- Malaysia

- /

- Metals and Mining

- /

- KLSE:LEONFB

I Ran A Stock Scan For Earnings Growth And Leon Fuat Berhad (KLSE:LEONFB) Passed With Ease

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Leon Fuat Berhad (KLSE:LEONFB), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Leon Fuat Berhad

Leon Fuat Berhad's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Leon Fuat Berhad managed to grow EPS by 15% per year, over three years. That's a good rate of growth, if it can be sustained.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Leon Fuat Berhad shareholders can take confidence from the fact that EBIT margins are up from 3.9% to 17%, and revenue is growing. That's great to see, on both counts.

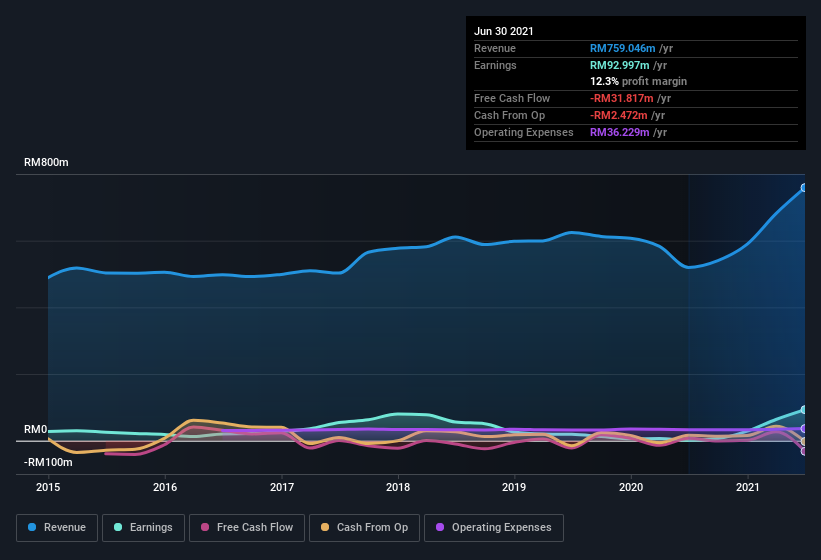

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Leon Fuat Berhad isn't a huge company, given its market capitalization of RM344m. That makes it extra important to check on its balance sheet strength.

Are Leon Fuat Berhad Insiders Aligned With All Shareholders?

I always like to check up on CEO compensation, because I think that reasonable pay levels, around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalizations under RM832m, like Leon Fuat Berhad, the median CEO pay is around RM515k.

The CEO of Leon Fuat Berhad was paid just RM70k in total compensation for the year ending . This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Leon Fuat Berhad To Your Watchlist?

One positive for Leon Fuat Berhad is that it is growing EPS. That's nice to see. On top of that, my faith in the board of directors is strengthened by the fact of the reasonable CEO pay. So I do think the stock deserves further research, if not instant addition to your watchlist. What about risks? Every company has them, and we've spotted 5 warning signs for Leon Fuat Berhad (of which 2 shouldn't be ignored!) you should know about.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:LEONFB

Leon Fuat Berhad

An investment holding company, processes and trades in steel products in Malaysia.

Moderate risk with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026