Here's What We Learned About The CEO Pay At CYL Corporation Berhad (KLSE:CYL)

Yat Chen became the CEO of CYL Corporation Berhad (KLSE:CYL) in 2000, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether CYL Corporation Berhad pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for CYL Corporation Berhad

How Does Total Compensation For Yat Chen Compare With Other Companies In The Industry?

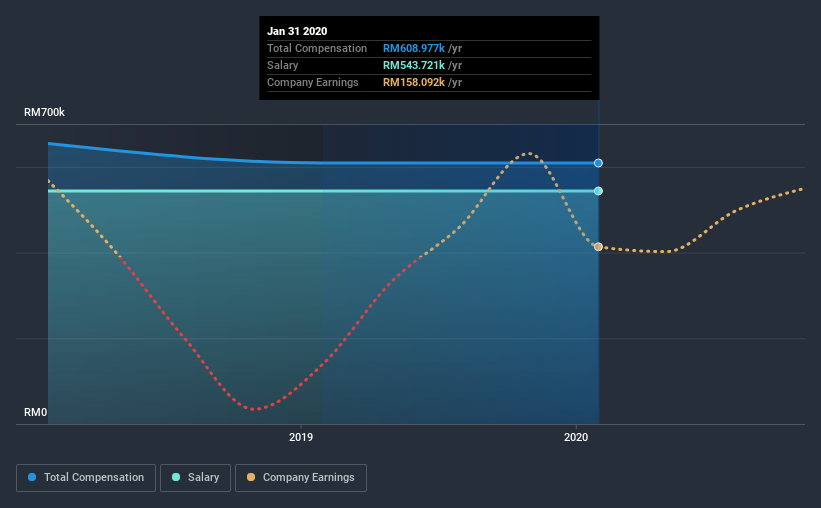

According to our data, CYL Corporation Berhad has a market capitalization of RM46m, and paid its CEO total annual compensation worth RM609k over the year to January 2020. That is, the compensation was roughly the same as last year. In particular, the salary of RM543.7k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below RM812m, reported a median total CEO compensation of RM750k. From this we gather that Yat Chen is paid around the median for CEOs in the industry. Furthermore, Yat Chen directly owns RM16m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | RM544k | RM544k | 89% |

| Other | RM65k | RM65k | 11% |

| Total Compensation | RM609k | RM609k | 100% |

Speaking on an industry level, nearly 74% of total compensation represents salary, while the remainder of 26% is other remuneration. CYL Corporation Berhad pays out 89% of remuneration in the form of a salary, significantly higher than the industry average. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

CYL Corporation Berhad's Growth

Over the last three years, CYL Corporation Berhad has shrunk its earnings per share by 2.9% per year. Its revenue is down 17% over the previous year.

The lack of EPS growth is certainly unimpressive. This is compounded by the fact revenue is actually down on last year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has CYL Corporation Berhad Been A Good Investment?

With a three year total loss of 25% for the shareholders, CYL Corporation Berhad would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

As we touched on above, CYL Corporation Berhad is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. In the meantime, the company has reported declining EPS growth and shareholder returns over the last three years. We'd stop short of saying compensation is inappropriate, but we would understand if shareholders had questions regarding a future raise.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 3 warning signs for CYL Corporation Berhad (of which 1 makes us a bit uncomfortable!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade CYL Corporation Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:CYL

CYL Corporation Berhad

An investment holding company, manufactures and supplies plastic packaging products and moulds in Malaysia and internationally.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026