- Malaysia

- /

- Metals and Mining

- /

- KLSE:PA

We Think Some Shareholders May Hesitate To Increase P.A. Resources Berhad's (KLSE:PA) CEO Compensation

Key Insights

- P.A. Resources Berhad to hold its Annual General Meeting on 17th of December

- Total pay for CEO Kuan Lau includes RM1.03m salary

- The overall pay is 91% above the industry average

- P.A. Resources Berhad's three-year loss to shareholders was 23% while its EPS was down 4.9% over the past three years

In the past three years, the share price of P.A. Resources Berhad (KLSE:PA) has struggled to grow and now shareholders are sitting on a loss. Per share earnings growth is also poor, despite revenues growing. The AGM coming up on 17th of December will be an opportunity for shareholders to have their concerns addressed by the board and for them to exercise their influence on management through voting on resolutions such as executive remuneration. Here's why we think shareholders should hold off on a raise for the CEO at the moment.

See our latest analysis for P.A. Resources Berhad

How Does Total Compensation For Kuan Lau Compare With Other Companies In The Industry?

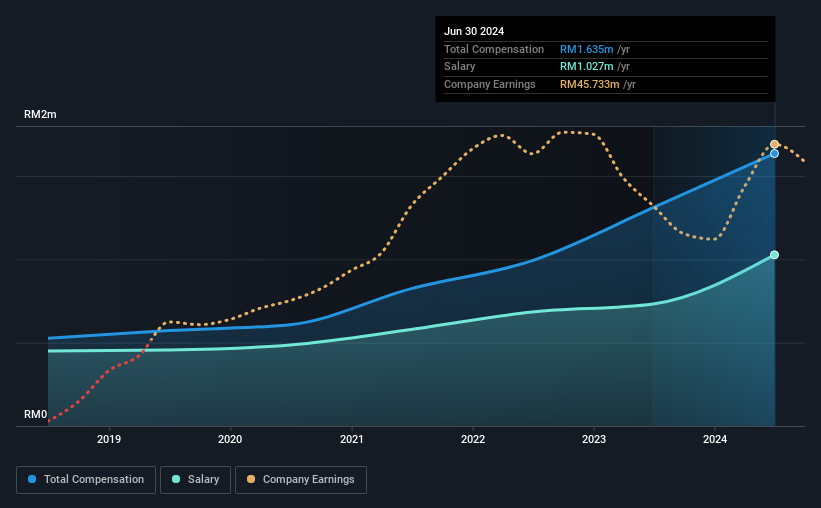

According to our data, P.A. Resources Berhad has a market capitalization of RM414m, and paid its CEO total annual compensation worth RM1.6m over the year to June 2024. We note that's an increase of 25% above last year. We note that the salary portion, which stands at RM1.03m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the Malaysian Metals and Mining industry with market capitalizations below RM885m, reported a median total CEO compensation of RM855k. Accordingly, our analysis reveals that P.A. Resources Berhad pays Kuan Lau north of the industry median. Moreover, Kuan Lau also holds RM18m worth of P.A. Resources Berhad stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | RM1.0m | RM732k | 63% |

| Other | RM608k | RM578k | 37% |

| Total Compensation | RM1.6m | RM1.3m | 100% |

On an industry level, roughly 73% of total compensation represents salary and 27% is other remuneration. P.A. Resources Berhad pays a modest slice of remuneration through salary, as compared to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at P.A. Resources Berhad's Growth Numbers

Over the last three years, P.A. Resources Berhad has shrunk its earnings per share by 4.9% per year. In the last year, its revenue is up 31%.

Investors would be a bit wary of companies that have lower EPS But on the other hand, revenue growth is strong, suggesting a brighter future. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has P.A. Resources Berhad Been A Good Investment?

Given the total shareholder loss of 23% over three years, many shareholders in P.A. Resources Berhad are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

The returns to shareholders is disappointing along with lack of earnings growth, which goes some way in explaining the poor returns. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for P.A. Resources Berhad that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PA

P.A. Resources Berhad

An investment holding company, provides aluminum extrusion, fabrication, and related services in Malaysia and the United States.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026