- Malaysia

- /

- Metals and Mining

- /

- KLSE:MASTEEL

Shareholders Will Probably Hold Off On Increasing Malaysia Steel Works (KL) Bhd.'s (KLSE:MASTEEL) CEO Compensation For The Time Being

Key Insights

- Malaysia Steel Works (KL) Bhd's Annual General Meeting to take place on 30th of May

- Salary of RM1.36m is part of CEO Hean Tai's total remuneration

- Total compensation is 82% above industry average

- Malaysia Steel Works (KL) Bhd's EPS declined by 20% over the past three years while total shareholder loss over the past three years was 27%

The underwhelming share price performance of Malaysia Steel Works (KL) Bhd. (KLSE:MASTEEL) in the past three years would have disappointed many shareholders. Per share earnings growth is also lacking, despite revenue growth. Shareholders will have a chance to take their concerns to the board at the next AGM on 30th of May and vote on resolutions including executive compensation, which studies show may have an impact on company performance. Here's our take on why we think shareholders might be hesitant about approving a raise at the moment.

See our latest analysis for Malaysia Steel Works (KL) Bhd

Comparing Malaysia Steel Works (KL) Bhd.'s CEO Compensation With The Industry

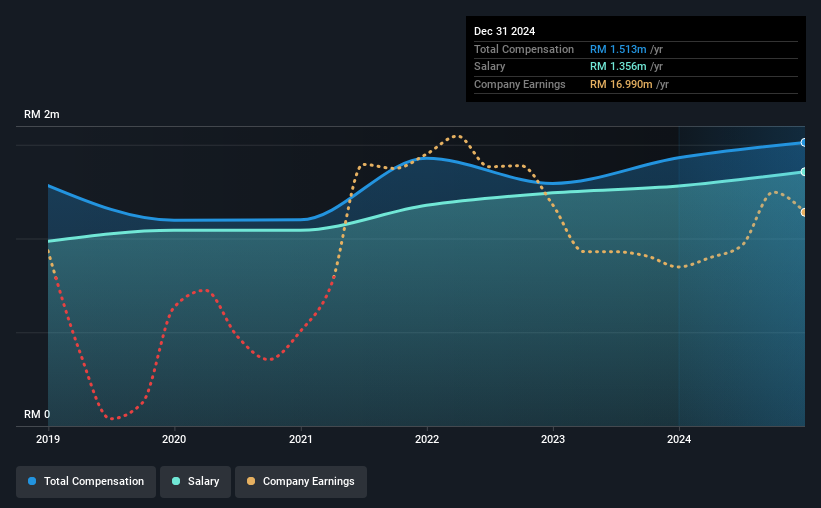

At the time of writing, our data shows that Malaysia Steel Works (KL) Bhd. has a market capitalization of RM166m, and reported total annual CEO compensation of RM1.5m for the year to December 2024. That's a fairly small increase of 5.7% over the previous year. In particular, the salary of RM1.36m, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the Malaysian Metals and Mining industry with market capitalizations below RM847m, we found that the median total CEO compensation was RM831k. Hence, we can conclude that Hean Tai is remunerated higher than the industry median. Furthermore, Hean Tai directly owns RM342k worth of shares in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | RM1.4m | RM1.3m | 90% |

| Other | RM157k | RM151k | 10% |

| Total Compensation | RM1.5m | RM1.4m | 100% |

Talking in terms of the industry, salary represented approximately 77% of total compensation out of all the companies we analyzed, while other remuneration made up 23% of the pie. It's interesting to note that Malaysia Steel Works (KL) Bhd pays out a greater portion of remuneration through salary, compared to the industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Malaysia Steel Works (KL) Bhd.'s Growth

Over the last three years, Malaysia Steel Works (KL) Bhd. has shrunk its earnings per share by 20% per year. Its revenue is up 25% over the last year.

Investors would be a bit wary of companies that have lower EPS On the other hand, the strong revenue growth suggests the business is growing. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Malaysia Steel Works (KL) Bhd. Been A Good Investment?

Since shareholders would have lost about 27% over three years, some Malaysia Steel Works (KL) Bhd. investors would surely be feeling negative emotions. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The returns to shareholders is disappointing along with lack of earnings growth, which goes some way in explaining the poor returns. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 2 warning signs (and 1 which is potentially serious) in Malaysia Steel Works (KL) Bhd we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you're looking to trade Malaysia Steel Works (KL) Bhd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MASTEEL

Malaysia Steel Works (KL) Bhd

Manufactures and markets tensile steel bars, mild steel bars, and prime steel billets for the construction and infrastructure sectors in Malaysia and internationally.

Solid track record with mediocre balance sheet.

Market Insights

Community Narratives