- Malaysia

- /

- Metals and Mining

- /

- KLSE:MESTRON

The Mestron Holdings Berhad (KLSE:MESTRON) Share Price Is Up 88% And Shareholders Are Holding On

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the Mestron Holdings Berhad (KLSE:MESTRON) share price is up 88% in the last year, clearly besting the market return of around 6.0% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! We'll need to follow Mestron Holdings Berhad for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

See our latest analysis for Mestron Holdings Berhad

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Mestron Holdings Berhad went from making a loss to reporting a profit, in the last year.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

We doubt the modest 1.3% dividend yield is doing much to support the share price. We think that the revenue growth of 673% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

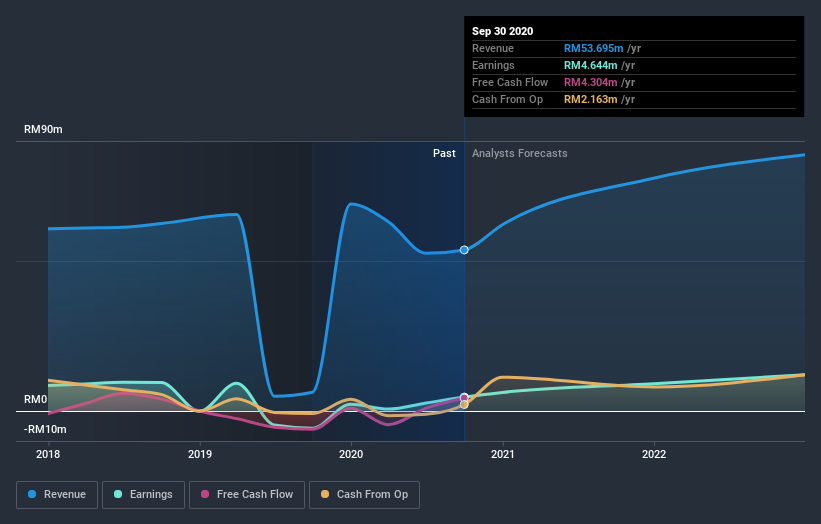

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Mestron Holdings Berhad has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Mestron Holdings Berhad in this interactive graph of future profit estimates.

A Different Perspective

It's nice to see that Mestron Holdings Berhad shareholders have gained 89% over the last year, including dividends. And the share price momentum remains respectable, with a gain of 34% in the last three months. This suggests the company is continuing to win over new investors. It's always interesting to track share price performance over the longer term. But to understand Mestron Holdings Berhad better, we need to consider many other factors. To that end, you should be aware of the 4 warning signs we've spotted with Mestron Holdings Berhad .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you decide to trade Mestron Holdings Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:MESTRON

Mestron Holdings Berhad

An investment holding company, engages in manufacture and sale of steel poles in Malaysia.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.