- Malaysia

- /

- Entertainment

- /

- KLSE:KUCINGKO

Are Kucingko Berhad's (KLSE:KUCINGKO) Fundamentals Good Enough to Warrant Buying Given The Stock's Recent Weakness?

With its stock down 55% over the past three months, it is easy to disregard Kucingko Berhad (KLSE:KUCINGKO). However, the company's fundamentals look pretty decent, and long-term financials are usually aligned with future market price movements. In this article, we decided to focus on Kucingko Berhad's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Kucingko Berhad is:

12% = RM5.0m ÷ RM43m (Based on the trailing twelve months to December 2024).

The 'return' is the amount earned after tax over the last twelve months. One way to conceptualize this is that for each MYR1 of shareholders' capital it has, the company made MYR0.12 in profit.

See our latest analysis for Kucingko Berhad

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Kucingko Berhad's Earnings Growth And 12% ROE

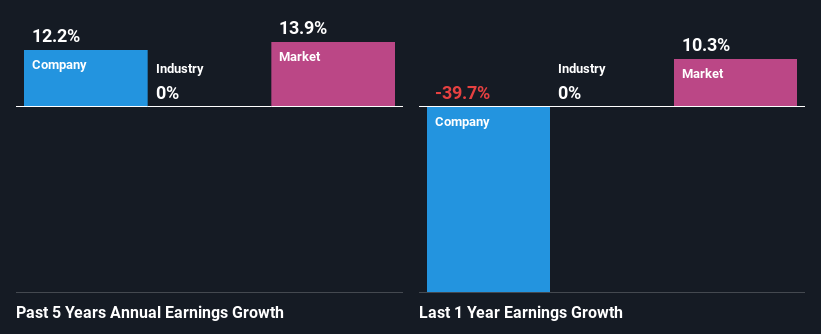

To begin with, Kucingko Berhad seems to have a respectable ROE. On comparing with the average industry ROE of 7.5% the company's ROE looks pretty remarkable. Probably as a result of this, Kucingko Berhad was able to see a decent growth of 12% over the last five years.

As a next step, we compared Kucingko Berhad's net income growth with the industry and found that the company has a similar growth figure when compared with the industry average growth rate of 12% in the same period.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. Has the market priced in the future outlook for KUCINGKO? You can find out in our latest intrinsic value infographic research report

Is Kucingko Berhad Efficiently Re-investing Its Profits?

Kucingko Berhad's high three-year median payout ratio of 5,917% suggests that the company is paying out more to its shareholders than what it is making. Still the company's earnings have grown respectably. That being said, the high payout ratio could be worth keeping an eye on in case the company is unable to keep up its current growth momentum. To know the 4 risks we have identified for Kucingko Berhad visit our risks dashboard for free.

Existing analyst estimates suggest that the company's future payout ratio is expected to drop to 33% over the next three years. The fact that the company's ROE is expected to rise to 22% over the same period is explained by the drop in the payout ratio.

Summary

On the whole, we do feel that Kucingko Berhad has some positive attributes. Specifically, its high ROE which likely led to the growth in earnings. Bear in mind, the company reinvests little to none of its profits, which means that investors aren't necessarily reaping the full benefits of the high rate of return. Having said that, looking at the current analyst estimates, we found that the company's earnings are expected to gain momentum. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kucingko Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KUCINGKO

Kucingko Berhad

Provides animation production services in Malaysia, Canada, Singapore, the United Kingdom, and the United States.

Moderate risk with mediocre balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)