Is It Worth Considering Scientex Packaging (Ayer Keroh) Berhad (KLSE:SCIPACK) For Its Upcoming Dividend?

It looks like Scientex Packaging (Ayer Keroh) Berhad (KLSE:SCIPACK) is about to go ex-dividend in the next 4 days. The ex-dividend date is two business days before a company's record date in most cases, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is important as the process of settlement involves at least two full business days. So if you miss that date, you would not show up on the company's books on the record date. Thus, you can purchase Scientex Packaging (Ayer Keroh) Berhad's shares before the 24th of June in order to receive the dividend, which the company will pay on the 15th of July.

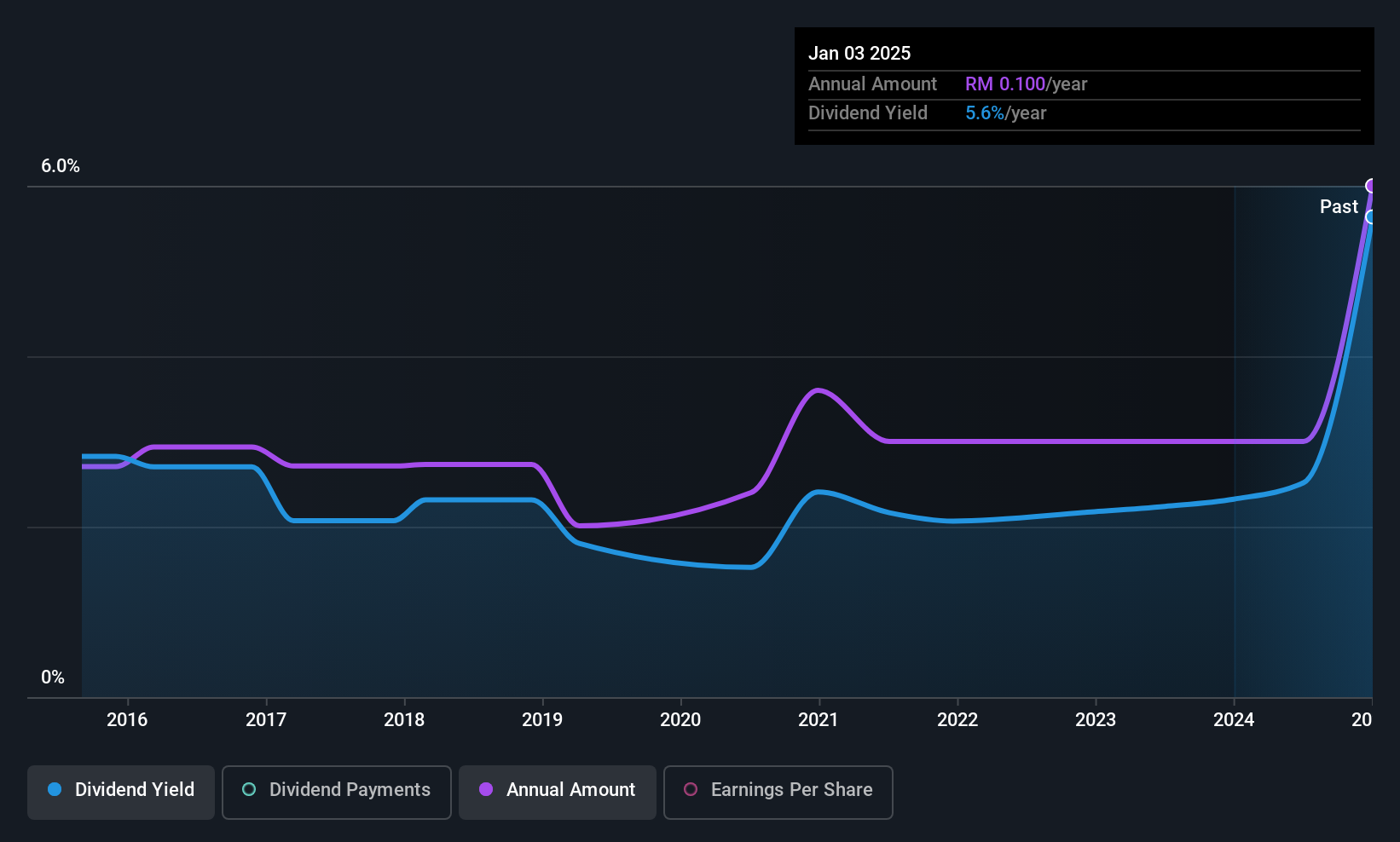

The company's next dividend payment will be RM00.025 per share, and in the last 12 months, the company paid a total of RM0.10 per share. Based on the last year's worth of payments, Scientex Packaging (Ayer Keroh) Berhad stock has a trailing yield of around 6.7% on the current share price of RM01.50. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Last year, Scientex Packaging (Ayer Keroh) Berhad paid out 100% of its income as dividends, which is above a level that we're comfortable with, especially if the company needs to reinvest in its business. A useful secondary check can be to evaluate whether Scientex Packaging (Ayer Keroh) Berhad generated enough free cash flow to afford its dividend. Scientex Packaging (Ayer Keroh) Berhad paid out more free cash flow than it generated - 120%, to be precise - last year, which we think is concerningly high. It's hard to consistently pay out more cash than you generate without either borrowing or using company cash, so we'd wonder how the company justifies this payout level.

As Scientex Packaging (Ayer Keroh) Berhad's dividend was not well covered by either earnings or cash flow, we would be concerned that this dividend could be at risk over the long term.

View our latest analysis for Scientex Packaging (Ayer Keroh) Berhad

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Fortunately for readers, Scientex Packaging (Ayer Keroh) Berhad's earnings per share have been growing at 18% a year for the past five years. It's not encouraging to see Scientex Packaging (Ayer Keroh) Berhad paying out basically all of its earnings and cashflow to shareholders. We're glad that earnings are growing rapidly, but we're wary of the company stretching itself financially.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Since the start of our data, 10 years ago, Scientex Packaging (Ayer Keroh) Berhad has lifted its dividend by approximately 8.3% a year on average. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

Final Takeaway

Is Scientex Packaging (Ayer Keroh) Berhad an attractive dividend stock, or better left on the shelf? Earnings per share have been growing, despite the company paying out a concerningly high percentage of its earnings and cashflow. We struggle to see how a company paying out so much of its earnings and cash flow will be able to sustain its dividend in a downturn, or reinvest enough into its business to continue growing earnings without borrowing heavily. With the way things are shaping up from a dividend perspective, we'd be inclined to steer clear of Scientex Packaging (Ayer Keroh) Berhad.

Although, if you're still interested in Scientex Packaging (Ayer Keroh) Berhad and want to know more, you'll find it very useful to know what risks this stock faces. For example - Scientex Packaging (Ayer Keroh) Berhad has 3 warning signs we think you should be aware of.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SCIPACK

Scientex Packaging (Ayer Keroh) Berhad

Engages in the manufacture and marketing of flexible packaging materials in Malaysia, Australia, Thailand, Myanmar, Singapore, the Philippines, Myanmar, and internationally.

Flawless balance sheet and overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion