Sasbadi Holdings Berhad (KLSE:SASBADI) Could Be Riskier Than It Looks

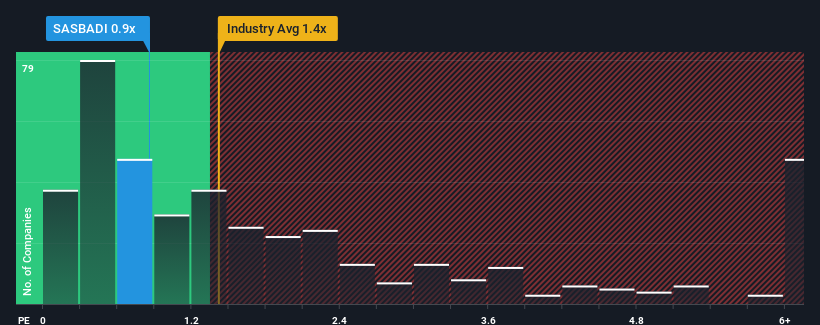

With a median price-to-sales (or "P/S") ratio of close to 1.1x in the Media industry in Malaysia, you could be forgiven for feeling indifferent about Sasbadi Holdings Berhad's (KLSE:SASBADI) P/S ratio of 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Sasbadi Holdings Berhad

How Has Sasbadi Holdings Berhad Performed Recently?

Sasbadi Holdings Berhad certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Sasbadi Holdings Berhad's future stacks up against the industry? In that case, our free report is a great place to start.How Is Sasbadi Holdings Berhad's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Sasbadi Holdings Berhad's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 39% last year. The latest three year period has also seen an excellent 53% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 9.5% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 0.9%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Sasbadi Holdings Berhad's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Sasbadi Holdings Berhad's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, Sasbadi Holdings Berhad's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 3 warning signs for Sasbadi Holdings Berhad that you need to take into consideration.

If these risks are making you reconsider your opinion on Sasbadi Holdings Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SASBADI

Sasbadi Holdings Berhad

An investment holding company, publishes books and educational materials primarily in Malaysia.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives