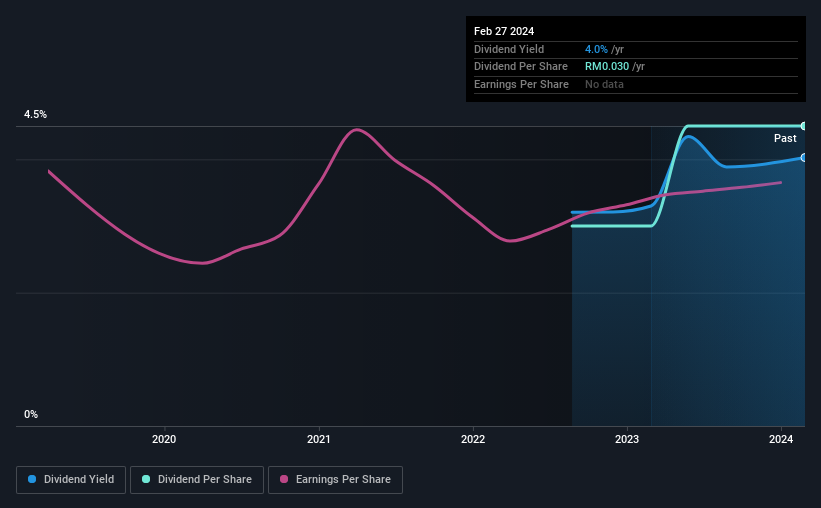

Kerjaya Prospek Property Berhad's (KLSE:KPPROP) investors are due to receive a payment of MYR0.01 per share on 29th of March. This means that the annual payment will be 4.0% of the current stock price, which is in line with the average for the industry.

View our latest analysis for Kerjaya Prospek Property Berhad

Kerjaya Prospek Property Berhad's Earnings Easily Cover The Distributions

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. Based on the last payment, Kerjaya Prospek Property Berhad was earning enough to cover the dividend, but free cash flows weren't positive. In general, we consider cash flow to be more important than earnings, so we would be cautious about relying on the sustainability of this dividend.

EPS is set to fall by 6.6% over the next 12 months if recent trends continue. Assuming the dividend continues along recent trends, we believe the payout ratio could be 18%, which we are pretty comfortable with and we think is feasible on an earnings basis.

Kerjaya Prospek Property Berhad Doesn't Have A Long Payment History

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. Since 2022, the annual payment back then was MYR0.02, compared to the most recent full-year payment of MYR0.03. This implies that the company grew its distributions at a yearly rate of about 22% over that duration. The dividend has been growing rapidly, however with such a short payment history we can't know for sure if payment can continue to grow over the long term, so caution may be warranted.

Dividend Growth May Be Hard To Come By

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Let's not jump to conclusions as things might not be as good as they appear on the surface. It's not great to see that Kerjaya Prospek Property Berhad's earnings per share has fallen at approximately 6.6% per year over the past five years. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends.

An additional note is that the company has been raising capital by issuing stock equal to 32% of shares outstanding in the last 12 months. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

Kerjaya Prospek Property Berhad's Dividend Doesn't Look Sustainable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. While Kerjaya Prospek Property Berhad is earning enough to cover the payments, the cash flows are lacking. We don't think Kerjaya Prospek Property Berhad is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. To that end, Kerjaya Prospek Property Berhad has 4 warning signs (and 1 which doesn't sit too well with us) we think you should know about. Is Kerjaya Prospek Property Berhad not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kerjaya Prospek Property Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KPPROP

Kerjaya Prospek Property Berhad

Engages in property development and construction businesses in Malaysia.

Medium-low risk with imperfect balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion