RGT Berhad (KLSE:RGTBHD) jumps 14% this week, though earnings growth is still tracking behind three-year shareholder returns

RGT Berhad (KLSE:RGTBHD) shareholders might be concerned after seeing the share price drop 15% in the last quarter. But that doesn't undermine the rather lovely longer-term return, if you measure over the last three years. Indeed, the share price is up a very strong 146% in that time. So the recent fall in the share price should be viewed in that context. The thing to consider is whether the underlying business is doing well enough to support the current price.

Since it's been a strong week for RGT Berhad shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for RGT Berhad

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

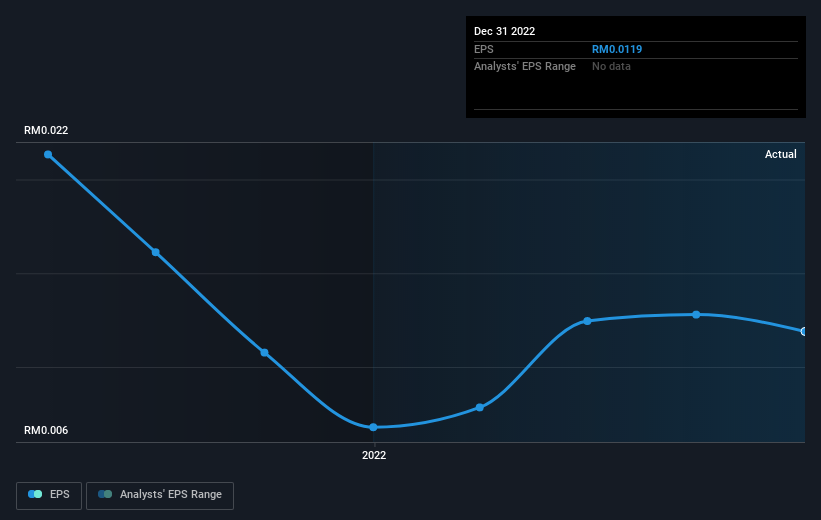

During three years of share price growth, RGT Berhad achieved compound earnings per share growth of 5.3% per year. This EPS growth is lower than the 35% average annual increase in the share price. This indicates that the market is feeling more optimistic on the stock, after the last few years of progress. It's not unusual to see the market 're-rate' a stock, after a few years of growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on RGT Berhad's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We've already covered RGT Berhad's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for RGT Berhad shareholders, and that cash payout contributed to why its TSR of 150%, over the last 3 years, is better than the share price return.

A Different Perspective

We regret to report that RGT Berhad shareholders are down 35% for the year. Unfortunately, that's worse than the broader market decline of 3.8%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 17%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for RGT Berhad that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:RGTBHD

RGT Berhad

An investment holding company, designs, manufactures, and sells moulded plastic products in Malaysia, North America, Europe, other Asian countries, and internationally.

Slight with acceptable track record.

Market Insights

Community Narratives