- Malaysia

- /

- Metals and Mining

- /

- KLSE:PMETAL

It's Unlikely That Press Metal Aluminium Holdings Berhad's (KLSE:PMETAL) CEO Will See A Huge Pay Rise This Year

Key Insights

- Press Metal Aluminium Holdings Berhad's Annual General Meeting to take place on 26th of June

- Total pay for CEO Poh Koon includes RM2.01m salary

- The overall pay is 266% above the industry average

- Press Metal Aluminium Holdings Berhad's EPS grew by 14% over the past three years while total shareholder return over the past three years was 10%

Under the guidance of CEO Poh Koon, Press Metal Aluminium Holdings Berhad (KLSE:PMETAL) has performed reasonably well recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 26th of June. However, some shareholders may still want to keep CEO compensation within reason.

View our latest analysis for Press Metal Aluminium Holdings Berhad

Comparing Press Metal Aluminium Holdings Berhad's CEO Compensation With The Industry

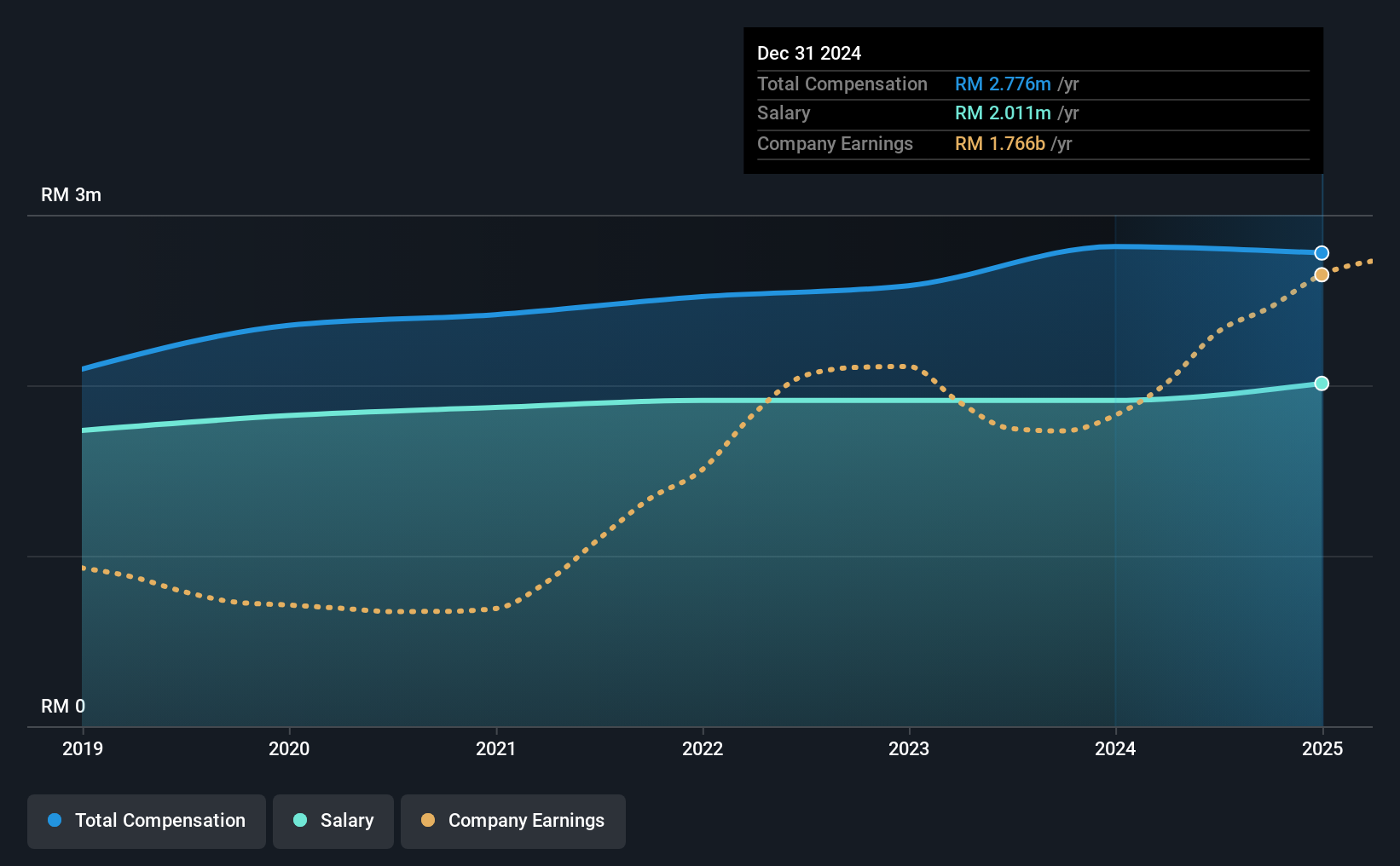

Our data indicates that Press Metal Aluminium Holdings Berhad has a market capitalization of RM40b, and total annual CEO compensation was reported as RM2.8m for the year to December 2024. That is, the compensation was roughly the same as last year. Notably, the salary which is RM2.01m, represents most of the total compensation being paid.

For comparison, other companies in the Malaysian Metals and Mining industry with market capitalizations ranging between RM17b and RM51b had a median total CEO compensation of RM759k. Hence, we can conclude that Poh Koon is remunerated higher than the industry median. Furthermore, Poh Koon directly owns RM1.2b worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | RM2.0m | RM1.9m | 72% |

| Other | RM765k | RM903k | 28% |

| Total Compensation | RM2.8m | RM2.8m | 100% |

Talking in terms of the industry, salary represented approximately 77% of total compensation out of all the companies we analyzed, while other remuneration made up 23% of the pie. Our data reveals that Press Metal Aluminium Holdings Berhad allocates salary more or less in line with the wider market. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Press Metal Aluminium Holdings Berhad's Growth Numbers

Over the past three years, Press Metal Aluminium Holdings Berhad has seen its earnings per share (EPS) grow by 14% per year. In the last year, its revenue is up 5.9%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Press Metal Aluminium Holdings Berhad Been A Good Investment?

Press Metal Aluminium Holdings Berhad has served shareholders reasonably well, with a total return of 10% over three years. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

In Summary...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

Shareholders may want to check for free if Press Metal Aluminium Holdings Berhad insiders are buying or selling shares.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PMETAL

Press Metal Aluminium Holdings Berhad

Engages in the manufacture and trading of aluminum, and smelting and extrusion products in Malaysia, Asia, Europe, the Oceania, Europe, and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives