If You Had Bought Lotte Chemical Titan Holding Berhad's (KLSE:LCTITAN) Shares Three Years Ago You Would Be Down 42%

Lotte Chemical Titan Holding Berhad (KLSE:LCTITAN) shareholders will doubtless be very grateful to see the share price up 51% in the last quarter. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 42% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

Check out our latest analysis for Lotte Chemical Titan Holding Berhad

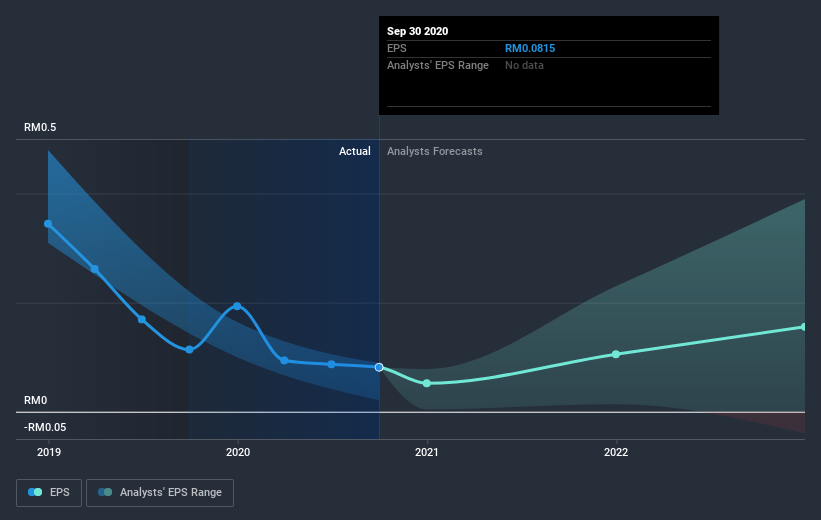

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Lotte Chemical Titan Holding Berhad saw its EPS decline at a compound rate of 46% per year, over the last three years. In comparison the 17% compound annual share price decline isn't as bad as the EPS drop-off. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Lotte Chemical Titan Holding Berhad's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Lotte Chemical Titan Holding Berhad, it has a TSR of -34% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Lotte Chemical Titan Holding Berhad shareholders have gained 24% (in total) over the last year. And yes, that does include the dividend. This recent result is much better than the 10% drop suffered by shareholders each year (on average) over the last three. The optimist would say this is evidence that the stock has bottomed, and better days lie ahead. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Lotte Chemical Titan Holding Berhad .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you decide to trade Lotte Chemical Titan Holding Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:LCTITAN

Lotte Chemical Titan Holding Berhad

Engages in manufacture and sale of petrochemical products and polyolefin resins in Malaysia, Indonesia, China, Southeast Asia, Northeast Asis, Indian Sub-Continent, and internationally.

Fair value with concerning outlook.

Market Insights

Community Narratives